Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 30 March 2021 03:21 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The second phase of the primary Treasury bond auctions held yesterday was opened on all three maturities at its weighted average rates due to its offered amount of Rs. 60 billion not been fully subscribed at its first phase of the auction. However, only an amount of Rs. 27.44 billion was subscribed in total, recording a shortfall of Rs. 32.56 billion.

The second phase of the primary Treasury bond auctions held yesterday was opened on all three maturities at its weighted average rates due to its offered amount of Rs. 60 billion not been fully subscribed at its first phase of the auction. However, only an amount of Rs. 27.44 billion was subscribed in total, recording a shortfall of Rs. 32.56 billion.

The 15.11.2023 and 15.01.2026 maturities recorded weighted average rates of 6.30% and 7.05% respectively, similar to its stipulated cut of rates while the 01.05.2028 maturity recorded a weighted average rate of 7.58%, marginally below its stipulated cut off rate of 7.60%.

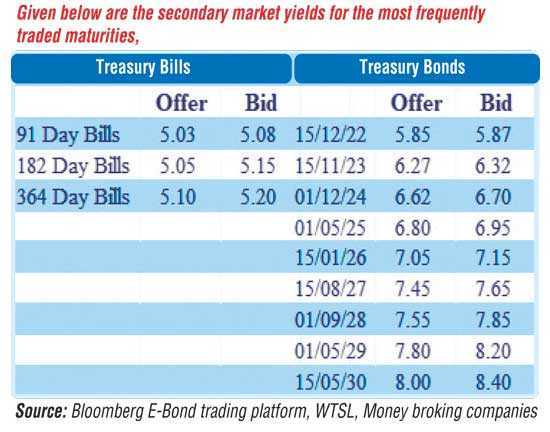

Activity in the secondary bond and bill markets at the start of a fresh week dried up considerably yesterday, with limited trades seen on the bond maturities of 15.01.23, 15.05.23, 01.12.24 and 15.09.34 and a bill maturity of 3 December at levels of 5.95%, 6.25%, 6.60%, 8.35% and 5.09% respectively.

The total secondary market Treasury bond/bill transacted volume for 27 March was Rs. 5.16 billion.

In money markets, the weighted average rates on call money and repo was registered at 4.61% and 4.62% respectively yesterday while the net liquidity surplus stood at Rs. 110.37 billion with an amount of Rs. 146.37 billion been deposited at Central Banks SDFR of 4.50% against an amount of Rs. 36.00 billion withdrawn from Central Banks SLFR of 5.50%.

USD/LKR

In the Forex market, USD/LKR rate on the more active one-week forward contracts remained mostly unchanged yesterday to close the day at Rs. 199.25/199.75. Spot contracts were traded at levels of Rs. 199.50 to Rs. 199.80.

The total USD/LKR traded volume for 26 March was $ 86.57 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)