Friday Feb 27, 2026

Friday Feb 27, 2026

Tuesday, 23 November 2021 04:23 - - {{hitsCtrl.values.hits}}

|

LOLC Vice Chairman Ishara Nanayakkara

|

LOLC Holdings PLC yesterday issued a further clarification by way of disclosure to the Colombo Stock Exchange (CSE) on the creation of a new platform to attract foreign investors to its finance companies.

Following is the disclosure:

1. Date of the transaction – 19 November 2021

2. Name of the Related Party – LOLC Ceylon Holdings Ltd. (LOCH)

3. Relationship between the Entity and the Related Party – Fully owned subsidiary

4. Details of the transaction including the amount, relevant terms of the transaction and the basis on which the terms were arrived at

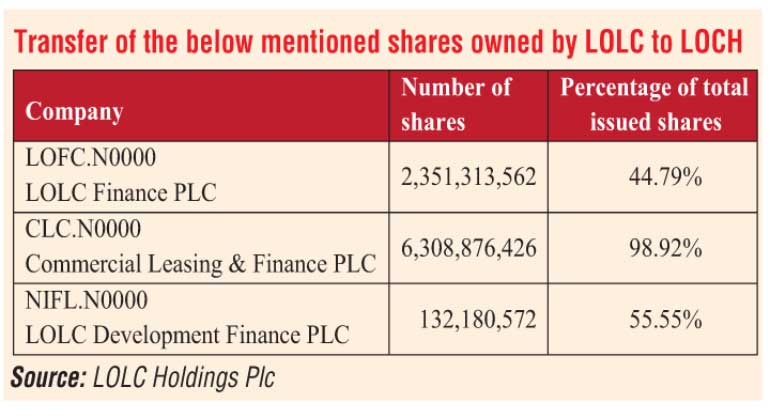

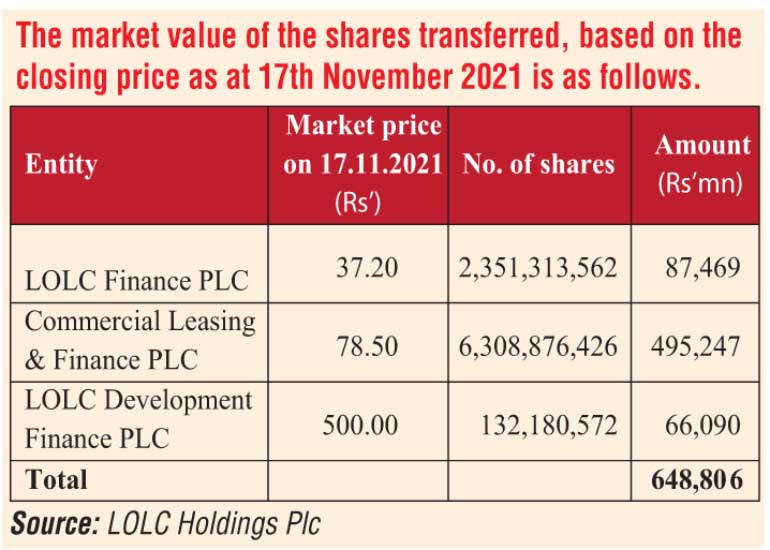

The market value of the shares transferred, based on the closing price as at 17 November 2021 is as follows:

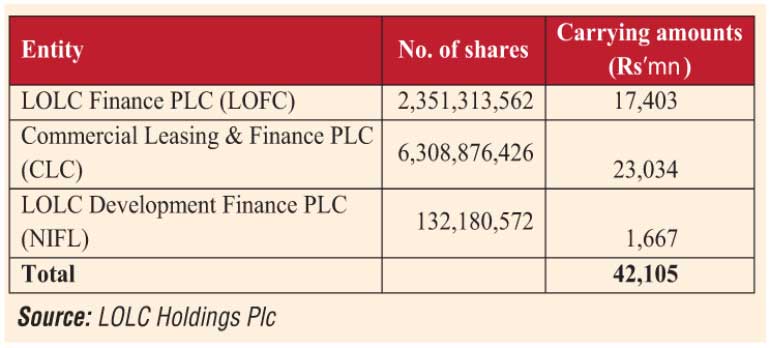

The transfer of the shares was executed as an off-the-floor transfer considering the closing prices as at 17 November 2021. However, as this is a transaction between the parent company (LOLC) and its fully owned subsidiary (LOCH), i.e. a common control transaction, LOLC will not be recognising any gain nor will LOCH recognise any goodwill. This is due to the transfer of shares being within the Group and the status of control of these entities remains unchanged, as the ultimate parent continues to be LOLC. Therefore, the transaction is effectively accounted for, based on its carrying amounts, as reflected below.

LOCH will settle the above transaction value by issuing new shares amounting to Rs. 41,105 million to LOLC and pay Rs. 1,000 million in cash.

Consequently, LOLC will derecognise its investment in LOFC, CLC and NIFL and recognise a new investment in LOCH amounting to Rs. 41,105 million.

LOCH will account for its new investment in LOFC, CLC and NIFL at the above reflected carrying amounts in its Statement of Financial Position.

Rationale for entering into the transaction – as disclosed in the disclosure made on 12 January 2021 – to create a platform to own the finance companies of LOLC Group.

This transaction exceeds 10% of the Equity of LOLC as per the latest Audited Financial

Statements. The Related Party Transactions Review Committee of LOLC is of the view that the transaction is on normal commercial terms and is not prejudicial to the interests of the Entity and its minority shareholders. The Related Party Transaction Review Committee is not obtaining an opinion from an independent expert prior to forming its view on the transaction.

7. This transaction exceeds one-third of the Total Assets of the entity as per the latest Audited Financial Statements. Hence, shareholder approval was obtained prior to the transaction.

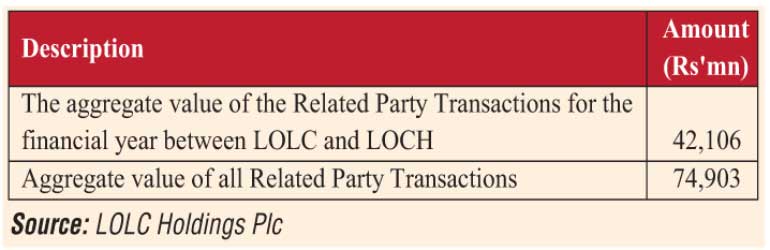

Aggregate value of Related Party Transactions