Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 17 May 2018 00:30 - - {{hitsCtrl.values.hits}}

Lanka Impact Investing Network (LIIN), the pioneering impact investing network and the entity that launched the first TV reality show ‘Ath Pavura’ that connects impact investors to social entrepreneurs, will host, for the very first time, a two-day residential program for 30 high-profile, Sri Lankan investors in partnership with World University Service of Canada (WUSC) and the United Nations Development Program (UNDP).

The concept of impact investing is relatively new to Sri Lanka. It is through Ath Pavura that the first engagement of Sri Lankan investors investing in social entrepreneurs took place. The impact investors, Tuskers of Ath Pavura, have invested nearly Rs. 50 million in impact investments on 44 social entrepreneurs.

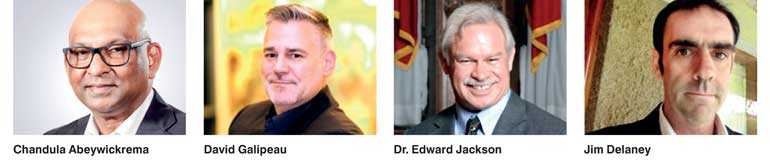

Three global experts on impact investing, Dr. Edward Jackson, President of Jackson and Associates, an Ottawa-based consulting firm, Jim Delaney, Director of WUSC, and David Galipeau, Chief Impact Officer of UNDP SDG Impact Finance (UNSIF) will conduct the program moderated by Chandula Abeywickrema, Founder and Chairman of LIIN and Co-Founder of Ath Pavura.

The two-day program will increase Sri Lankan investors’ understanding of impact investing by discussing its purpose and return, impact management strategies, innovative business models and impact measurement in Sri Lanka.

The program will cover all of the practical skills in the impact investing lifecycle. In addition, the three global experts will discuss the following key developments from a global perspective:

1) The concept of ‘impact investing’; the developments of the past few years, and the excitement that has been generated around the term “impact investing” – an investment approach that intentionally seeks to create both financial return and measurable positive social or environmental impact.

2) The importance of the incorporation of mainstream investors to foster the growth of the impact investment sector.

3) The difference between impact, sustainable and responsible investing. In short, responsible investing refers to a broad array of investment practices – including socially responsible, sustainable and impact investing.

4) The capital providers that are most active in the impact investment sector.

5) Impact investment fund-of-fund structures.

6) The emerging initiatives and trends in impact investing globally.

7) The role of Sri Lankan Impact investors in driving Sri Lanka›s silent economic revolution through social entrepreneurship.

8) Gender lens investing and the importance of the inclusion and integration of women.

The two-day program will also have deliberations, discussions and brainstorming sessions on the following key areas, all of which will benefit the creation of the social entrepreneur ecosystem in Sri Lanka:

1) How impact investing improves society

2) How impact investing drives innovation to solve social and environmental issues

3) How impact investing can ensure good governance, efficiency and transparency

4) How impact investing can create wealth for more people in more places and reduce income inequality

The following key sectors will be examined during brainstorming sessions on social entrepreneurship, inclusive business and responsible business in Sri Lanka for impact investing:

1) Agriculture

2) Education

3) Energy

4) Environment

5) Health

6) Housing

7) Water and sanitation

8) Info and Communication Technology

9) Financial services

Non-profit organisations, WUSC and UNDP’s UNSIF, are working in partnership with LIIN to support this initiative in the effort to foster socio-economic development in Sri Lanka.

WUSC – World University Service of Canada – is a leading Canadian non-profit organisation in international development, committed to building a more equitable and sustainable world. It works with a unique and powerful network of post-secondary institutions, private-sector partners and volunteers to provide education, employment and empowerment opportunities that improve the lives of millions of disadvantaged youth around the world.

WUSC is excited to be part of this pioneering initiative, as new financing models like impact investing hold tremendous promise for facilitating the inclusion of marginalised groups such as women and youth in Sri Lanka›s socio-economic growth.

WUSC believes that impact investing can be used to address diverse areas where access to finance is a challenge, from a woman-owned business in need of capital, to a young person looking to fund a professional course at a private vocational training institution.

WUSC believes that impact investors have a vital role to play and must be equipped to do so. Therefore, they are delighted to be able to bring leading experts from Canada to share knowledge and impart skills to a new cadre of Sri Lankan impact investors.

The 2030 UN agenda entails substantial costs well beyond resource envelopes of many countries. The recently set-up UNDP SDG Impact Finance (UNSIF) unit of the UNDP supports countries to set up innovative financing schemes for SDG financing to meet this challenge.

UNSIF provides comprehensive and holistic eco-system development assistance to countries while pulling together resources from the UN system and building strategic partnerships with other global and national institutions. UNSIF has launched several initiatives in the Asia-Pacific region and is also exploring several options in Sri Lanka and Maldives.

Participation in the two-day program is by invitation and will be held on 26 to 28 July at Jetwing Lagoon Resort in Negombo.