Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Tuesday, 5 March 2019 01:16 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market rallied towards the latter part of the week ending 1 March, driving yields lower on the back of the staff level agreement reached between the International Monetary Fund (IMF) and the Government of Sri Lanka. The downward rally in yields was further supported by the significant boost received to the prevailing liquidity shortfall in the money market, as the overall liquidity shortfall was seen reducing to Rs. 40.71 billion by the end of the week, to a level last seen during mid-September 2018 against its previous week’s Rs. 117.35 billion.

In addition, the drop on the 364-day bill weighted average at the weekly Treasury bill auction, reversing two consecutive weeks of increases added further impetus to the downward rally in bond yields.

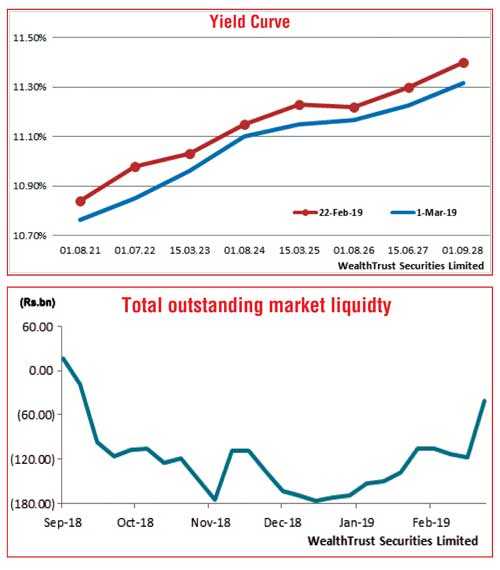

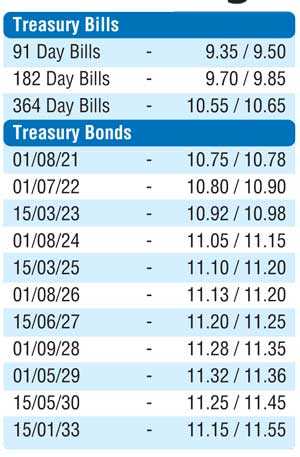

The overall yield curve witnessed a parallel shift downward for a second consecutive week with the liquid maturities of two 2021s (i.e. 01.08.21 and 15.12.21), 15.12.23, two 2027s (i.e. 15.01.27 and 15.06.27), 01.09.28 and 01.05.29 decreasing to hit intraweek lows of 10.72%, 10.74%, 10.92%, 11.12%, 11.15%, 11.26% and 11.30% against its previous week’s closing levels of 10.80/88, 10.85/88, 11.00/05, 11.25/32, 11.27/32, 11.35/45 and 11.43/53. Furthermore, the latest one-year bill was seen changing hands at 10.55% in the secondary bill market against its weighted average rate of 10.67%.

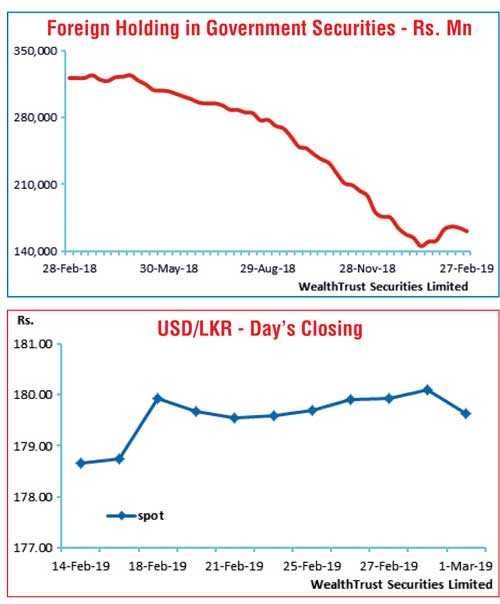

Meanwhile, the foreign holding in Sri Lankan Rupee bonds recorded an outflow for a second consecutive week to the tune of Rs. 3.43 billion for the week ending 27 February.

The daily secondary market Treasury bond/bill transacted volume for the first four days of the week averaged Rs. 6.06 billion. In money markets, the Open Market Operations (OMO) Department injected liquidity throughout the week on an overnight basis at weighted averages ranging from 8.93% to 9.00% in addition to injecting funds by way of a three- to seven-day reverse repo auctions at weighted averages ranging from 8.75% to 8.94%. The overnight call money and repo rates averaged at 8.96% and 8.98% respectively during the week

Rupee market fluctuates during the week

The rupee on spot contracts continued to fluctuate during the week, within a high of Rs. 179.60 to a low of Rs. 180.20 before closing the week higher at Rs. 179.55/70 against its previous week closing levels of Rs. 179.55/65. The daily USD/LKR average traded volume for the four days of the week stood at $ 87.77 million.

Some of the forward dollar rates that prevailed in the market were: one month – 180.50/75; three months – 182.35/65; and six months – 185.15/45.