Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 29 September 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The two Treasury bond auctions conducted yesterday following the removal of the stipulated cut-off rates produced mixed outcomes as the two-year and one-month maturity of 15.11.2023 fetched a weighted average of 8.12%, above its pre-auction level of 7.75/8 while only Rs. 6.80 billion was accepted against an offered amount of Rs. 10 billion. However, the eight-year and seven-month maturity of 15.05.2030 recorded a weighted average of 10.23%, within its pre-auction rate of 9.90/10.60 while its offered amount of Rs. 10 billion was fully accepted at its first phase. Phase 2 of the auction was opened for the 2023 maturity while an issuance window of 20% of the offered amount on the 2030 maturity was opened until close of business of the day prior to settlement (i.e. 4 p.m. on 30 September).

The two Treasury bond auctions conducted yesterday following the removal of the stipulated cut-off rates produced mixed outcomes as the two-year and one-month maturity of 15.11.2023 fetched a weighted average of 8.12%, above its pre-auction level of 7.75/8 while only Rs. 6.80 billion was accepted against an offered amount of Rs. 10 billion. However, the eight-year and seven-month maturity of 15.05.2030 recorded a weighted average of 10.23%, within its pre-auction rate of 9.90/10.60 while its offered amount of Rs. 10 billion was fully accepted at its first phase. Phase 2 of the auction was opened for the 2023 maturity while an issuance window of 20% of the offered amount on the 2030 maturity was opened until close of business of the day prior to settlement (i.e. 4 p.m. on 30 September).

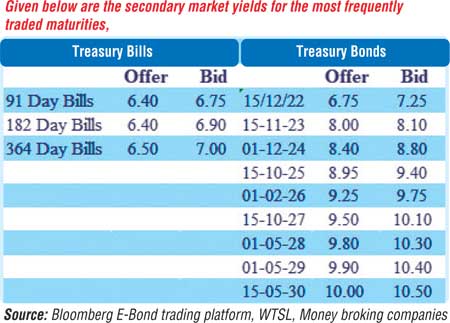

The secondary bond market activity remained dull with limited trades seen on the 15.11.23 and 01.12.24 maturities at levels of 8% and 8.70%, respectively, post-auction and against its previous day’s closings of 7.75/00 and 8.20/50.

The total secondary market Treasury bond/bill transacted volume for 27 September 2021 was Rs. 981 million.

In money markets, the net liquidity deficit increased once again to be recorded at Rs. 119.34 billion yesterday as an amount of Rs. 99.40 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 5% against an amount of Rs. 218.75 billion withdrawn from Central Banks SLFR (Standard Deposit Facility Rate) of 6%. The weighted average rates on overnight call money and repo decreased marginally to 5.94% and 5.93%, respectively.

USD/LKR

The forex market continued to remain inactive yesterday. The total USD/LKR traded volume for 27 September was $ 48 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)