Saturday Feb 28, 2026

Saturday Feb 28, 2026

Monday, 4 September 2023 00:01 - - {{hitsCtrl.values.hits}}

By Securities and Exchange Commission of Sri Lanka

Islamic Capital Market Products (ICMP) are securities which are developed in compliance with Islamic Law, and ICMPs play an important role in the development of the Capital Market and the economy as it opens up opportunities for investment and fund raising. Many countries have introduced different types of ICMPs, such as Shariah-compliant equities, Islamic Collective Investment Schemes (ICIS) and Sukuk.

With the expansion of global private capital flows into high demand Capital Market product categories, Capital Markets have become important sources for tapping into domestic and foreign funds. Therefore, businesses willing to adhere to Shariah principles can raise funds by utilising the growing demand and popularity enjoyed by ICMPs, especially Sukuk.

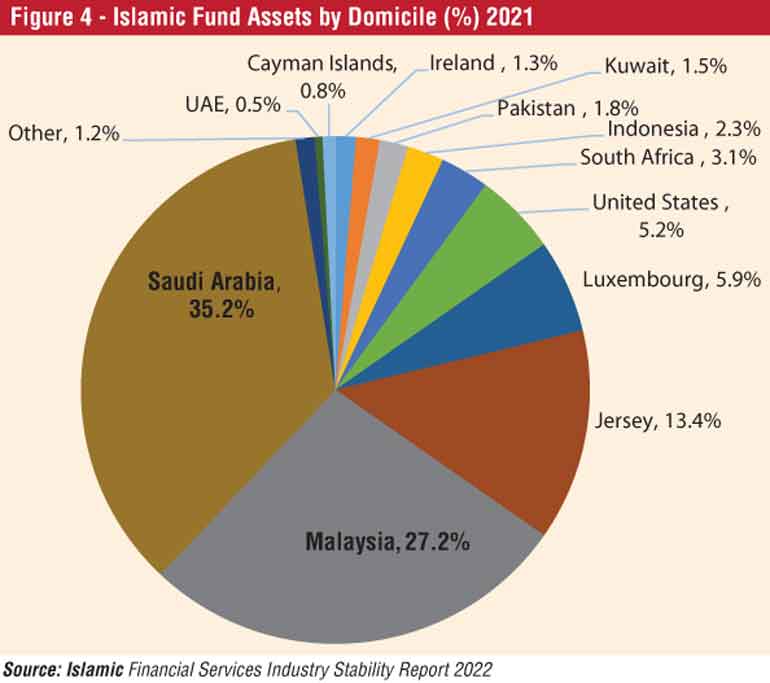

As per the Islamic Finance Development Indicator Report 2022 by Refinitiv, at present the global Islamic finance industry’s assets amount to over $ 3 trillion, and according to Fitch Ratings, the value of Sukuk outstanding globally at the end of year 2022 was $ 765 billion; a 7.6% increase from the outstanding value in 2021. Further, there is an increasing trend in the issuance of sustainable Sukuk fuelled by the emergence of green projects in need of funds and high demand driven by Environment, Social and Governance (ESG) centric investors. Accordingly, the total ESG Sukuk volume as at year 2022 stood at $ 24.5 billion, which is approximately 3% of the global Sukuk outstanding value.

Shariah governance

The ICMPs require a product structure, screening methodology, etc. to be approved by a Shariah board, the precise details vary from jurisdiction to jurisdiction. For example, some have a central Shariah authority, while others rely on Shariah boards at company level. Even where such approval is not a regulatory requirement, it is often a commercial requirement in the market.

Types of ICMPs

The ICMPs belong to three main categories; Shariah-compliant equities, Islamic Collective Investment Schemes (ICIS) and Sukuk.

Shariah compliant equities

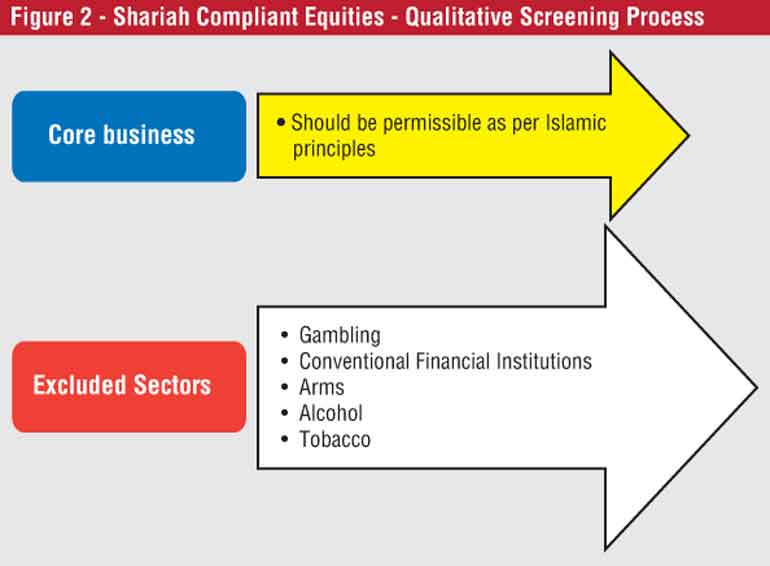

Shariah-compliant equities are equities that are determined to be Shariah compliant, though the issuer may never have made a claim of compliance. The process for determining whether an equity is Shariah-compliant, and thus appropriate for investment by observant Muslims or by funds or institutions seeking Shariah compliance is known as Shariah screening. This applies a set of criteria approved by a board of Shariah scholars and includes both qualitative and quantitative factors.

Screens the main business of the company with the intention of determining that it is not engaged in activities forbidden by Shariah principles such as conventional insurance, manufacture or sale of tobacco-based products or related products, conventional banking, etc. Different Shariah boards have slightly different views on what is permissible. In the screening process, a small amount of non-compliant activity, typically up to 5%, may be permitted.

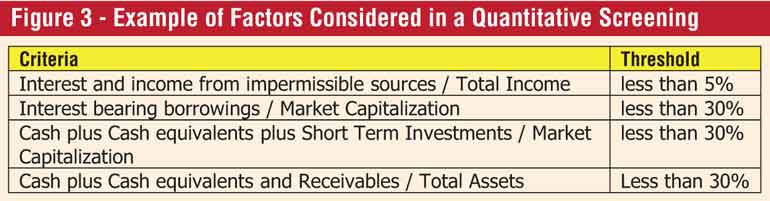

Screens the financial ratios of the company to ensure that it is not receiving or paying substantial amounts of interest. For example, a quantitative screen may require that the company’s interest-bearing debt should not exceed 30% of its market capitalisation.

The Shariah-compliance status of an equity may change from time to time. Conversely, a company may sell off a business that was making it non-compliant or pay down existing debts. Therefore, the list of compliant equities is to be reviewed from time to time.

Islamic Collective Investment Schemes

Islamic Collective Investment Schemes (ICISs) in general use the same legal structures as conventional funds but is required to invest in Shariah-compliant assets. Equities will be screened in a similar way as described above with appropriate variations for non-equity assets. In addition to funds investing in equities and other tradable securities, there are money market funds, real estate funds, commodities funds, venture capital funds, etc.

Sukuk

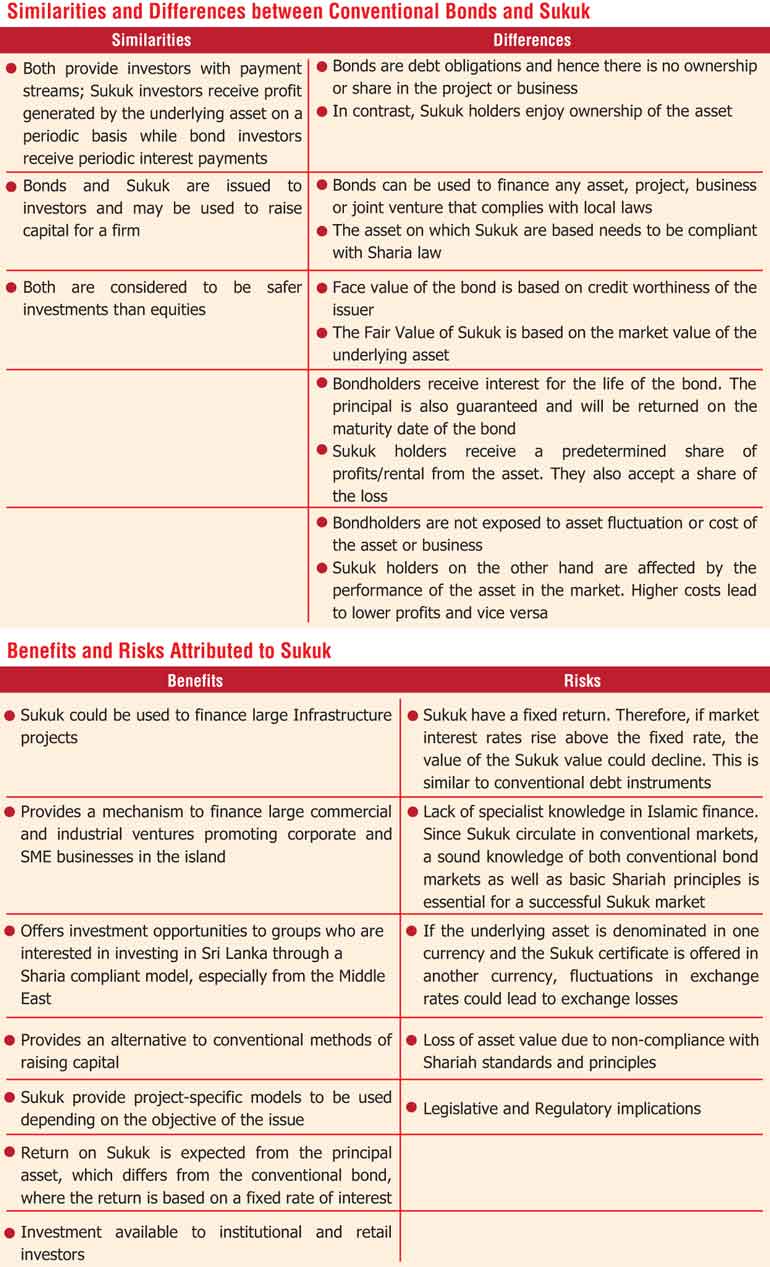

A Sukuk is a financial instrument similar to conventional debt securities and is linked to an underlying asset (normally tangible). From the perspective of investors, holding a Sukuk represents partial ownership of the relevant asset. Sukuk exists because in Islamic finance, the charging or receiving of interest is prohibited; under Shariah, an investor should realise no profit or gain merely for the employment of money.

Whereas conventional bonds evidence a debt owed by the issuer to the bondholders, Sukuk certificates evidence the investors’ ownership interest in the underlying Sukuk asset, which entitles them to a share of the income generated by that asset. However, in practice, the contractual structure is such that the return is predetermined and the dominant risk is the credit risk of an ultimate obligor. They are thus very similar to conventional debt securities in economic terms.

The underlying Sukuk assets must be Shariah-compliant, as must the use of the Sukuk proceeds. The assets or businesses underlying the Sukuk cannot be related to gambling, manufacture or sale of tobacco-based products or related products, conventional banking amongst other things.

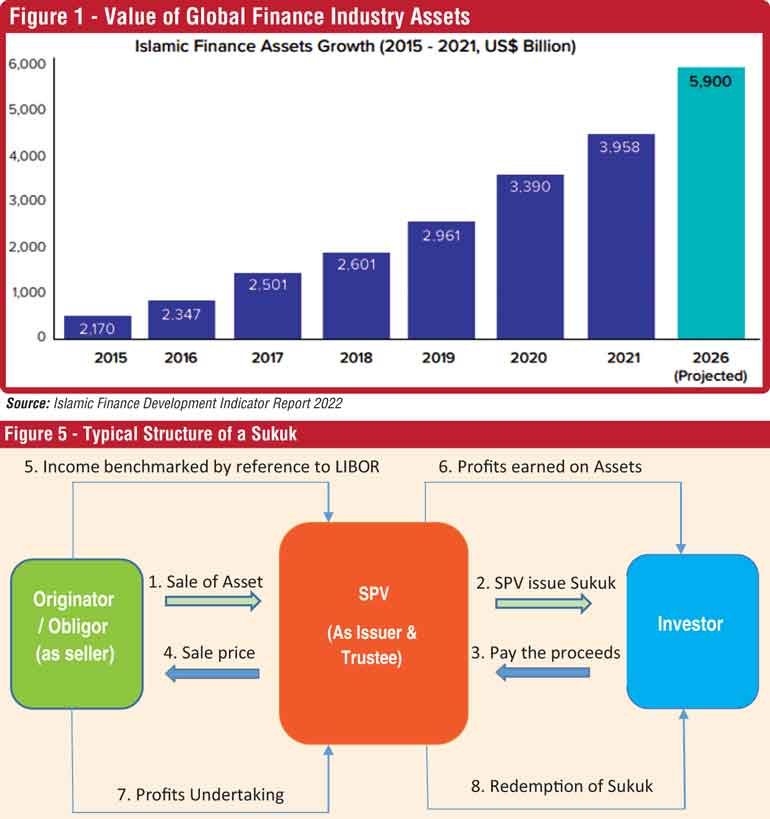

The nature of Sukuk structures vary. A few examples of Sukuk structures include, Ijarah, Murabaha, Salem, Wakala and Mudaraba. However, typically, a company that requires capital (referred to as the “originator”) establishes a Special Purpose Vehicle (SPV) and sells assets to the SPV. This SPV issues Sukuk certificates that are sold to the investors. The originator then contracts to use the assets in its business, for example, by leasing them back; the payments received for this provide the return to the investors. It also contracts to buy back the assets at the end of the period. A well-known variation on this structure involves transferring the beneficial but not the legal ownership of the underlying assets. One way of doing this is for the originator to grant the SPV a long lease over the assets (e.g. 15 years) and to lease them back for a shorter period (e.g. 5 years).

Sukuk may be issued in a domestic or foreign currency (usually USD). Where they are aimed at an international market it is common for them to be listed on more than one exchange; Kuala Lumpur, Dublin and Dubai are popular listing venues for non-local issuers.

Sukuk vary in tenor; short-term and with durations in excess of 10 years. However, the majority of Sukuk issued up until now have a maturity of three or five years.

Statistics on Sukuk Issuances

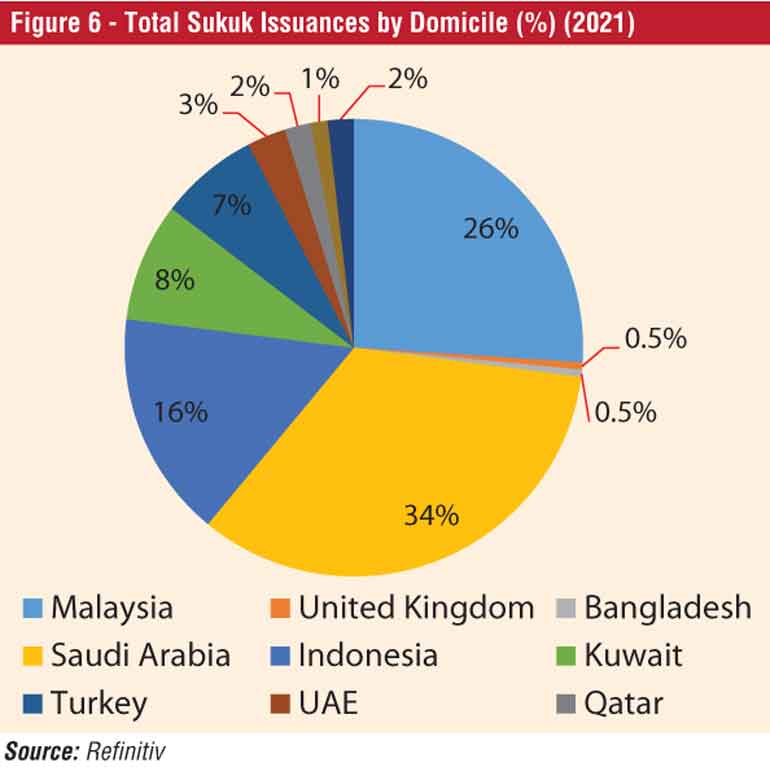

Malaysia, Saudi Arabia and Indonesia remain as the largest issuers of Sukuk and, together made up approximately 75% of Sukuk issued in the year 2021 and the first half of year 2022. Sovereigns continue to drive Sukuk issuance, claiming to about 60% of global issuances.

Proposed introduction of sukuk products at the Colombo Stock Exchange (CSE)

At a time when there is a growing appetite and demand for ICMPs from investors and, with the success of other jurisdictions entwining the product into the Capital Market framework, by introducing a product such as Sukuk at the CSE, Sri Lanka would be able to tap into the much needed foreign funds and source it for development goals through the Capital Market framework.

The SEC approved in principle the introduction of ICMPs to the Sri Lankan Capital Market in June 2021. Thereafter, under the Capital Market Development Program of the Asian Development Bank (ADB), the SEC received technical assistance for conducting a needs assessment for Shariah-compliant securities in Sri Lanka, and identify potential Shariah-compliant Capital Market instruments to be introduced to the local market, and to formulate a policy and regulatory framework for the identified products in consultation with the SEC and the CSE.

Subsequent to the assessment done by the ADB experts, it was highlighted that there is a keen interest by the issuers and investors both for introducing Sukuk products and it was recommended to introduce Sukuk products to the Capital Market by making amendments to the existing listing rules applicable to debt securities at the CSE.

Subsequent to a stakeholder consultation process, the ADB consultants together with the SEC and the CSE developed the Regulatory Framework for introducing Sukuk products which was approved by the SEC Commission. According to the Regulatory Framework, an entity planning to list Sukuk products at the CSE is required to provide details such as a description of the underlying Sukuk structure, the relationships between the parties, and the flow of funds including a structure diagram in the Prospectus or Introductory Document. The rules for introducing Sukuk products were developed by the CSE in accordance with the approved Regulatory Framework by the SEC Commission in June 2023.

The issue of Sukuk products in various jurisdictions over the world has grown rapidly during the past few years giving proof of the popularity of the product. The introduction of Sukuk products at the CSE would broaden the product offering and open up new avenues for attracting much needed foreign funds to the Sri Lankan Capital Market, and be a catalyst towards the growth of Sri Lanka’s economy.