Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 6 October 2022 01:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

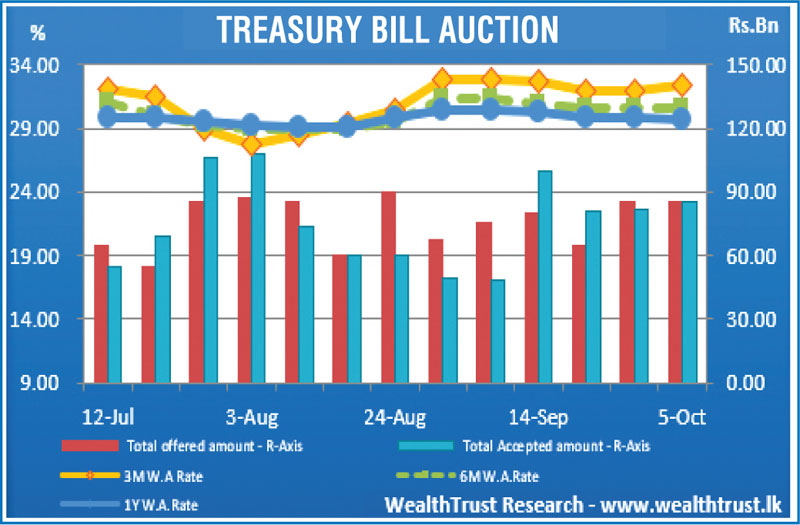

The weekly weighted average rates reflected an upward trend for the first time in four weeks at its auctions conducted yesterday ahead of the seventh monitory policy announcement for the year 2022 due today at 7:30 a.m.

The weekly weighted average rates reflected an upward trend for the first time in four weeks at its auctions conducted yesterday ahead of the seventh monitory policy announcement for the year 2022 due today at 7:30 a.m.

The Monetary Board of the Central Bank of Sri Lanka kept policy rates unchanged at 14.50% and 15.50% on its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) respectively at its previous announcement on 18 August.

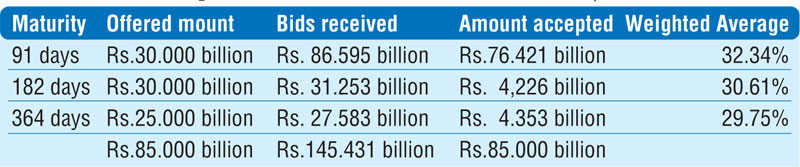

The total offered amount of Rs. 85 billion was successfully accepted at yesterday’s weekly Treasury bill auction as its bids to offer ratio stood at 1.71:1. The market favourite 91-day bill maturity recorded an increase of 40 basis points to 32.34% while the 182-day bill registered an increase of 02 basis point to 30.61%. However, the 364-day maturity decreased by 10 basis points to 29.75%.

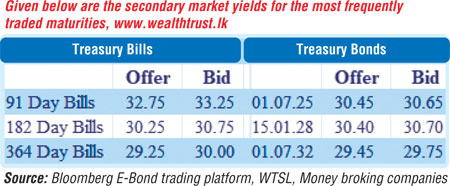

In the secondary bond market, activity moderated yesterday with most market participants opting to be on the side-lines. Limited trades were seen on the maturities of 01.07.25, 15.01.28 and 01.07.32 at levels of 30.40% to 30.45%, 30.40% and 29.50% to 29.55% respectively while two-way quotes were seen increasing and widening following the bill auction outcome.

In secondary bills, November and December 2022 maturities traded at levels of 27.40% to 28.10% and 31.60% to 32.50% respectively.

The total secondary market Treasury bond/bill transacted volume for 4 October was Rs. 3.97 billion.

In money markets, the weighted average rate on overnight REPO stood at 15.50% while an amount Rs. 692.68 billion was withdrawn from Central Bank’s Standard Lending Facility Rate (SLFR) of 15.50%. The net liquidity deficit stood at Rs. 363.74 billion yesterday as an amount of Rs. 328.94 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 14.50%.

Forex market

In the forex market, the middle rate for USD/LKR spot contracts remained steady at Rs. 362.90.

The total USD/LKR traded volume for 4 October was $ 127.31 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)