Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 7 April 2025 05:21 - - {{hitsCtrl.values.hits}}

By WealthTrust ecurities

The total outstanding liquidity surplus in the inter-bank money market surged to Rs. 191.21 billion as at the week ending 4 April, from Rs. 184.26 billion recorded the previous week. This marks the highest level recorded since January 2021. The weighted average interest rates on call money and repo were recorded within the ranges of 7.94%-7.96 and 7.96%-7.98% respectively. Meanwhile, the Secondary Bond market last week started off on a slow note. However, the market quicky shifted gears and activity picked up during the week. Midweek, yields were seen increasing, following the results at the weekly Treasury Bill auction, which recorded the first instance weighted averages increased in 20 weeks. The upward momentum was further compounded by news of the imposition of 44% reciprocal tariffs by the United States on Sri Lankan exports, which led to a further drastic increase in yields. However, sporadic bouts of renewed buying interest were seen kicking in at the elevated yield levels, leading to a partial recovery. Despite this, secondary market two-way quotes closed higher on a week-on-week basis. Overall market activity and transaction volumes were seen at healthy levels during the week.

The total outstanding liquidity surplus in the inter-bank money market surged to Rs. 191.21 billion as at the week ending 4 April, from Rs. 184.26 billion recorded the previous week. This marks the highest level recorded since January 2021. The weighted average interest rates on call money and repo were recorded within the ranges of 7.94%-7.96 and 7.96%-7.98% respectively. Meanwhile, the Secondary Bond market last week started off on a slow note. However, the market quicky shifted gears and activity picked up during the week. Midweek, yields were seen increasing, following the results at the weekly Treasury Bill auction, which recorded the first instance weighted averages increased in 20 weeks. The upward momentum was further compounded by news of the imposition of 44% reciprocal tariffs by the United States on Sri Lankan exports, which led to a further drastic increase in yields. However, sporadic bouts of renewed buying interest were seen kicking in at the elevated yield levels, leading to a partial recovery. Despite this, secondary market two-way quotes closed higher on a week-on-week basis. Overall market activity and transaction volumes were seen at healthy levels during the week.

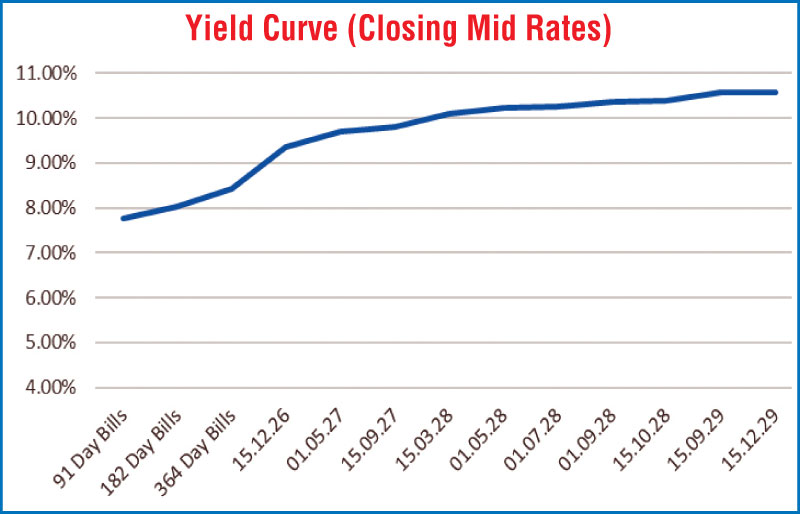

The 15.09.27 was seen trading at a high of 9.95% from a low of 9.50%, before rebounding to close at the two-way quote of 9.75%/9.85%. The yield on the 15.10.28 maturity initially moved up to trade at an intraweek high of 10.45% before settling at a two-way quote of 10.35%/10.40%. The rest of the yield curve followed a similar trading pattern. The 15.09.29 maturity was seen hitting an intraweek high of 10.75% from a low of 10.45, before recovering to close quoted at the rate of 10.55%/10.60%.

At the weekly Treasury Bill auction, weighted average yield rates were seen increasing across the board for the first time in 20 weeks. Accordingly, the weighted average rate on the 91-day tenor increased by 09 basis points to 7.59%, the 182-day tenor by 07 basis points to 7.91% and the 364-day tenor by 06 basis point to 8.31%. The auction went undersubscribed for a second consecutive week, as only 55.73% or Rs 78.02 billion was accepted in total of the total Rs. 140.00 billion amount offered. This was despite total bids received exceeding the offered amount by 1.30 times.

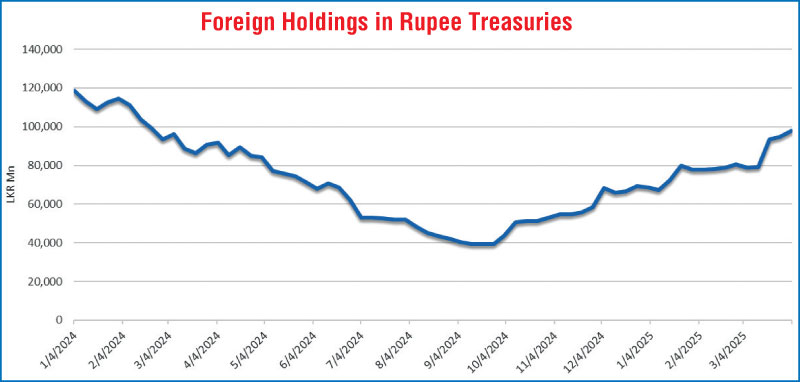

The foreign holding in Rupee Treasuries recorded a net inflow for the fourth consecutive week for the week ending 3 April 2025 amounting to Rs 3.09 billion, and as a result the total holding rose to Rs. 97.86 billion reaching the highest level since February 2024.

The daily secondary market Treasury Bond/Bill transacted volumes for the first three days of the week averaged at Rs. 22.90 billion.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at

Rs. 2,511.92 billion as at 4 April, unchanged from the previous week’s closing level.

Forex market

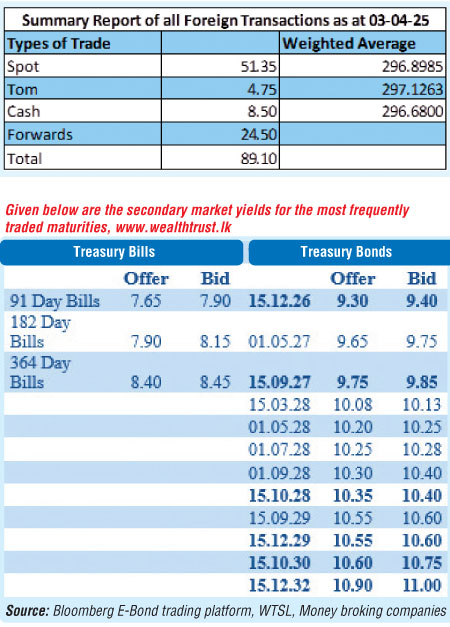

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating, to close the week at Rs. 296.65/296.75 as against the previous week’s closing level of

Rs. 296.25/296.35 and subsequent to trading at a high of

Rs. 296.05 and a low of Rs. 297.80.

The daily USD/LKR average traded volume for the first three trading days of the week stood at

$ 96.94 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)