Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 27 February 2018 00:03 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The new Treasury bond auction system was tested for the first time at its auctions conducted yesterday since its introduction in July 2017.

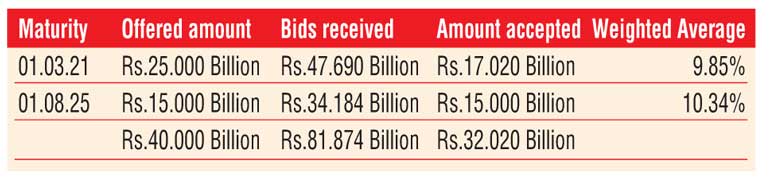

The offered amount of Rs. 25 billion on the 3 year maturity of 01.03.2021 was not fully accepted at its 1st phase of the auction. The shortfall was reduced further at its 2nd phase of the auction at its weighted average and did not lead to its mandatory 3rd phase due to the minimum requirement of 60% not been subscribed to at its 1st phase. However, the total offered amount of Rs. 25 billion on the 7.05 year maturity of 01.08.2025 was fully accepted at its 1st phase of the auction.

The weighted averages were seen increasing keeping with its recent trend in primary auctions as the 3 year maturity of 01.03.2021 and the 7.05 year maturity of 01.08.2025 recorded averages of 9.85% and 10.34% respectively. This is in comparison to weighted averages of 9.44% and 10.05% recorded on the 29th of January for a 5.03 year maturity of 15.03.2023 and a 14.11 year maturity of 15.01.2033.

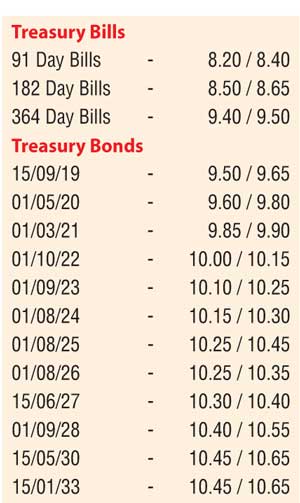

Activity in the secondary bond market remained very dull yesterday with limited trades seen on the auction maturity of 01.03.21 within the range of 9.88% to 9.90%, following the auction outcome.

The total secondary market Treasury bond/bill transacted volumes for 23 February was Rs. 14.35 billion.

In money markets, the overnight call money and repo rates averaged at 8.14% and 7.55% respectively as the OMO (Open Market Operations) Department of the Central Bank of Sri Lanka was seen draining out an amount of Rs. 21.6 billion on an overnight basis by way of a Repo auction at a weighted average of 7.25%. The net liquidity surplus increased to Rs. 42.53 billion yesterday.

Furthermore it drained out an amount Rs. 3.00 billion by way of three auctions for outright sales of Treasury bills at weighted average yields of 8.10%, 8.15% and 8.20% respectively for the periods of 38 days, 45 days and 52 days, valued today.

Rupee appreciates

In the Forex market, the USD/LKR rate on spot appreciated yesterday to close the day at Rs. 154.90/95 against its previous day’s closing levels of Rs. 155.15/25 on the back of selling interest by banks and export conversions

The total USD/LKR traded volume for 23 February was $ 45.20 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 155.60/75; 3 Months - 157.35/45 and 6 Months - 159.80/95.