Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 18 October 2021 01:56 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The upward momentum in secondary bond market yields witnessed over the past few weeks came to halt during the latter part of week ending 15 October following the outcome of the monetary policy announcement on 14 October, at where the Central Bank of Sri Lanka was seen holding policy rates unchanged.

The upward momentum in secondary bond market yields witnessed over the past few weeks came to halt during the latter part of week ending 15 October following the outcome of the monetary policy announcement on 14 October, at where the Central Bank of Sri Lanka was seen holding policy rates unchanged.

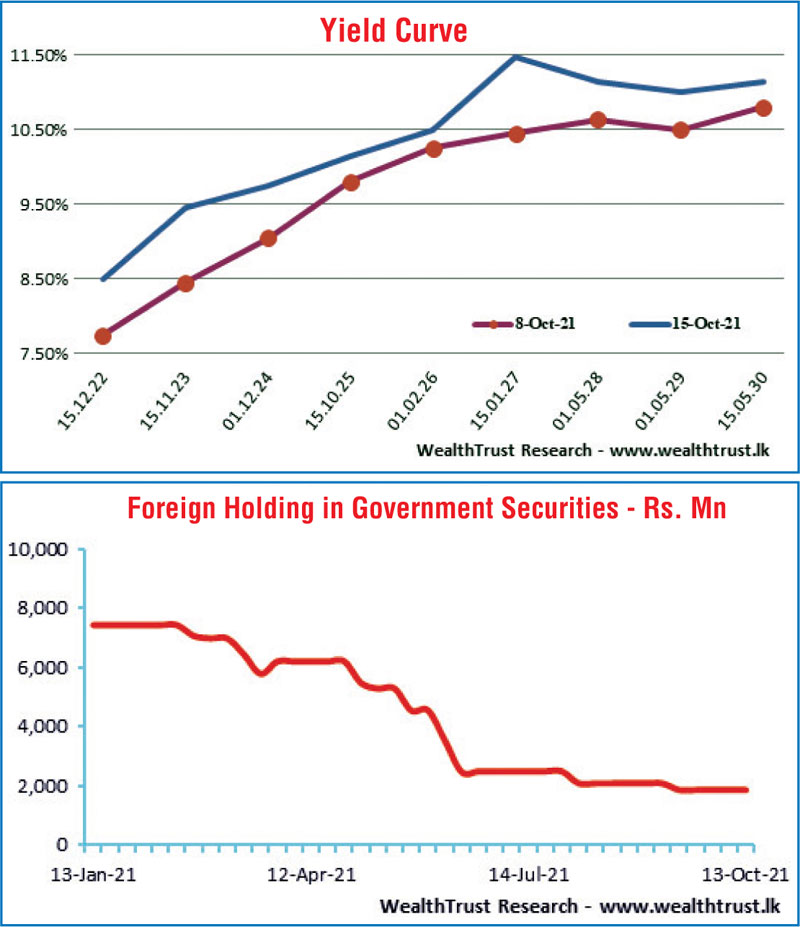

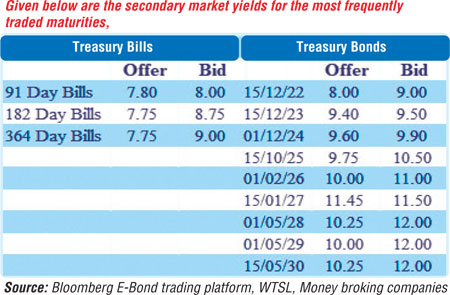

However, yields were seen increasing during the first half of the week driven by the continuous increase in primary market weighted average rates. At the T-bond auctions, the maturities of 15.12.23, 15.01.27 and 01.10.32 registered weighted average rates of 9.36%, 11.14% and 11.23% respectively against the weighted average rates of 8.12% and 10.23% recorded for the maturities of 15.11.23 and 15.05.30 respectively at the bond auctions conducted on 28 September 2021. At the weekly bill auction, the weighted average rate on the 91 day bill increased by 89 basis points to 8.04% while all bids received on the 182 day and 364 day maturities were rejected.

The yield on the liquid maturity of 15.12.23 was seen decreasing to a low of 9.25% against its high of 10.00% on Thursday while the maturities of 01.12.24 and 15.01.27 decreased to 9.70% and 11.25% respectively as well. The same momentum was even witnessed in the secondary bill market, as the 91 day bill was traded at a low of 7.60%. However, selling interest at these levels curtailed any further downward movement while the overall yield curve still produced a parallel shift upwards week on week.

Furthermore, the weekly Treasury bill auction for the week ending 22 October will be conducted today, due to the shortened trading week. A total volume of Rs. 74.5 billion will be on offer, which will be Rs. 10.5 billion less than its previous weeks total offered volume. This will be consist of Rs. 20 billion on the 91 day maturity, Rs. 22 billion on the 182 day maturity and Rs.32.5 billion the 364 day maturity.

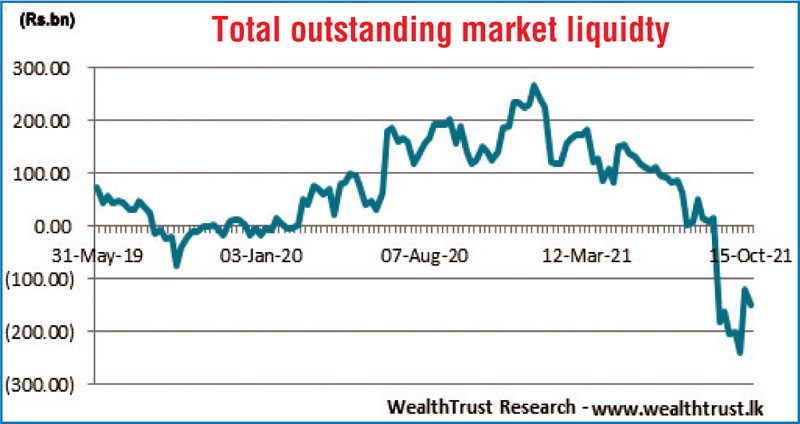

The foreign holding in rupee bonds remained steady at Rs. 1,861.77 million for the week ending 13 October while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 18.27 billion.

In money markets, the weighted average rates on overnight call money and repo remained mostly unchanged at 5.92% and 5.93% respectively for the week against its previous weeks 5.91% and 5.93% while the total outstanding liquidity shortage at the end of the week stood at Rs.151.62 billion against its previous weeks of Rs. 119.86 billion.

The CBSL’s holding of Government Securities was registered at Rs. 1,469.84 billion against its previous weeks of Rs. 1,450.21 billion while the Domestic Operations Department (DOD) of Central Bank drained out liquidity during the week from a two day to seven day period by way of repo auctions at weighted average yields ranging from 5.98% to 6.05%.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts traded at Rs. 203 during the week while overall activity remained moderate.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 37.11 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)