Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Wednesday, 10 July 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

Moderate activity was witnessed in the secondary bond market yesterday as most market participants was seen on the sidelines ahead of today’s weekly Treasury bills auction.

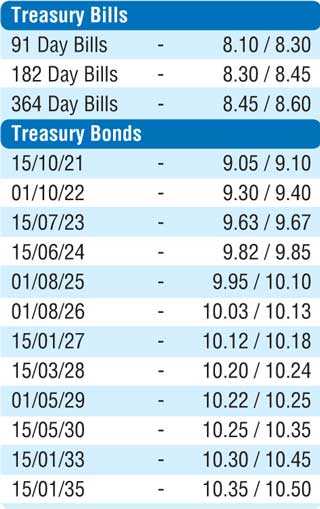

At the auction, a total amount of Rs. 22.5 billion will be on offer consisting of Rs. 3.0 billion on the 91 day maturity, Rs. 5.0 billion on the 182 day maturity and a further Rs. 14.5 billion on the 364 day maturity. At last weeks of auction, where a total amount of Rs. 23 billion was successfully subscribed, the weighted averages decreased across the board by 07, 17 and 11 basis points respectively to 8.17%, 8.32% and 8.59% on the 91 day, 182 day and 364 day maturities.

In the secondary bond market, limited trades were witnessed on the liquid maturities of 01.08.21, two 2023’s (i.e. 15.03.23 & 15.07.23) and two 2024’s (i.e. 15.03.24 and 15.06.24) at levels of 9.00%, 9.60% to 9.61%, 9.65% to 9.67%, 9.82% and 9.83% to 9.84% respectively, while two-way quotes on the rest of the yield curve were seen narrowing as well.

The total secondary market Treasury bond/bill transacted volumes for 8 July was Rs. 7.40 billion.

In money markets, the overnight call money and repo rates averaged 7.79% and 7.85% respectively yesterday as the OMO (Open Market Operations) Department of the Central Bank of Sri Lanka drained out an amount of Rs. 9.45 billion by way of an overnight repo auction at weighted average rate of 7.71%. The overnight net liquidity surplus increased further to Rs. 27.56 billion.

Rupee appreciates further

In the Forex market, the USD/LKR rate on spot contracts appreciated further yesterday to close the day at levels of Rs. 175.65/70 against its previous day’s closing levels of Rs. 176.00/10 on the back of continued selling interest by Banks and a drop in forward premiums.

The total USD/LKR traded volume for 8 July was $ 130.96 million.

Some forward USD/LKR rates that prevailed in the market are: 1 Month - 176.25/45; 3 Months - 177.65/85; 6 Months - 179.50/80.