Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 30 September 2024 00:08 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market during the trading week ending 27 September, started off on a positive note following the conclusion of the Presidential election and rallied strongly throughout the week. Frenzied buying pushed yields to fresh lows, supported by robust market activity and sizeable transaction volumes. This was despite, a no change outcome on CBSL’s policy rates at the 5th Monetary Policy Review for 2024, at the end of last week. The market was buoyed by optimistic remarks shared by the international rating agencies, Moody’s and Fitch, and reports of overperformance on key macroeconomic metrics. Notably, the Central Bank of Sri Lanka (CBSL) suggested GDP growth could exceed the initial projection of 3.00% for 2024.

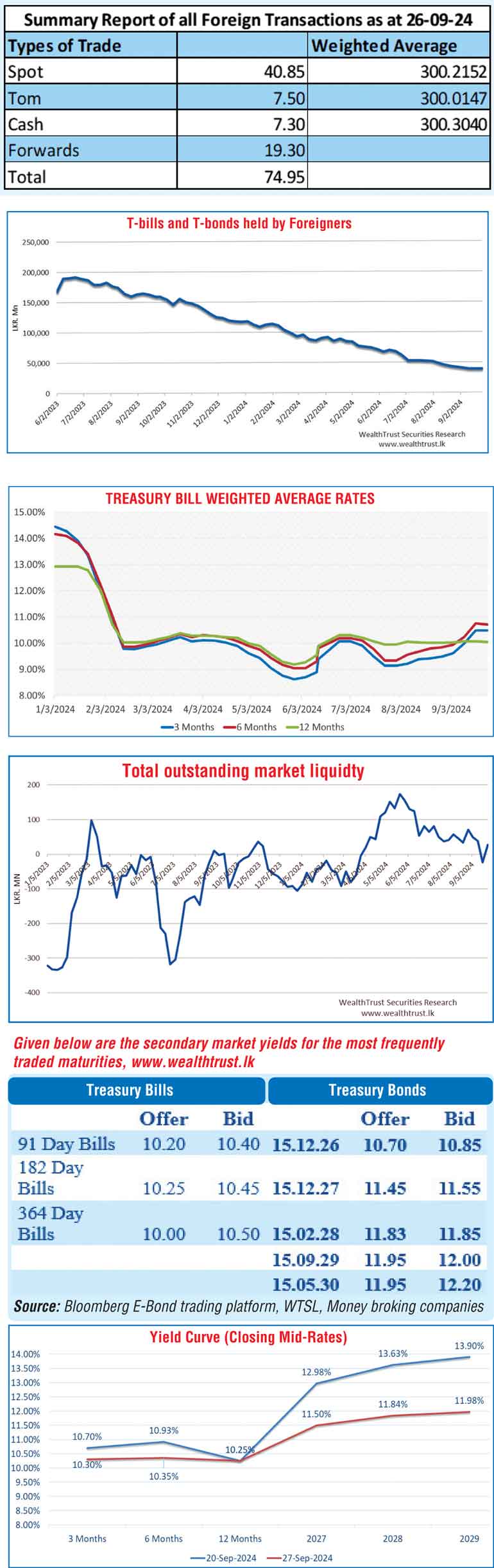

Accordingly, yields on the 2028 tenors, specifically the liquid 15.02.28 dropped drastically to an intraweek low of 11.83%, down from an intraweek high of 13.65%. Similarly, the yield on the 15.06.29 maturity declined from 13.80% to 11.98% intraweek. The shorter tenors – 15.05.26, 01.06.26, and 15.12.26 – traded lower, with yields dropping down from 11.80% to 10.50%. The 2027 tenor 01.05.27, 15.09.27 and 15.12.27 maturities saw yields drop from 12.60% to 11.49%, collectively. Additionally, trades were observed on the medium tenor 15.05.30 maturity with its yield declining from 13.63% to 12.00% during the week.

Much of the action focused on the recently auctioned bonds, specifically the 15.02.28 and 15.06.29 maturities, which were issued at the weighted average rates of 13.79% and 13.98% respectively on the 12 September, reflecting a sharp decrease of around 200 basis points in a period of just two weeks.

In conclusion, at the close of the week the yield curve was observed shifting down dramatically.

At the 5th monetary policy review of 2024 announced last Friday, 27 September, the Monetary Policy Board of the Central Bank of Sri Lanka decided to pause its monetary easing cycle, keeping key policy rates unchanged. The Standing Deposit Facility Rate (SLDR) was maintained at 8.25%, while the Standing Lending Facility Rate (SLFR) remained at 9.25%. The Statutory Reserve Ratio (SRR) was also held steady at 2.00%. Since the current monetary easing cycle commenced in June 2023, policy rates have been reduced by a total of 725 basis points. As per the official press release: The board noted that the current accommodative monetary policy stance is yielding the expected outcomes, particularly in terms of the continued easing of market lending interest rates, expansion of credit to the private sector, and a strong rebound in domestic economic activity amidst a low inflation environment.

Meanwhile, last week’s Treasury bill auction reflected the enthusiasm in the secondary market and recorded a bullish outcome, which saw an end to an eight-week streak of rising weighted averages. Accordingly, the rate on the 91-day tenor held steady at 10.49%, the 182-day tenor dropped by 4 basis points to 10.72% and the 364-day tenor declined by two basis points to 10.05%. The bids received exceeded the offered amount by two times and the entire Rs 120 billion amount offered was raised successfully at the 1st phase of the auction.

For the week ending 26 September 2024, foreign holdings in Sri Lankan rupee-denominated Treasury securities saw a modest net inflow of Rs. 4.00 million. This marked the second consecutive week of positive inflows, bringing total foreign holdings to Rs. 39.396 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 37.27 billion.

In money markets, the total outstanding liquidity was a surplus of Rs. 27.43 billion by the week ending 27 September, as against a deficit of Rs. 23.83 billion the previous week. The Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of overnight reverse repo auctions and a 6-day term reverse repo auction at weighted average rates of 8.58% to 8.93%. The weighted average interest rate on call money and repo ranged between 8.61% to 8.63% and 8.85% to 8.95% respectively.

The Central Bank of Sri Lankas (CBSL) holding of Government Securities was registered at Rs. 2,515.62 billion at 27 September 2024 unchanged from the previous week’s level.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating during the week to close the week at Rs. 298.70/298.90 against its previous week’s closing level of Rs. 305.25/306.00 and subsequent to trading at a high of Rs. 298.70 and a low of Rs. 305.50.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 63.34 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)