Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 1 June 2023 02:19 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities Ltd

The Colombo Consumer Price Index (CCPI; Base 2021=100) for the month of May decreased sharply for a second consecutive month to 25.2% on its point to point against its previous month’s figure of 35.3%.

The Colombo Consumer Price Index (CCPI; Base 2021=100) for the month of May decreased sharply for a second consecutive month to 25.2% on its point to point against its previous month’s figure of 35.3%.

This was ahead of the 4th monitory policy announcement for the year 2023 due today at 7.30 a.m. The monetary board of the Central Bank of Sri Lanka kept policy rates unchanged at 15.50% and 16.50% on its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) respectively at its previous announcement on the 4 April 2023.

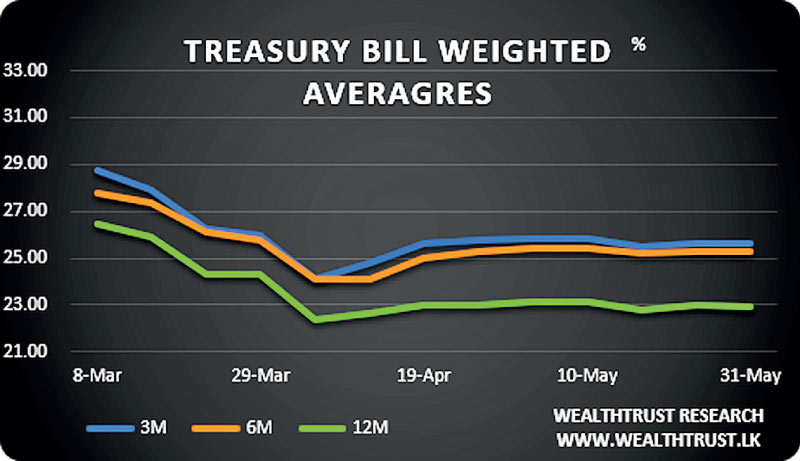

Meanwhile, the weekly weighted average rates dipped across the board at its Treasury bill auctions conducted yesterday. The 182-day bill reflected a decrease of 06 basis points to 22.91% followed by the 91-day and 364-day bills by 01 basis points each to 25.65% and 25.29% respectively.

The total offered amount of Rs. 160 billion was fully accepted at the 1st phase of the auction while at the 2nd phase of the auction, only the 182-day and 364-day maturities were offered at its weighted average rates. Given below are the details of the auction,

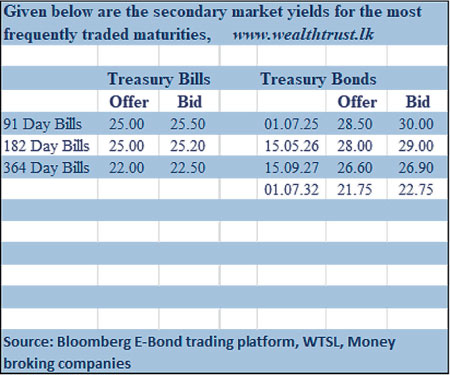

In secondary bond markets, limited trades were seen on the maturities of 01.05.27 and 01.07.32 at levels of 26.75% and 26.85% and 22.25% to 23.00% respectively.

The total secondary market Treasury bond/bill transacted volume for 30 May 2023 was Rs. 4.69 billion.

In money markets, overnight call money and repo averaged 16.50% each as the DOD (Domestic Operations Department) of Central Bank was seen injecting an amount of Rs. 25 billion on an overnight basis by way of a Reverse Repo auction at a weighted average of 16.07% yesterday.

The net liquidity shortfall stood at Rs. 84.46 billion yesterday as further an amount of Rs. 98.82 billion was withdrawn at Central Banks SLFR (Standard Lending Facility Rate) of 16.50% against an amount of Rs. 39.36 billion deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 15.50%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts appreciated further yesterday to close the day at Rs. 290.00/291.00 against its previous day’s closing level of Rs. 293.50/294.50 on the back of continued selling pressure on the dollar.

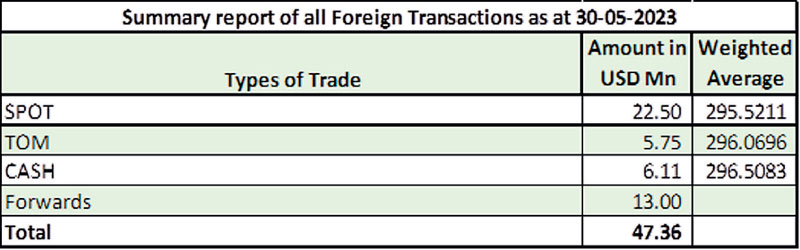

The total USD/LKR traded volume for 30 May was $ 47.36 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)