Saturday Feb 14, 2026

Saturday Feb 14, 2026

Friday, 12 March 2021 03:59 - - {{hitsCtrl.values.hits}}

Combining technology with human to be bionic

| The webinar participants |

|

| BCG Principal Chilman Jain |

|

| BCG Managing Director and Partner Prateek Roongta |

|

| FairFirst Insurance MD and CEO Sanjeev Jha |

|

| Ceylinco Life Insurance MD and CEO Thushara Ranasinghe |

|

| BCG Managing Director and Senior Partner Pranay Mehrotra |

|

| BCG Managing Director and Partner Pallavi Malani

|

COVID-19 has disrupted most businesses globally and the insurance industry is no exception. Given the restrictions imposed by the pandemic, insurers have been compelled to accelerate their digital journeys and holistically digitise their operations. In this regard, the Insurance Association of Sri Lanka (IASL) hosted a webinar on ‘What does it mean to be a truly bionic insurance company?’ with Boston Consulting Group (BCG) as its knowledge partner, on 23 February.

BCG MD and Partner Prateek Roongta facilitated the event and BCG MD and Partner Pallavi Malani delivered the keynote presentation, which was followed by a panel discussion comprising Ceylinco Life Insurance Ltd. MD/CEO Thushara Ranasinghe, Fairfirst Insurance MD and CEO Sanjeev Jha, and BCG MD and Senior Partner Pranay Mehrotra. The panel discussion was moderated by BCG Colombo Principal Chilman Jain.

Pallavi Malani of BCG, while addressing 60+ CXOs from Sri Lanka’s insurance industry, explained what being ‘bionic’ means and outlined the imperatives for becoming a bionic insurer in the post-COVID-19 world. In order to achieve bionic outcomes, insurers need to integrate human elements with technology and not replace one with another. “There is a need to empower talent and enhance efficiencies by leveraging the right tech stack and data. However, businesses will still have to engage with new talent pools and create agile teams to effectively make the shift to bionic ways of working,” she said.

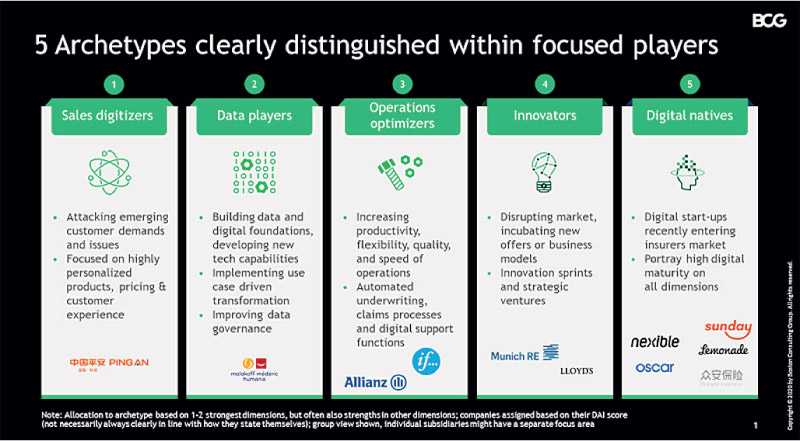

Pallavi further discussed the five archetypes within which distinguished bionic players fall – i) Sales digitisers, ii) Data players, iii) Operations optimisers, iv) Innovators, and v) Digital natives. The discussion was made real with the example of PingAn, the largest Life Insurance company in China. Despite a salesforce of 1.3 million agents, PingAn has a ‘digital attacker agency distribution’ model and boasts of approximately 40% higher productivity than the second largest player in China. It has progressed from leveraging traditional technologies to mobile internet, to now using artificial intelligence (AI) across agent recruitment, training, agent management, sales model, and services. “PingAn has truly been a pioneer in digitising its entire sales force, at scale,” shared Pallavi.

BCG Managing Director and Senior Partner Pranay Mehrotra emphasised on the need to use data as a differentiator. Data players are creating value by building digital foundations, developing new technology capabilities, implementing use case driven transformation, and improving overall data governance.

In his opening remarks, Ceylinco Life Insurance Ltd. MD/CEO Thushara Ranasinghe said, “In 2019, the Sri Lankan insurance industry grew by 10.5% and in 2020, it grew by an estimated 16%. Despite the lockdown, insurers were able to witness steep growth, proving that adversity reveals genius”. He stated that the pandemic took everyone by surprise and rendered all business continuity manuals irrelevant. Nevertheless, Ceylinco was able to quickly adapt to the changing situation and recover from the initial shock by installing proper infrastructure in place.

Sanjeev Jha of FairFirst Insurance said, “COVID-19 has taken away our choice to invest in digital initiatives or data optimisation. Bionic is the need of the hour. Insurance companies typically are data intensive and cognisant of risks. Organisations that don’t become digitally sensitive would miss the race.”

In line with this chain of thought, Pranay from BCG emphasised the importance of transforming the agency channel. “COVID-19 is expected to accelerate digitisation of the agency channel. Omni channel is expected to be a norm in the future. While it hasn’t happened in the last 12 months, a war for talent is imminent. Digitally evolved companies will be better positioned to capture, share, and create value as opposed to their traditional counterparts,” he said.

When asked about strategic initiatives being undertaken by their organisations, both CEOs had some valuable insights to share. Ceylinco, a company with a primarily physical model was compelled to make the shift to video doctor appointments, organise trainings for customers to make online payments, enable digital platforms, and facilitate remote ways of working. At FairFirst, the focus was on organisational transformation as well as digitisation. To achieve this end, the company has adopted agile ways of working and a people strategy that explicitly factors this evolution towards a digital future. In addition, ‘Click to Claim’ – an initiative to assess damages in motor accidents, ‘work from home’, fraud analytics, and customer journeys are the focus areas.

In conclusion, Pranay from BCG shared three key steps for insurers to kick-start their bionic journey:

Create digitally enabled core processes like sales

Create a fund to invest in future-looking business models

Begin the cultural shift now as the migration has a long gestation period

The webinar ended on an action-oriented note, with insurers feeling motivated to kickstart the transition from normal to the ‘new normal’.

Five archetypes of bionic seen within players