Sunday Feb 15, 2026

Sunday Feb 15, 2026

Friday, 24 November 2023 00:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The eighth and final Mone-tary Policy Announcement for the year 2023 is due today, 24 November at 7:30 a.m.

The eighth and final Mone-tary Policy Announcement for the year 2023 is due today, 24 November at 7:30 a.m.

It was reported that Bloomberg expects a cut of 100 basis points citing a need to reduce real borrowing costs and support economic growth.

The Central Bank of Sri Lanka (CBSL) is due to conduct a round of Treasury bond auctions on 28 November, which will see a total offered amount of Rs. 45 billion. The auctions will have on offer Rs. 22.50 billion each on a 15 January 2027 maturity bearing a coupon rate of 11.40% and a 1 September 2028 maturity bearing a coupon of 11.50%.

For context, the previous round of bond auctions, which incidentally had the largest ever offered amount in Sri Lanka’s history held on 13 November, went undersubscribed. Only 29.29% or Rs. 73.22 billion was raised out of the total offered amount of Rs. 250 billion at its 1st and 2nd phases. From the maturities on offer, demand was seen for the shorter tenure 15.01.27 maturity, which saw its offered amount of Rs. 60 billion being raised at a weighted average yield of 15.22%. However, the 15.03.28 maturity, with the highest offered amount of Rs. 110 billion, and the 15.03.31 maturity, with Rs. 80 billion on offer, went significantly undersubscribed, with only Rs. 4.56 billion and Rs. 8.67 billion accepted, at weighted average yields of 14.52% and 13.56%, respectively.

Upon the announcement of the upcoming Treasury bond auctions, the secondary bond market experienced some selling pressure that caused yields to edge up while activity remained high. The majority of trading continued to centre on the short end of the yield curve. Accordingly, trades were seen on the maturities of 01.07.25, two 26s (01.06.26 and 01.08.26), three 27’s (15.01.27, 01.05.27 and 15.09.27), 01.07.28, 15.05.30, 01.07.32 within the ranges of 14.19% to 14.25%, 14.35% to 14.50%, 14.55% to 14.65%, 14.53% to 14.75%, 14.40% to 14.60% and 14.35% to 14.40% respectively.

In secondary market bills, February 2024 maturities were seen trading at 15.10% to 15.25%, while May 2024 maturities were seen trading within the range of 14.75% to 14.77%.

The total secondary market Treasury bond/bill transacted volume for 22 November 2023 was Rs. 76.99 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 10.25% and 10.93% respectively while the net liquidity stood at a deficit of Rs. 84.63 billion yesterday.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight Repo auction for Rs. 56.85 billion at a weighted average rate of 10.18%. An amount of Rs. 41.08 billion was withdrawn from Central Bank’s SLFR (Standard Lending Facility Rate) of 11.00% while an amount of Rs. 13.30 billion was deposited at the Central Bank’s SDFR (Standard Deposit Facility Rate) of 10.00%

Forex market

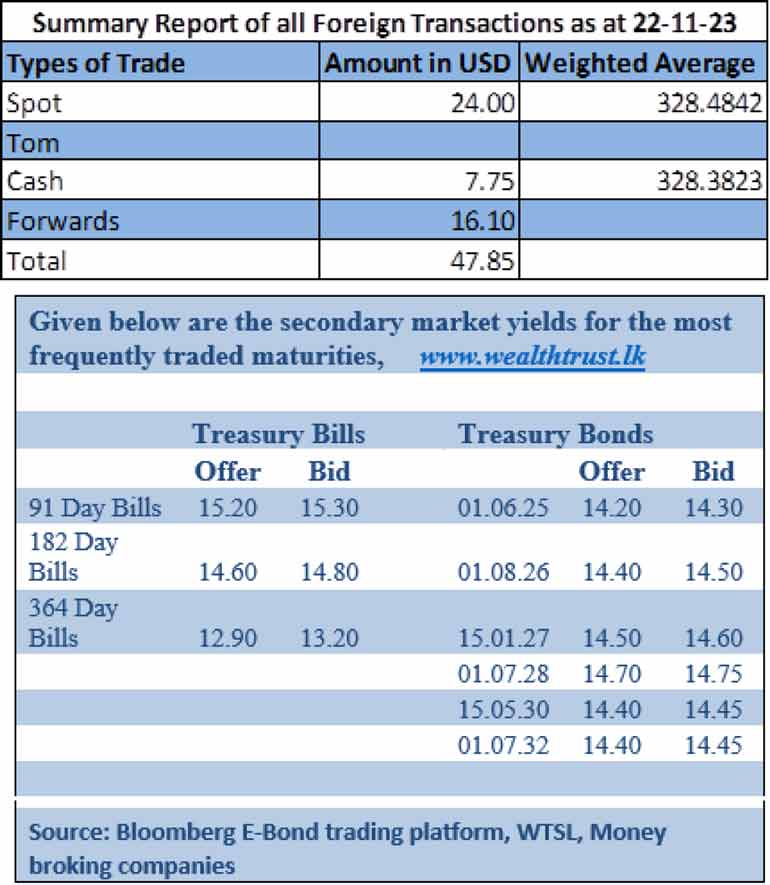

In the forex market, the USD/LKR rate on spot contracts closed the day marginally weaker at Rs. 328.75/328.80 yesterday against its previous day’s closing level of Rs. 328.50/328.65.

The total USD/LKR traded volume for 22 November was $ 47.85 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)