Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 29 May 2023 00:21 - - {{hitsCtrl.values.hits}}

NDB Strives to Empower SMEs through Partnership with IFC 01

NDB Strives to Empower SMEs through Partnership with IFC 02.

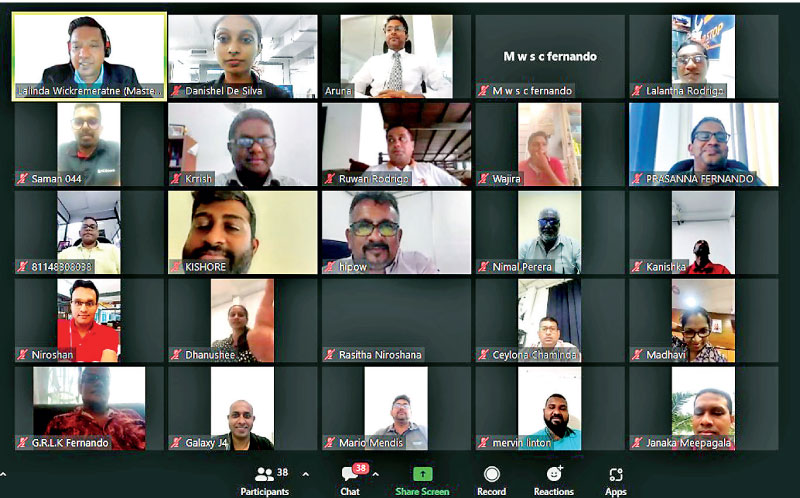

There has been substantial growth in small and medium-sized enterprises (SMEs) in Sri Lanka, amidst countless market and financial challenges. To further empower a critical growth engine in the country, the National Development Bank (NDB) in partnership with the International Finance Corporation (IFC) conducted a series of webinars to boost and expand operation of SMEs across Sri Lanka.

NDB Bank and IFC have a longstanding partnership spanning for decades, with IFC assisting the Bank in realigning its strategic vision of expanding access to financial services across Sri Lanka. By leveraging IFC’s expertise, NDB was able to transform the bank, enabling it to deliver greater business impacts.

The ongoing webinar series that kicked off in March till the end of June aims to help small businesses improve their operational efficiencies and empower Sri Lankan SMEs, thereby also enabling the Bank to expand its reach across the country. Representing a diverse set of entrepreneurs – including from agriculture, tourism and hospitality, trading, logistics and transport, education, healthcare – the series covers a wide array of subject areas including tips on access to finance, innovation, marketing, digital business, among others.

During these sessions, NDB was also able to advise audiences on how the global pandemic, compounded by the country’s economic crisis have affected certain processes in the bank, including on lending and loan submissions. Further, information related to special financing options, multilateral or bilateral funding schemes, special customer service/relationship measures were also included. Through the series, the Bank also guided the SMEs on the enhanced digital banking services that have emerged as a result of multiple crises, including on loan processing to avoid physical branch visits, guidance or measures for forbearance, deferments as well as on restructuring of loans.