Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 23 August 2022 02:04 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

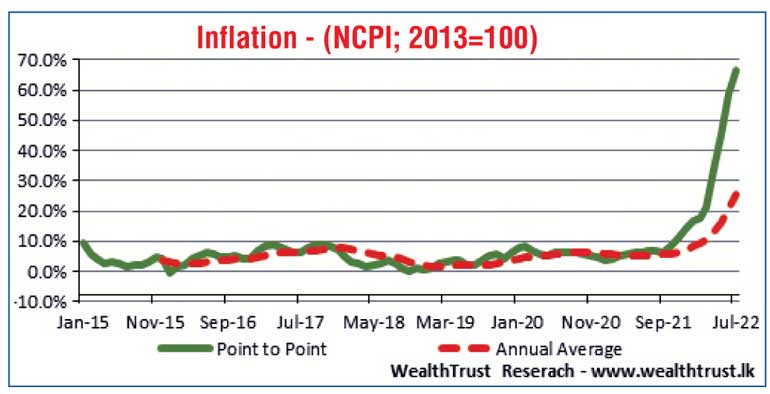

The new trading week commenced with the National Consumer Price Index (NCPI) for the month of July increasing for a 10th consecutive month to 66.7% at its announcement yesterday in comparison to its previous month of 58.9%. The annual average also increased to 25.9% against 20.8%.

Activity in the secondary bond market was at a complete standstill yesterday due to all market participants continuing to be on the side-lines.

The total secondary market Treasury bond/bill transacted volume for 19 August 2022 was Rs. 0.4 billion.

In money markets, the weighted average rate on overnight REPO stood at 15.50% while an amount of Rs. 800.22 billion was withdrawn from Central Banks SLFR (Standard Deposit Facility Rate) of 15.50%. However, the net liquidity deficit stood at Rs. 513.57 billion yesterday as an amount of Rs. 286.65 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 14.50%. No Call money transactions were witnessed.

Forex Market

In the Forex market, the middle rate for USD/LKR spot contracts appreciated marginally to Rs. 360.9467 yesterday against its previous day’s closing level of Rs. 361.00.

The total USD/LKR traded volume for 19 August 2022 was $ 131.52 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies and Department of Census and Statistics)