Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 16 December 2024 03:15 - - {{hitsCtrl.values.hits}}

By Michelle Therese Alles

Sri Lanka’s banking sector is navigating significant challenges as it adjusts to the implementation of new corporate governance rules.

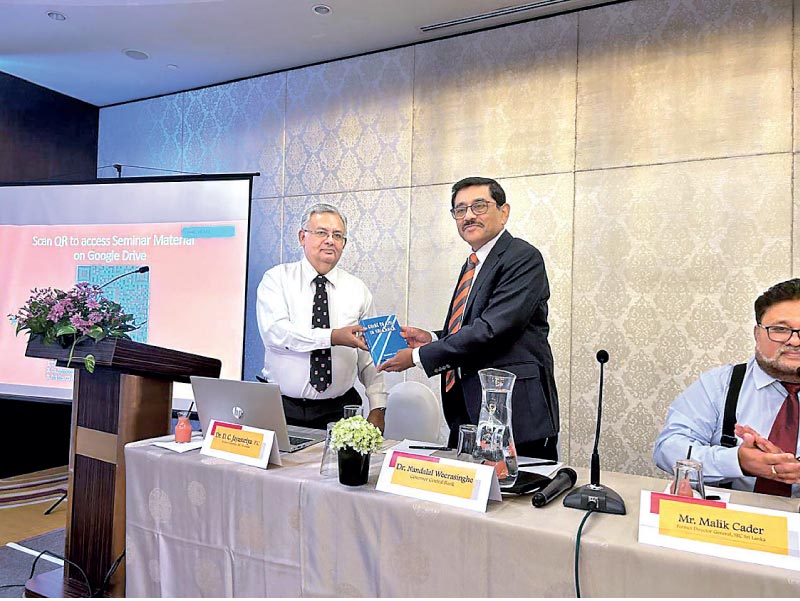

During a recent seminar titled, ‘New Corporate Governance Rules for Banks: Is It a Paradigm Shift?’ key stakeholders from the banking and financial industry gathered to analyse the implications of these reforms. The seminar highlighted the importance of the Central Bank’s new corporate governance rules, set to take effect on 1 January 2025. These regulations aim to strengthen the soundness of Sri Lanka’s banking system by replacing and modernising provisions issued in 2007.

CBSL Governor Dr. Nandalal Weerasinghe delivered the keynote address, emphasising the urgent need for banks to adapt to the new governance requirements. He explained how stronger corporate governance frameworks can bolster resilience in a volatile economic environment. Dr. Weerasinghe also noted that the new reforms aim to enhance transparency, accountability, and long-term sustainability within the sector. “These measures are designed to ensure trust and confidence among stakeholders while safeguarding the stability of our banking system,” he remarked. “A strong governance framework is essential for driving sustainable growth and weathering future challenges.”

The panel discussion that followed provided in-depth insights into the implications of the new rules. SEC and IBSL Former DG and Chairman Dr. D.C. Jayasuriya, P.C. addressed the legal dimensions of the updated regulations, emphasising their alignment with global best practices. He discussed their capacity to mitigate systemic risks while supporting compliance across the financial sector, highlighting their critical role in ensuring regulatory harmony and strong oversight.

Focusing on sections 46.1 and 76.1 of the revised regulations, Dr. Jayasuriya explained how these reforms empower the Central Bank to establish governance standards. He emphasised the measures’ objectives of maintaining stability, enhancing institutional integrity, and reinforcing directors’ duties — such as care, prudence, and loyalty — by aligning them with international frameworks, including the UK Companies Act.

ICASL Corporate Governance Committee Former Chairman Asitha Talwatte elaborated on operational challenges, drawing on his extensive experience in auditing and risk management. He stressed the necessity of strong risk management frameworks to navigate the complexities introduced by these reforms.

HNB PLC Director and LOLC Holdings PLC COO Kithsiri Gunawardena discussed the critical role of technology, advocating for digital transformation to meet transparency and efficiency goals. He proposed leveraging fintech solutions to streamline compliance processes.

SEC Former DG and Ministry of Finance Senior Advisor Malik Cader examined the policy implications, suggesting that the new rules could boost investor confidence and enhance the competitiveness of Sri Lanka’s banking sector on a global scale.

The updated regulations introduced several critical reforms, including the repeal of outdated provisions from the 2007 Banking Act, staggered timelines for compliance, and expanded responsibilities for board members. These include defining risk appetites, improving stakeholder communication, and strengthening risk management practices. Particular attention was also given to whistleblowing policies and the role of company secretaries in ensuring compliance. These measures aim to protect employees who raise legitimate concerns while addressing conflicts of interest and maintaining confidentiality, reflecting the broader push for accountability and transparency within the sector.

As Sri Lanka’s financial sector transitions toward a more regulated future, these corporate governance reforms represent a pivotal step in supporting stability and growth. The success of these initiatives, however, will hinge on the commitment of stakeholders to embrace change and adhere to the principles of good governance.

While the adjustments may pose challenges, they also present an opportunity to build a resilient banking system capable of supporting sustainable economic development. The seminar’s discussions underscored the need for collaborative efforts in shaping the future of Sri Lanka’s banking sector, ensuring it remains competitive and aligned with global standards.