Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 4 September 2023 00:02 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

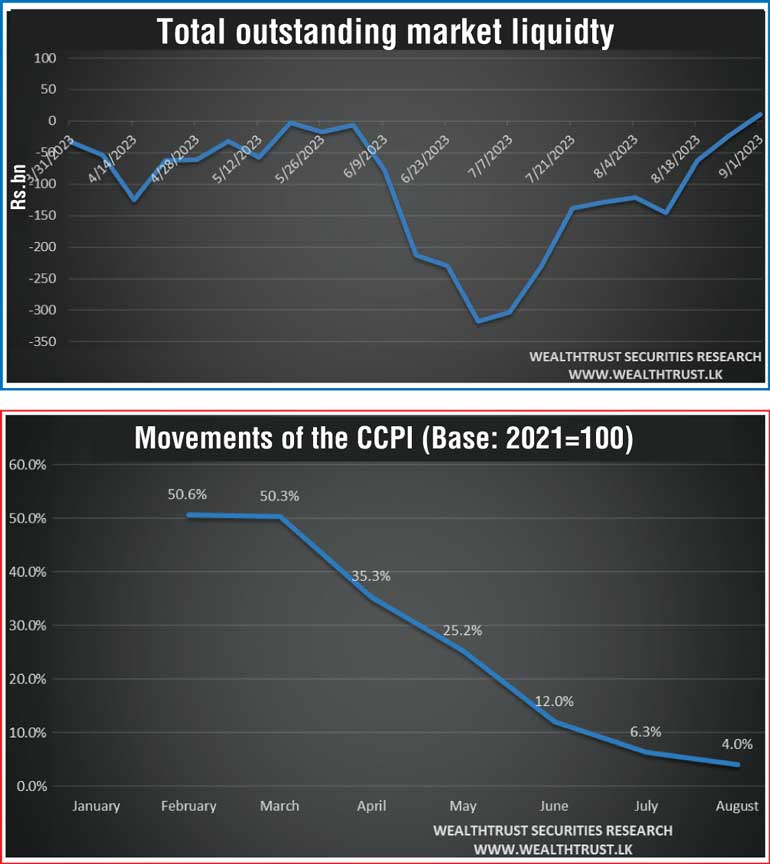

The total outstanding liquidity in the money market was seen turning positive for the first time since 17 March 2023 to a surplus of Rs. 10.50 billion at the end of the week against its previous week’s deficit of Rs. 23.55 billion.

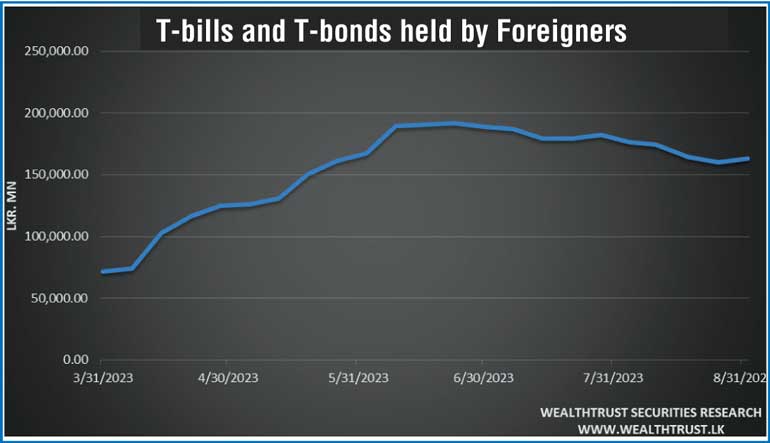

Foreign appetite for Rupee Treasuries was seen returning back as well to the market during the week as the foreign holding recorded its highest week on week increase in 12 weeks of Rs. 3.3 billion for the week ending 31 August while reversing four consecutive weeks of outflows.

Meanwhile, the largest Treasury Bond auction in Sri Lanka’s history, conducted last Monday, saw its total offered amount of Rs. 200 billion being successfully taken up. A further amount of Rs. 16 billion was raised on the 01.07.2028 maturity, through its direct issuance window as well.

On the inflation front, the Colombo Consumer Price Index -CCPI (Base: 2021=100) for the month of August decreased sharply to 4.00% on its point to point as against 6.30% recorded in July and a peak of 50.6% in February of 2023. This is the lowest level witnessed in the CCPI since the index was rebased, at the start of the year 2023. The figure also beats a Bloomberg consensus estimate of 4.5%.

Furthermore, in total an amount of Rs. 117.58 billion was raised at the weekly Treasury Bill auction against its offered amount of Rs. 150.00 billion as well.

The secondary market bond yields were seen increasing during the week following the bond auctions while activity picked up towards the latter part of the shortened trading week ending 01st September 2023. Trades were predominantly on the auction maturities. The quoted yields on the liquid auction maturities of 01.08.26 and 01.07.28 were 15.60/15.80 and 14.75/14.90. This was against its intraweek highs of 16.00% and 15.00% and intraweek lows of 15.74% and 14.70% respectively.

However, significant buying interest in secondary market bills was witnessed, centring October and November 2023 maturities along with August 2024 maturities that changed hands at levels of 16.50% to 17.50%, 18.25% to 20.00% and 16.00% respectively.

The daily secondary market Treasury Bond/Bill transacted volumes for the first three days of the week averaged at Rs. 55.56 billion.

In money markets, the Domestic Operations Department (DOD) of the Central Bank continued to inject liquidity during the week by way of overnight and term Reverse repo auctions at weighted average yields ranging from 11.54% to 14.33%. The Central Bank of Sri Lanka’s (CBSL) holding of Gov. Security was registered at Rs. 2,604.37 billion against its previous weeks of Rs. 2,571.92 billion.

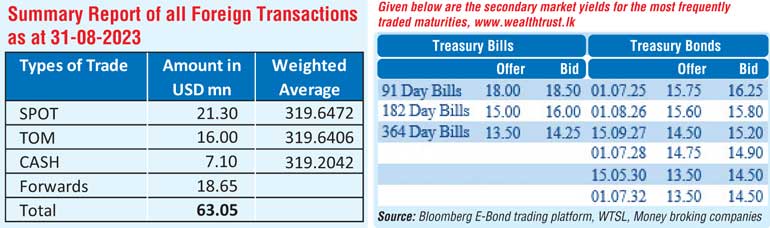

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating during the week to close the week at Rs. 319.50/320.00 against its previous week's closing level of Rs. 324.00/324.50, subsequent to trading at a low of Rs. 324.05 and a high of Rs. 318.75.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 63.42 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)