Sunday Feb 15, 2026

Sunday Feb 15, 2026

Monday, 3 January 2022 00:00 - - {{hitsCtrl.values.hits}}

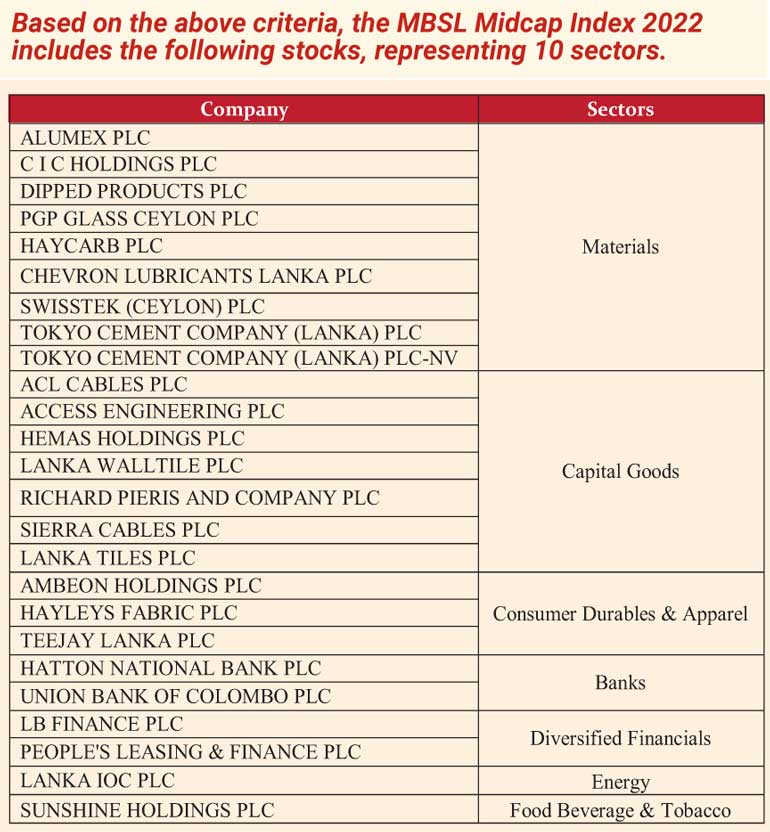

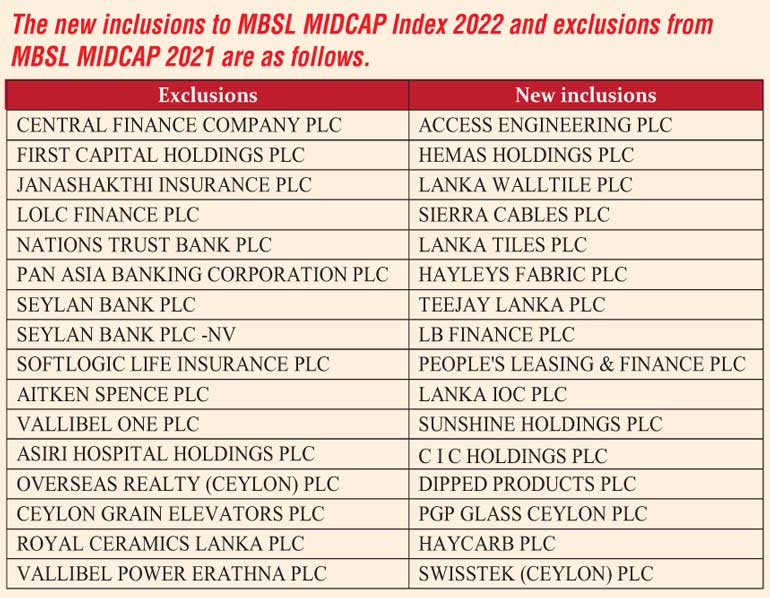

The MBSL Midcap Index has announced its new composition for the year 2022 following its annual review.

In a pioneering move, the Merchant Bank of Sri Lanka and Finance PLC (MBSL) constructed the ‘MBSL Midcap Index’, which measures the aggregate price level and price movements of medium-sized companies listed on the Colombo Stock Exchange (CSE). The index, which came into operation in 1999 and is revised annually, focuses on the Middle Range Market Capitalisation, Liquidity and the Profitability of the firms to be included in the MBSL Midcap Index.

MBSL said its MBSL Midcap Index can be used as the benchmark index by individuals and institutional investors who prefer growth but are prepared to withstand only conservative levels of volatility in their equity investments. It can be used as the benchmark index for the introduction of MBSL MIDCAP linked index funds.

“MBSL Midcap Index generates valuable signals for portfolio managers for switching from larger-cap more sensitive stocks to midcap less sensitive stocks with more growth potential in response to changing capital market conditions. The MBSL Midcap Index focus in profitability helps to screen stocks with better future prospects that will cross to higher market capitalisation in the coming year,” MBSL added.

The criteria for selecting the 25 stocks of the index remained unchanged. They are ‘Middle Range Market Capitalisation’, as at 30 November 2021; ‘Liquidity’, based on the number of trades during the year; and ‘Profitability’ within the last two years.

When calculating the midcap index for the previous year (2021), stocks were selected from the market capitalisation range of Rs. 2.32 billion to 23.23 billion, accounting for ASPI changes in the midcap range for the year 2022 as Rs. 4.26 billion to Rs. 42.57 billion.