Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 4 September 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

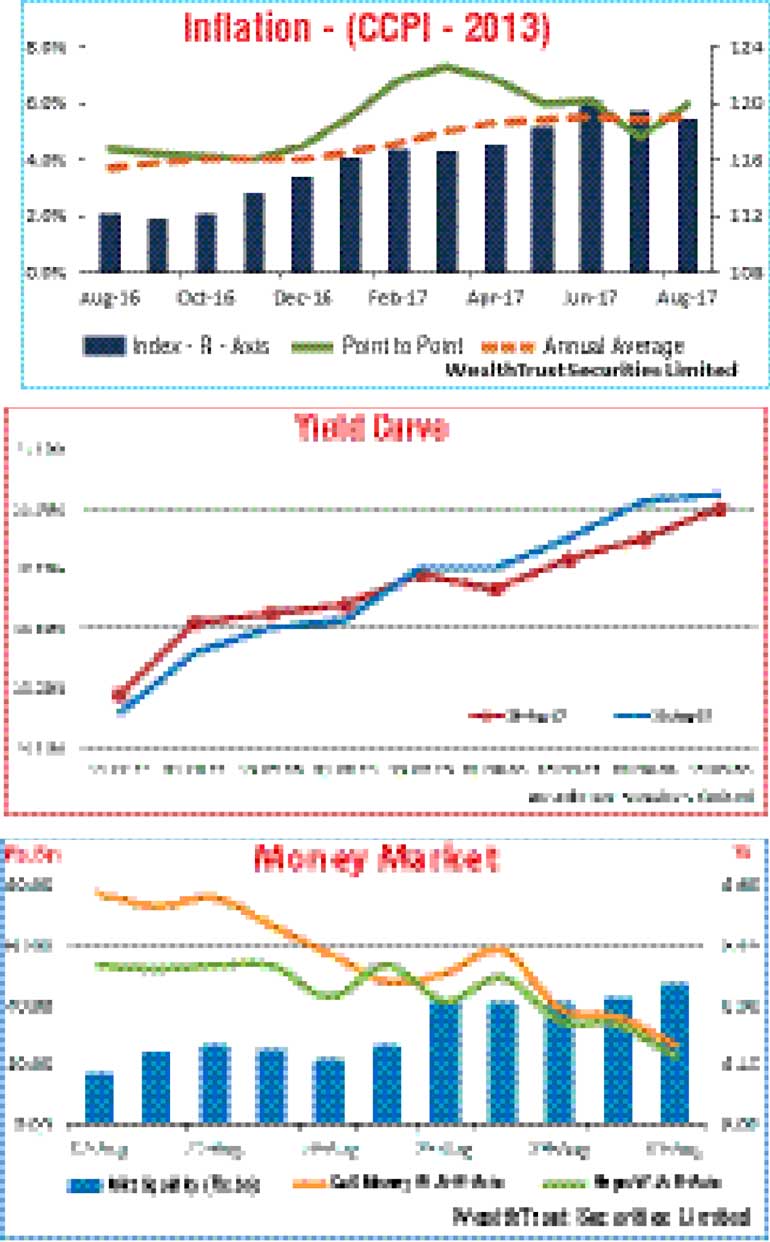

The inflation for the month of August was seen increasing once again to 6.00% on the basis of its point to point against its previous month of 4.8% while its annualised average also increased to 5.5% against 5.4%.

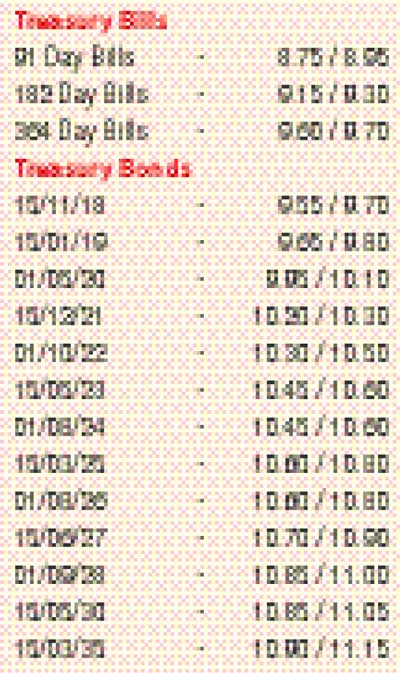

The short trading week ending 31 August witnessed an impressive outcome on the Treasury bond auctions, where the weighted averages of the 2.00 year maturity of 15.09.2019 and the 7.11 year maturity of 01.08.2025 recorded 9.83% and 10.54% respectively. However the weighted averages of the weekly Treasury bill auction continued to increase for a third consecutive week.

Activity in the secondary bond markets witnessed a mixed behaviour as the shorter to mid-term maturities of 01.03.21, 01.08.21, 15.12.21, 15.05.23 and 01.08.24 saw its yields dip to intraweek lows of 10.15%, 10.27%, 10.20%, 10.40% and 10.45% respectively against its previous weeks closing levels of 10.22/27, 10.30/38, 10.25/30, 10.50/60 and 10.50/65 on the back of foreign buying interest. However, foreign selling interest on the long term maturities of 01.09.28 and 15.05.30 saw its yields hitting intraweek highs of 10.93% and 10.90% respectively against its previous weeks closing levels of 10.75/85 and 10.85/95.

Nevertheless, on a net basis, the foreign holding in rupee bonds was seen increasing for a third consecutive week to record an inflow of Rs. 1.31 billion for the week ending 30 August.

The daily secondary market Treasury bond/bill transacted volumes during the first three days of the week averaged Rs. 6.61 billion.

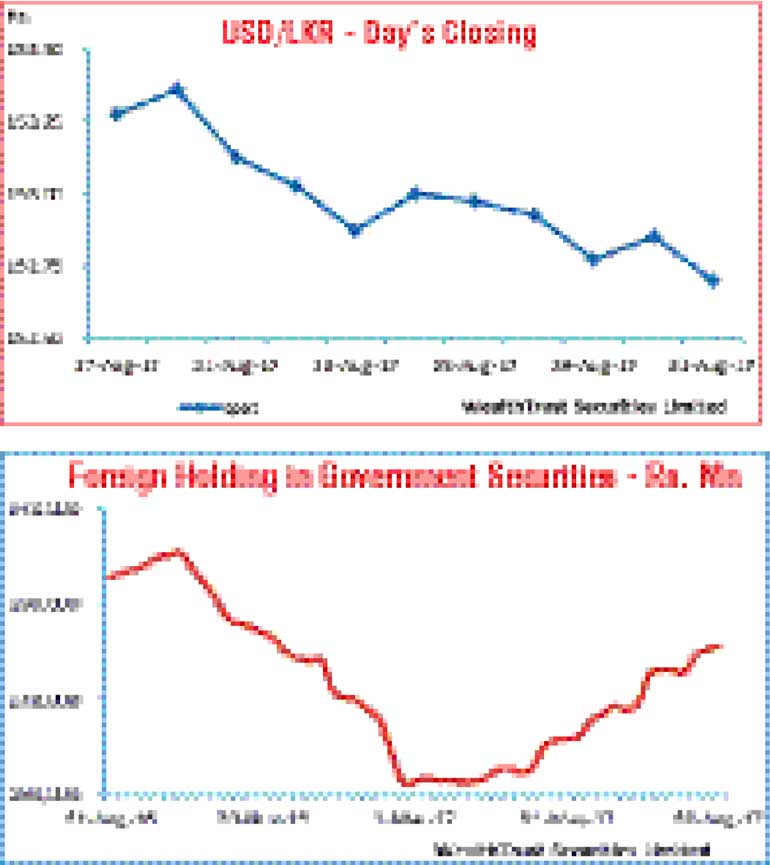

In money markets, the overnight call money and repo rates decreased to average 8.30% and 8.26% respectively for the week as the average net surplus liquidity in the system increased to Rs. 41.97 billion for the week against its previous weeks average of Rs. 27.38 billion. The OMO (Open Market Operation) Department of the Central Bank of Sri Lanka drained out liquidity throughout the week on an overnight basis at weighted average of 7.27%.

Furthermore the OMO Department of the Central Bank of Sri Lanka was also seen mopping up excess liquidity by way of auction for the outright sale of Treasury bill, where an amount of Rs. 1.5 billion was drained out at weighted averages of 8.50% for period of 39 days.

Rupee appreciates during the week

The rupee on spot contracts appreciated further during the week to close at Rs. 152.65/75 against its previous weeks closing level of Rs. 152.95/00 on the back of export conversions and inward remittances outweighing importer demand.

The daily USD/LKR average traded volume for the three days of the week stood at $ 63.58 million.

Some of the forward dollar rates that prevailed in the market were one month – 153.35/45; three months – 155.05/20 and six months – 157.45/55.