Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 29 January 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

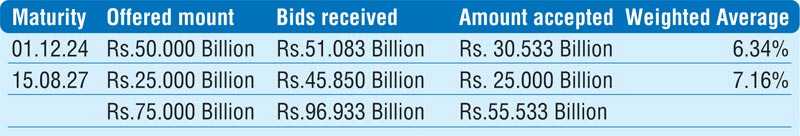

The Treasury bond auction conducted yesterday on the short tenure 01.12.2024 was undersubscribed at its 1st and 2nd phases as only an amount of Rs. 30.53 billion was accepted in total against its offered amount of Rs. 50 billion. However, Rs. 25 billion which was on offer on the mid tenure maturity of 15.08.2027 was fully subscribed at its 1st phase of the auction.

The Treasury bond auction conducted yesterday on the short tenure 01.12.2024 was undersubscribed at its 1st and 2nd phases as only an amount of Rs. 30.53 billion was accepted in total against its offered amount of Rs. 50 billion. However, Rs. 25 billion which was on offer on the mid tenure maturity of 15.08.2027 was fully subscribed at its 1st phase of the auction.

The 01.12.2024 maturity recorded a weighted average rate of 6.34% against its stipulated cut off rate of 6.35% while the maturity of 15.08.2027 recorded an impressive weighted average rate of 7.16% against its stipulated cut off rate of 7.20%.

Activity in the secondary bond market increased during the pre-auction trading session as yields increased marginally yesterday. The 15.11.22 maturity and 2024 maturities (i.e. 15.06.24, 15.09.24 and 01.12.24) hit intraday highs of 5.45%, 6.32% each and 6.35% respectively against its previous day’s closing levels of 5.40/45, 6.20/30, 6.23/28 and 6.30/33. In addition, the maturities of 15.01.23 and 15.07.23 traded at levels of 5.55% and 5.70% to 5.72% respectively as well with activity moderating towards the latter part of the day.

In the secondary bill market, the February 2021 maturities changed hands at levels of 4.58% to 4.59%.

The total secondary market Treasury bond/bill transacted volumes for 26 January 2021 was Rs. 6.38 billion.

In the money market, overnight surplus liquidity was registered at Rs. 123.23 billion yesterday while weighted average rates on call money and repo rates remained mostly unchanged at 4.54% and 4.56% respectively.

Rupee appreciates further

In the Forex market, the USD/LKR rate on spot contracts appreciated further yesterday to close the day at Rs. 192.25/193.00 against its previous day’s closing levels of Rs. 195.50/196.50, on the back of continued selling interest by banks.

The total USD/LKR traded volume for 26 January 2021 was $ 16.76 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)