Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 21 January 2022 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

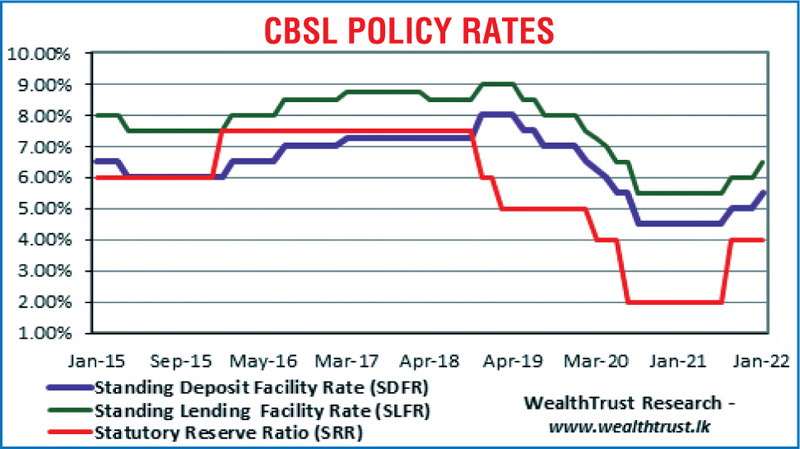

The Central Bank of Sri Lanka raised its monetary policy rates for a second time since August 2021 at its first review meeting for the year 2022, which was announced yesterday. An increase of 50 basis points saw the Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) advance to 5.50% and 6.50% respectively.

The Central Bank of Sri Lanka raised its monetary policy rates for a second time since August 2021 at its first review meeting for the year 2022, which was announced yesterday. An increase of 50 basis points saw the Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) advance to 5.50% and 6.50% respectively.

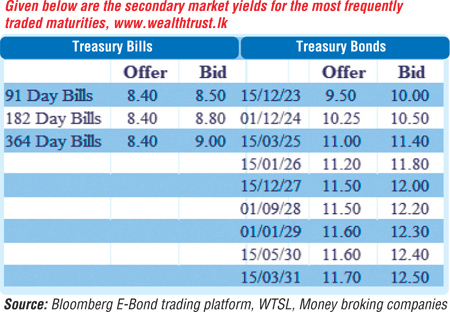

The bond market continued to remain inactive as only the 15.09.24 maturity was seen changing hands at a level of 10.25% yesterday.

The total secondary market Treasury bond/bill transacted volume for 19 January 2022 was Rs. 1.61 billion.

In money markets, the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka was seen draining out amounts of Rs. 61.90 billion and Rs. 5 billion by way of overnight and seven days repo auctions respectively at weighted average rates of 6.48% and 6.49%.

USD/LKR

In the Forex market, the overall market remained inactive yesterday. The total USD/LKR traded volume for 19 January was $ 62.60 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)