Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 21 January 2025 02:01 - - {{hitsCtrl.values.hits}}

By The Insurance Regulatory

Commission of Sri Lanka

Over the period from 2019, Sri Lanka’s insurance industry displayed resilience, navigating through the economic downturn caused by the COVID-19 pandemic and the unprecedented economic crisis in 2022. Despite these challenges, the sector managed to maintain stability, demonstrating a strong commitment to protecting policyholders and ensuring business continuity.

In 2023, there were gradual improvements in both the life and general insurance sectors, supported by the proactive regulatory measures implemented by the Insurance Regulatory Commission of Sri Lanka (IRCSL). The third quarter of 2024 further reflects this positive trajectory, with a steady increase in the Gross Written Premium (GWP). These advancements underscore the critical role of the insurance industry in supporting the country’s broader economic recovery, while highlighting the need for continued innovation and regulatory support to address challenges and to further expand insurance inclusiveness across all segments of society.

As at 30 September 2024, 15 insurance companies engaged in Long-Term (Life) Insurance Business and 14 insurance companies engaged in General Insurance Business.

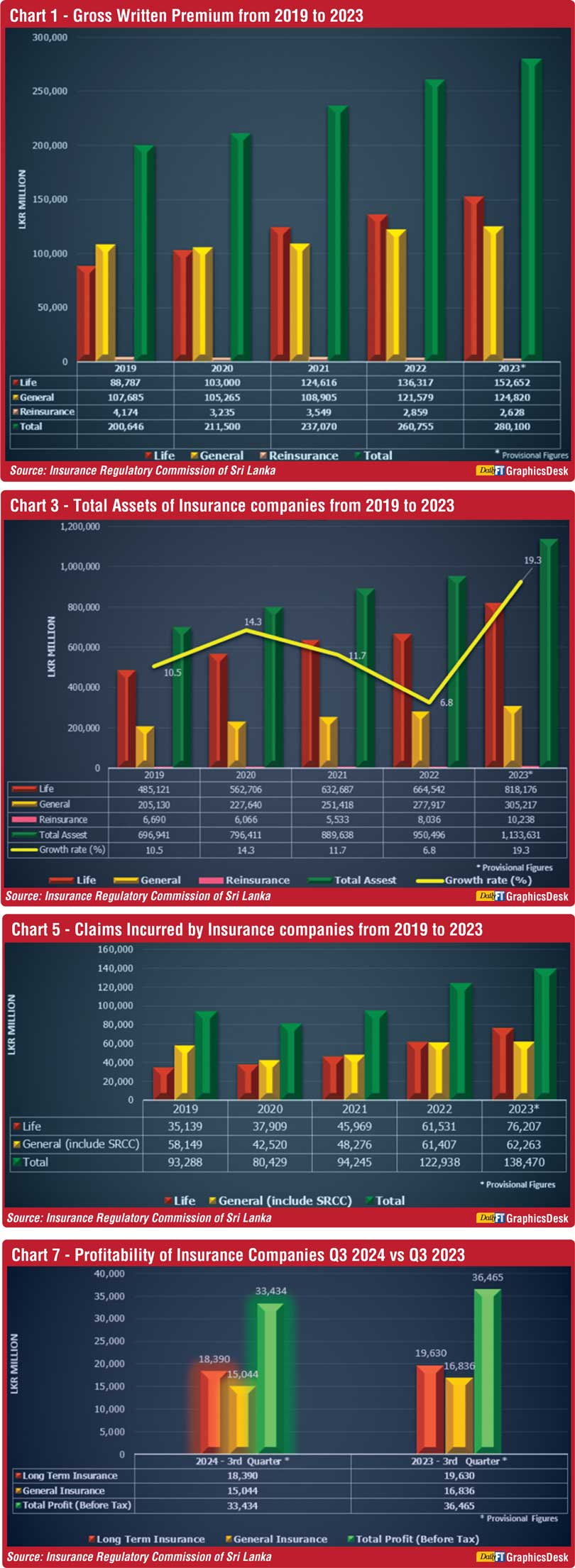

Gross Written Premium

Chart 1 illustrates the performance of the insurance industry from 2019 to 2023. The total GWP escalated to Rs. 280,100 million in 2023, compared to Rs. 200,646 million recorded in 2019, displaying a growth of 39.6%. Life insurance GWP rose from Rs. 88,787 million in 2019 to Rs. 152,652 million in 2023, marking a notable increase. This steady rise reflects the sector’s strengthening appeal and demand for long-term financial security. The general insurance sector also experienced growth over this period, with GWP rising from Rs. 107,685 million in 2019 to Rs. 124,820 million in 2023. This upward trend underscores a growing acceptance of insurance products across Sri Lanka, indicating greater public awareness in both life and general insurance offerings.

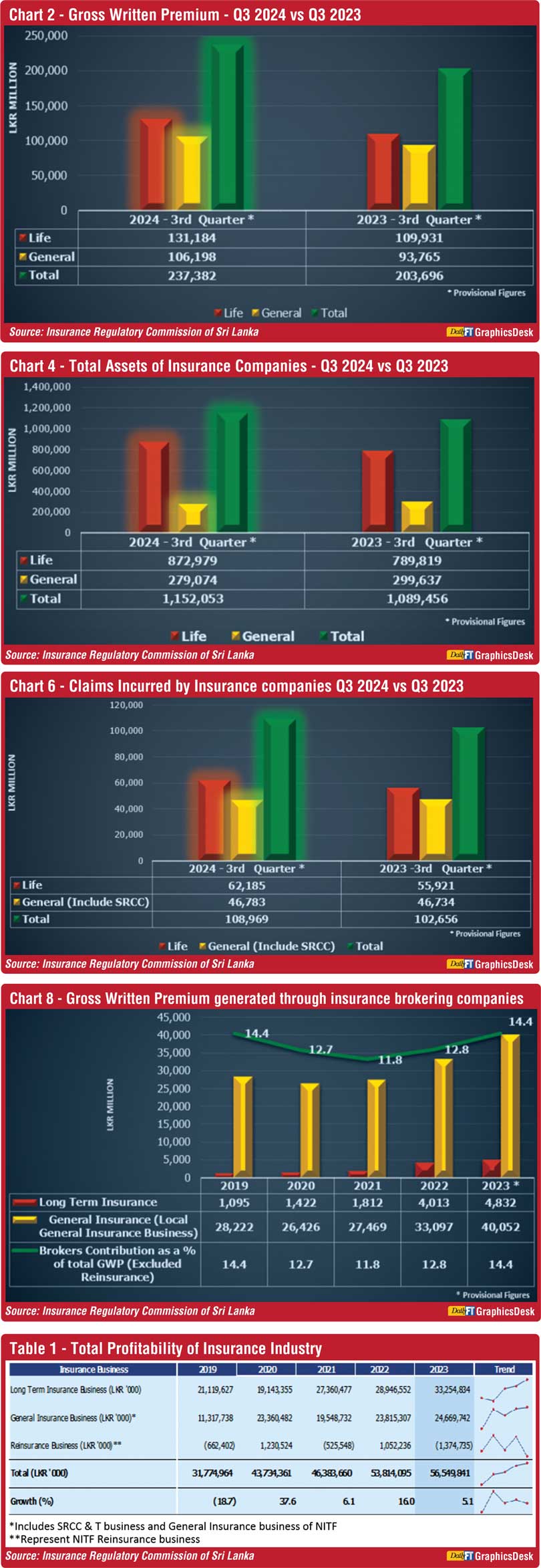

As depicted in chart 2, the GWP for Q3 2024 stood at Rs. 237,382 million, reflecting 16.5% growth compared to Rs. 203,696 million in Q3 2023. This represents a year-on-year (YoY) increase of Rs. 33,686 million. Long-Term Insurance Business reported a GWP of Rs. 131,184 million, a significant growth of 19.33% from Rs. 109,931 million in Q3 2023. Meanwhile, the General Insurance Business recorded a GWP of Rs. 106,198 million, a moderate growth of 13.26% compared to Rs. 93,765 million in the same period in 2023.

Total assets

Chart 3 depicts the total assets of insurance companies from 2019 to 2023. Total assets surpassed Rs. 1 trillion and reached Rs. 1,133,631 million by the end of 2023. Life insurance assets saw substantial growth, from Rs. 485,121 million in 2019 to Rs. 818,176 million in 2023. General insurance assets showed a more moderate increase, from Rs. 205,130 million in 2019 to Rs. 305,217 million in 2023.

The YoY asset growth rates highlight a positive upward trend, with a notable increase of 19.3% in 2023. While asset growth remained modest in 2022, consistent asset accumulation within the insurance sector in previous years, with growth rates of 10.5% in 2019, 14.3% in 2020, and 11.7% in 2021, supported sustained overall growth.

As displayed in chart 4, in Q3 2024, the total assets of insurance companies increased to Rs. 1,152,053 million, reflecting a 5.75% growth compared to Rs. 1,089,456 million in Q3 2023. The assets of the Long-Term Insurance Business grew by 10.53% to Rs. 872,979 million, up from Rs. 789,819 million in the same period in 2023. Conversely, the assets of the General Insurance Business decreased by 6.86%, totalling Rs. 279,074 million compared to Rs. 299,637 million in Q3 2023.

Claims incurred by insurance companies

Chart 5 displays the analysis of claims incurred by insurance companies from 2019 to 2023. In the life insurance segment, claims incurred have steadily increased each year, rising from Rs. 35,139 million in 2019 to Rs. 76,207 million in 2023. This growth reflects a substantial 117% increase over the five-year period, indicating an increasing reliance on life insurance products and a corresponding rise in policyholder claims.

General insurance claims incurred displayed notable fluctuations, with a decline to Rs. 42,520 million in 2020, followed by an increase to Rs. 48,276 million in 2021 and a further rise to Rs. 61,407 million in 2022. In 2023, general insurance claims incurred experienced a marginal increase, reaching Rs. 62,263 million.

Overall, total claims incurred by the insurance sector increased from Rs. 93,288 million in 2019 to Rs. 138,470 million in 2023, marking a growth of approximately 48%.

As shown in chart 6, in Q3 2024, total claims incurred by both the Long-Term and General Insurance Businesses amounted to Rs. 108,969 million, reflecting a 6.15% YoY increase compared to Rs. 102,656 million in Q3 2023. Claims incurred from the Long-Term Insurance Business, including maturity and death benefits, rose by 11.2% to Rs. 62,185 million, up from Rs. 55,921 million in the same period in 2023. Meanwhile, claims incurred in the General Insurance Business, covering Motor, Fire, Marine, and other categories, saw a marginal increase of 0.11% to Rs. 46,783 million compared to Rs. 46,734 million in Q3 2023.

Profit (Before Tax) of insurance companies

As reflected in Table 1, the profitability of Sri Lanka’s insurance industry has experienced significant fluctuations over the past five years. In 2019, the industry saw a sharp decline in Profit Before Tax (PBT) of 18.7%, mainly due to tough economic conditions, including the impact of the Easter Sunday attacks. However, 2020 saw a strong recovery, with a 37.6% increase in profit, driven by strong performance in the General Insurance sector due to the outcome of the declined claim experience, especially in the motor class, as mobility was restricted by lockdown measures imposed in the country.

In 2021, the growth slowed to 6.1% as the industry continued to recover, though long-term insurers showed resilience. In 2022, the industry marked a solid rebound with a 16.0% increase in PBT, despite weaker premium growth and high interest rates affecting long-term insurers. In 2023, growth was modest at 5.1%, supported mainly by the Long-Term Insurance business. The profit in the reinsurance business has been negative in the years 2019, 2021, and in 2023.

In comparing the profitability for Q3 2023 and Q3 2024 as indicated in chart 7, a noticeable decline in PBT is observed across both Long-Term Insurance and General Insurance businesses.

For the Long-Term Insurance Business, the PBT decreased from Rs. 19,630 million in Q3 2023 to Rs. 18,390 million in Q3 2024, reflecting a decline of 6.31%. The General Insurance Business experienced a substantial decline, with the PBT dropping from Rs. 16,836 million in Q3 2023 to Rs. 15,044 million in Q3 2024, marking a significant decrease of 10.64%.

Overall, the total PBT for both sectors combined showed a decline from Rs. 36,465 million in Q3 2023 to Rs. 33,434 million in Q3 2024, a decrease of 8.31%.

Insurance brokers

82 insurance brokering companies were registered with the Commission as at 30 September 2024.

Chart 8 outlines the GWP generated through insurance brokering companies over the last five years from 2019 to 2023.

The GWP of insurance brokers in Sri Lanka has shown a steady increase, reflecting their growing role in the overall insurance market. In 2023, the total GWP of both General and Long-Term Insurance Businesses generated by brokers reached Rs. 44,884 million, a significant increase from Rs. 37,110 million in 2022, marking a growth of 20.9%.

Brokers’ contribution to the total GWP also grew, rising from 12.8% in 2022 to 14.4% in 2023. This indicates that brokers are capturing a substantial share of the market, particularly in General Insurance.