Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 29 May 2023 00:26 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

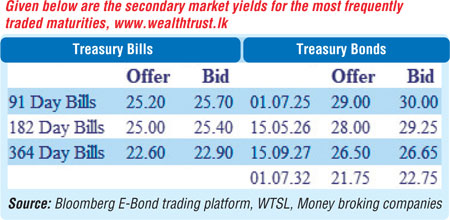

The USD/LKR or Rupee rate on spot contracts appreciated considerably during the week to hit an intraweek high of Rs. 296.45 before closing the week at Rs. 296.00/297.50 against its previous week’s closing level of Rs. 306.50/00, on the back of selling interest on the greenback. The rupee was traded below Rs. 300 for the first time since March 2022.

The USD/LKR or Rupee rate on spot contracts appreciated considerably during the week to hit an intraweek high of Rs. 296.45 before closing the week at Rs. 296.00/297.50 against its previous week’s closing level of Rs. 306.50/00, on the back of selling interest on the greenback. The rupee was traded below Rs. 300 for the first time since March 2022.

Meanwhile, the week ending 26 May saw secondary market bond yields see-saw, increasing during the first half of the week leading the mid-week Treasury bill auction outcome while decreasing once again towards the later part on the back of renewed buying interest while volumes traded remained moderate.

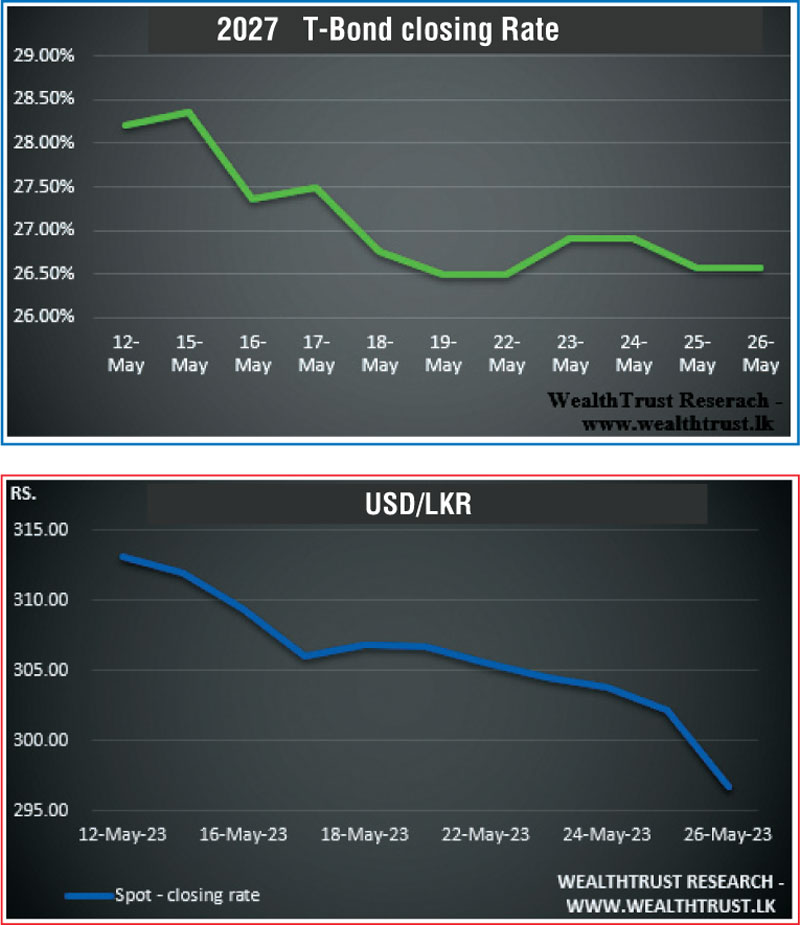

The yields on the liquid maturities of 2027’s (i.e., 01.05.27 and 15.09.27) increased to intraweek highs of 26.95% each against its previous week’s closing level of 26.40/60 and 26.45/65 respectively. However, buying interest towards the latter part of the week saw yields on the said maturities decreasing once again to hit lows of 26.75% and 26.50% respectively, closing the week mostly unchanged against its previous week.

At the weekly Treasury bill auction, weighted average rates increased across the board with only an amount of Rs. 149.42 billion been accepted in total against its total offered amount of Rs. 160 billion.

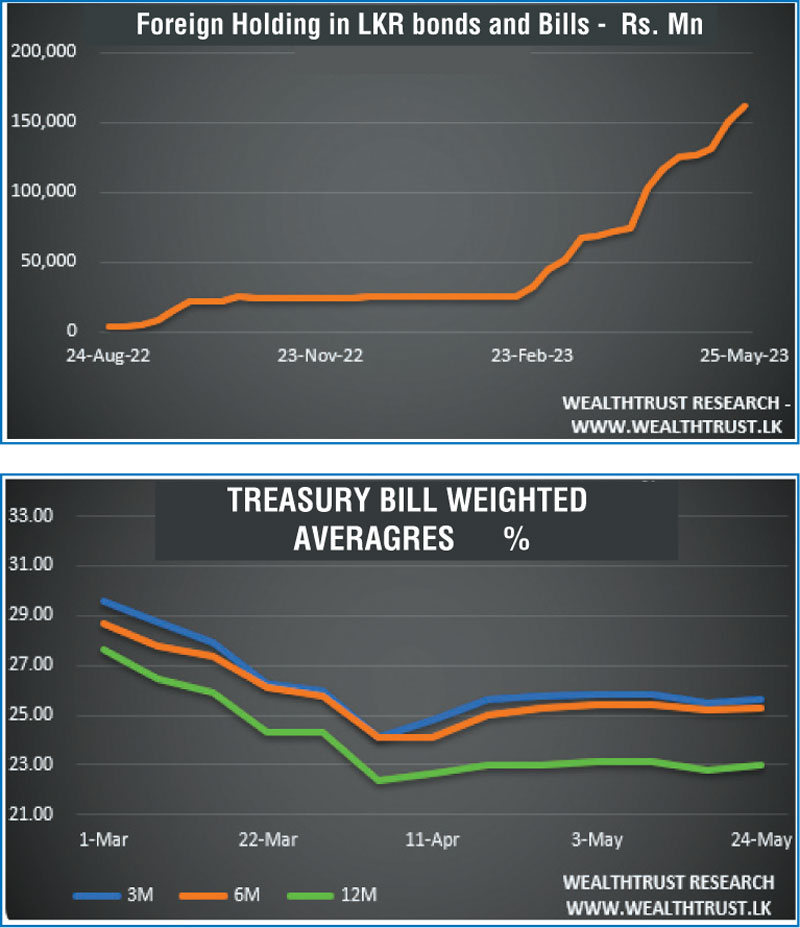

The foreign holding in rupee bills and bonds increased further by Rs. 10.69 billion to Rs. 161.22 billion for the week ending 25 May while the National Consumer Price Index (NCPI) or national inflation for the month of April saw its point to point decreasing to 33.6% as against 49.2% recorded in November.

The daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 32.34 billion.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 66.89 million.

In money markets, the total outstanding liquidity deficit increased to Rs. 16.81 billion by the end of the week against its previous week’s deficit of Rs. 2.44 billion while the Central Bank of Sri Lanka’s (CBSL) holding of Government Securities stood at Rs. 2,628.49 billion.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies.)