Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 27 May 2024 00:03 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

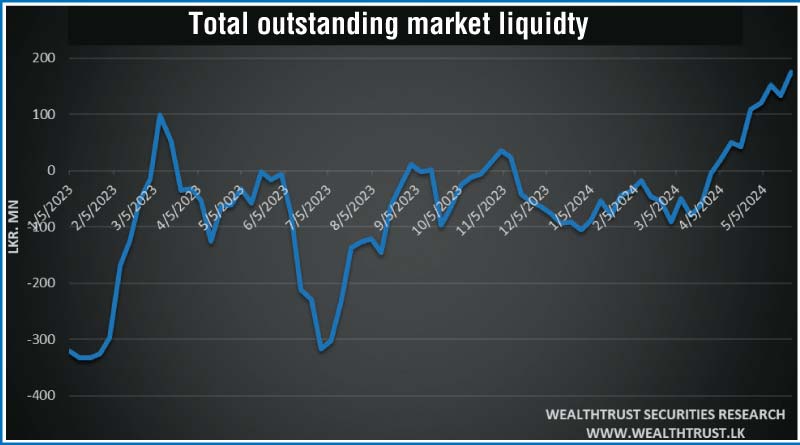

The total outstanding liquidity surplus which has been increasing continuously over the past few weeks, hit a three year high of Rs. 174.38 billion by end of the shortened trading week ending 22nd May in comparison to its previous week’s surplus of Rs. 132.86 billion, reaching its highest level since 19 March 2021.

The total outstanding liquidity surplus which has been increasing continuously over the past few weeks, hit a three year high of Rs. 174.38 billion by end of the shortened trading week ending 22nd May in comparison to its previous week’s surplus of Rs. 132.86 billion, reaching its highest level since 19 March 2021.

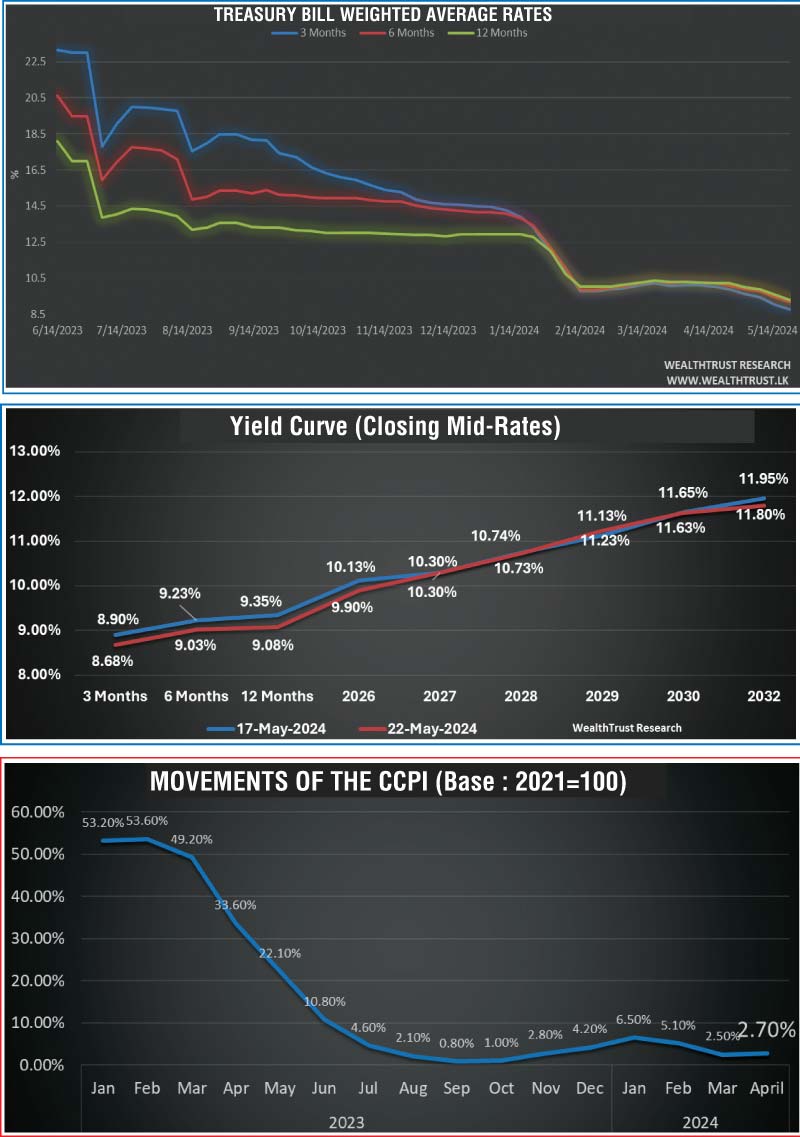

The steep increase in liquidity continued to propel the downward trend in the weekly Treasury bill weighted averages, as the yields declined for the seventh consecutive week, reaching the lowest levels in over two years. Interestingly, the yields on all three tenors were seen dropping below the Standing Lending Facility Rate (SLFR) for the first time in over two and a half years, which was last witnessed on the 1 September 2021. The current SLFR is at 9.50%.

These developments were ahead of the 3rd Monetary Policy announcement for the year 2024 due on 28 May. At the Second Monetary Policy review meeting for the year 2024, which was announced 26 March 2024, the Central Bank of Sri Lanka resumed monetary easing, cutting policy rates for a sixth time since June 2023. A decrease of 50 basis points saw the Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) reduce to 8.50% and 9.50% respectively, accumulating a total decrease of 700 basis points or 7.00% since June 2023.

Meanwhile, the foreign holding in rupee Treasuries decreased for a fifth consecutive week, by

Rs. 1.35 billion for the week ending 21 May 2024. Accordingly, the overall holding stood at Rs. 74.51 billion.

The secondary bond market commenced the week on a dull note, with a gradual moderate increase in activity during the course of the week. Yields overall initially moved upwards on the back of some profit taking pressure but subsequently renewed buying interest at the elevated levels brought yields back down, to close broadly steady as compared to the week prior. A notable exception were 2026 maturities which saw aggressive buying, which push its yields to fresh lows.

The yield on the liquid 2026 tenor of 15.12.26 was seen dropping to an intraweek low of 9.90%, from its intraweek high of 10.20%. Similarly, the other 2026 tenors 01.02.26 and 01.08.26 maturities were seen hitting intraweek highs of 10.00% and 10.10% before declining to intraweek lows of 9.60% and 9.80% respectively. Significant buying interest was observed on 2026 tenors at the end of the week.

Moreover, the popular 2028 tenors with maturities on 15.03.28 and 01.05.28 were seen hitting intraweek lows of 10.60% as against intraweek highs of 10.75% at the start of the week. Similarly, the relatively longer tenor 2028 maturities of 01.07.28 and 15.12.28 saw yields reducing to an intraweek low of 10.70%, as against highs of 10.90%. Additionally, demand was observed on the medium tenors of 15.05.30/15.10.30 and 01.10.32 maturities, trading within the ranges of 11.70% to 11.50% and 11.95 to 11.80% respectively.

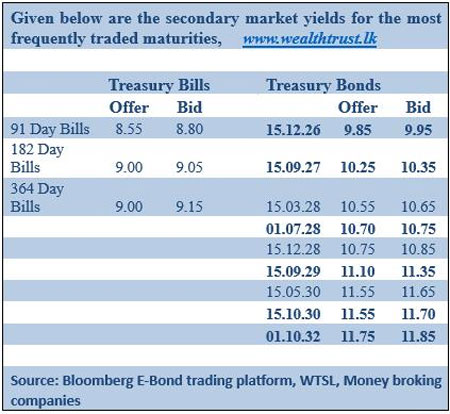

On the inflation front, the National Consumer Price Index -NCPI (Base: 2021=100) or National inflation for the month of April 2024 was recorded at 2.70% on its point to point as against 2.50% recorded in March 2024, while the annual average inflation was recorded at 5.20%.

The daily secondary market Treasury bond/bill transacted volumes for the first two days of the week averaged at Rs. 40.09 billion.

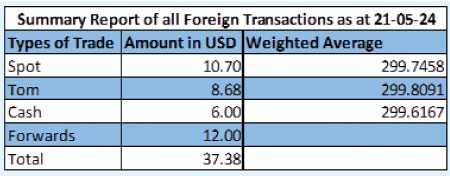

Forex Market

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating during the week to close at Rs. 300.10/300.30. This is as against its previous week’s closing level of Rs. 299.60/299.70 and subsequent to trading at a high of Rs. 299.60 and a low of Rs. 300.20.

The daily USD/LKR average traded volume for the first two trading days of the week stood at $ 46.94 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)