Sunday Feb 15, 2026

Sunday Feb 15, 2026

Thursday, 20 May 2021 00:44 - - {{hitsCtrl.values.hits}}

By Asia Securities Research

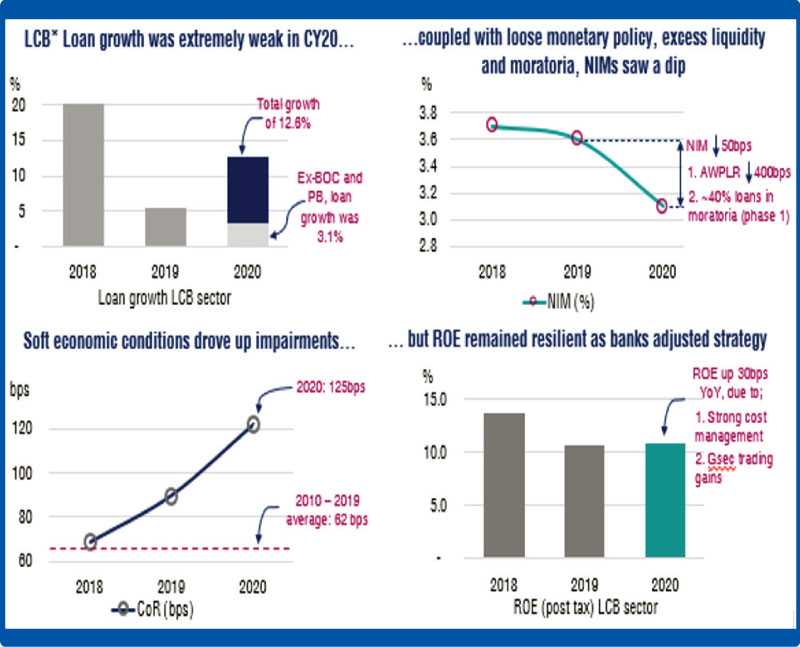

The recent year has seen the banking sector facing multiple storms, with sector valuations facing pressure even before the pandemic. Heightened political risk, lower foreign investor interest, and rights issues related to Basel III capital raising, resulted in a free-fall of the sector valuations since 2018. Sector valuations hit a decade low over the last two years due to poor economic growth, the Easter attack impact, and COVID-19-related concerns. However, we note that banks have managed to successfully navigate this turbulence, by adjusting its strategy and also managing risks prudently by increasing provisioning. While low interest rates and a surge in impairment charges meant that banks saw soft profitability in 2020, contrary to investor concerns, the sector posted a modest increase in ROEs. Asia Securities’ latest Banking Sector Outlook 2021 titled, ‘Rising Above the Clouds: Charting the Course for the Growth Phase,’ weighs in on the trends driving the sector’s performance, the COVID-19 implications, as well as the future of the banking sector.

Banks, a cyclical play to see an upward re-rating along with the next growth cycle

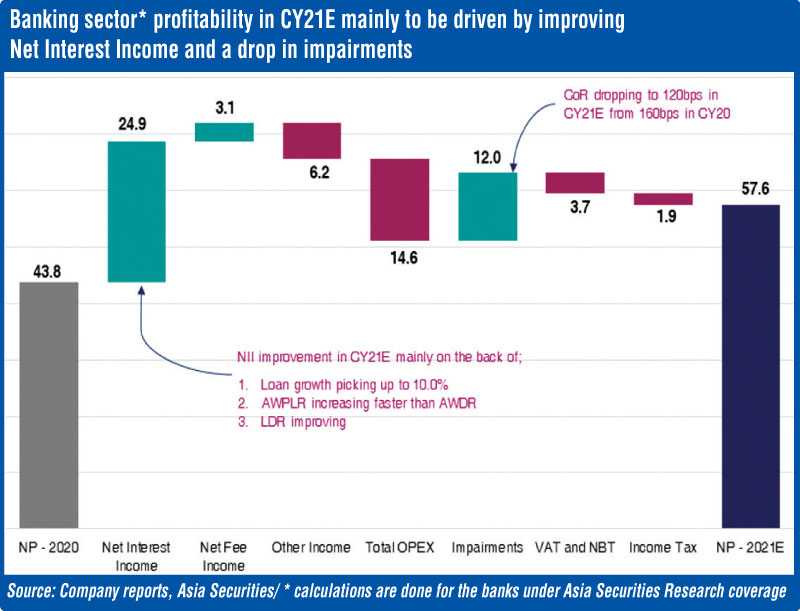

The Asia Securities report argues that there is potential for the sector valuations to re-rate upwards as the economic cycle picks up. This positive outlook underpins the thesis that as a cyclical play, banks would see ROEs expand in 2021 and 2022, mainly driven by improving top line and a drop in impairments. Several macro catalysts including stable fiscal policies, commitment to maintaining low interest rates, low consumption taxes are expected to drive private sector credit growth, and lower interest burden for borrowers, lending itself to the sector’s recovery story. Banking stocks took the biggest hit in 2020 during the pandemic, and currently trade at 0.5x 2021 forecasted book value, providing an attractive entry point for investors with a medium-term focus.

The report highlights Asia Securities’ expectation of private sector credit growth picking up to approx. 10% in 2021, driven mostly by corporate and retail lending. While the report also forecasts a pickup in SME lending, this would be mainly weighted towards the second half of 2021 once economic activities stabilise. The third wave of COVID infections poses a slight threat in this regard, and curbing the spread becomes an important factor to watch. The report also notes that market interest rates are expected to pick up from 2H 2021, driven by higher credit growth as the Government fulfils its refinancing needs in the market. Given the loan book structure of the banks, Asia Securities expects AWPLR to increase faster than AWDR, driving up loan yields. In addition, as banks utilise its excess liquidity and lower its dependence on deposits and borrowings, cost of funds is expected to show only marginal growth.

Improving asset quality and lower taxes add a further tailwind to profitability

The report also forecasts that non-performing loan stock will moderate in 2021, continuing the trend in 4Q 2020. Given the expectations of an economic expansion, the report forecasts a downward trend in the provisioning from 2021 onwards, in turn, leading to a drop in P&L impairment charges in 2021. However, external shocks, weather events impacting the agriculture sector, or a prolonged third wave would pose some threat to this estimate as banks may see it prudent to increase provisioning.

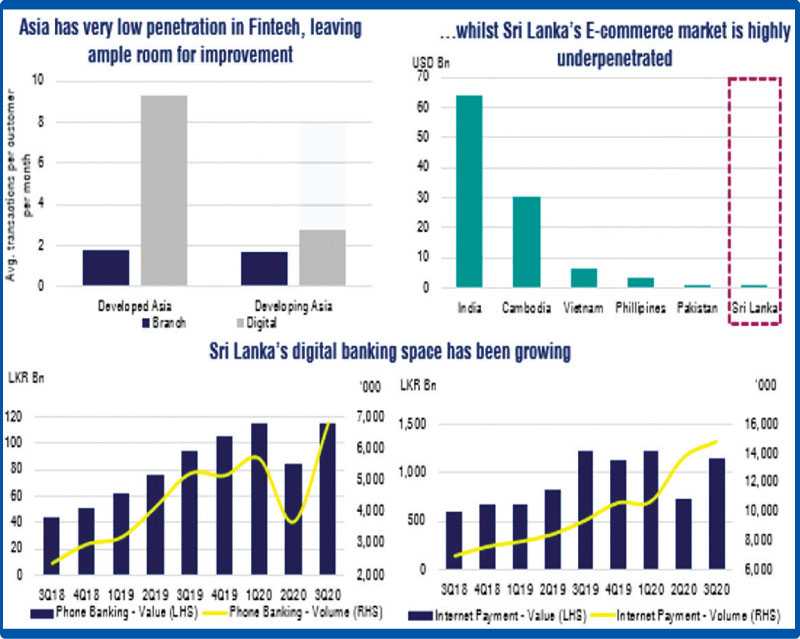

Adding a further tailwind to profitability is the proposal to reduce corporate income tax to 24% from 28%, which was presented to Parliament in March. Although Sri Lanka’s digital banking space has been growing, it is still at a nascent stage and has strong potential to structurally push up bank ROEs. The rise in e-commerce and online transactions also offers a significant opportunity in this regard. While the sector as a whole has pushed more into digital banking in 2020, more user adoption in the coming years could structurally lift sector ROEs similar to what is seen across the developed markets.

Strong capitalisation to drive growth; foreign investor activity would further help valuations

The Asia Securities’ report also notes that banks are well-capitalised to drive growth in the next few years following Basel III capital requirements. Given the positive growth outlook on growth, banks are expected to maintain a strong payout, although, scrip dividends are likely to remain a key component of dividends in 2021 and 2022.

The report also acknowledges concerns around the impact of ongoing moratoriums, highlighting that a worst-case scenario for valuations may see the sector trading at 0.6x-0.7x on forecasted 2021 book value. USD debt repayments would continue to be a major concern in foreign investors’ mind, and until a sustainable financing solution is visible, this is likely to weigh in on valuations. As large, stable and diversified players are still undervalued compared to historic levels, the report recommends investors focus on the diversified large banks as value picks and mid-tier/small banks as growth stocks. While regionally Sri Lankan banks are cheap, relative to its return and growth profile, foreign investors are likely to continue remain cautious on investing in Sri Lanka due to the overall perception of macro risks, and the lack of visibility around post-moratorium performance of asset quality. With the dust likely settling around both these factors around 2H 2021, Asia Securities notes that foreign investor interest is likely to return, pushing up valuations further through a multiple re-rating.

Asia Securities is a leading investment firm in Sri Lanka providing Investment Banking, Research, Equities and Wealth Management services to local and international corporate, institutional and individual clients. Asia Securities’ clients can access the full Banking Sector Outlook 2021 titled, ‘Rising Above the Clouds: Charting the Course for the Growth Phase,’ via the online research portal or their investment adviser.