Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 4 December 2017 00:09 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

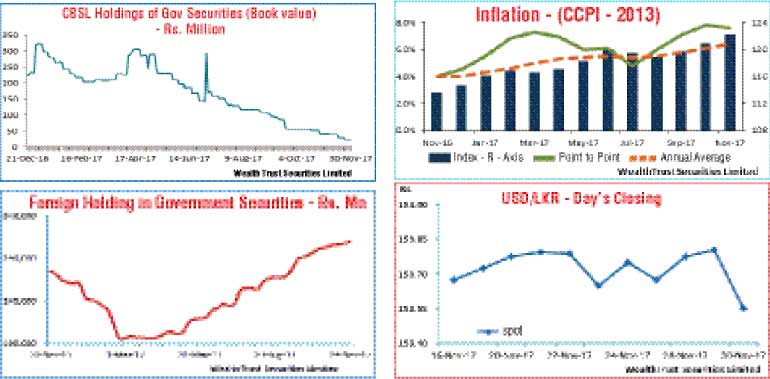

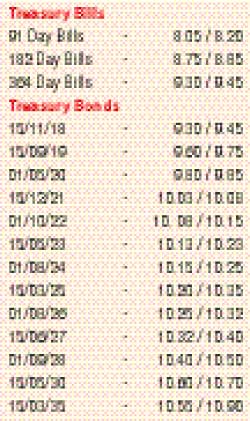

The overall activity in the secondary bond market moderated considerably during the shortened trading week ending 30 November 2017 with most market participants opting to be on the sidelines. However yields of the liquid maturities of 01.07.19, 01.05.20, 15.12.21 and 01.08.26 were seen increasing marginally during the latter part of the week to hit highs of 9.69%, 9.82%, 10.05% and 10.25% respectively leading to the Treasury bond auctions and following its outcomes where the weighted averages of the 5.05 year maturity of 15.05.2023 and the 9.06 year maturity of 15.06.2027 were recorded at 10.20% and 10.36% respectively.

Nevertheless the weighted averages of the weekly Treasury bill auction decreased across the board by 20 and 02 basis points each respectively on the 91day, 182 day and 364 day maturities. The continued demand was also witnessed in the secondary bills market with August, September and November 2018 bill maturities changings hands at lows of 8.90%, 9.00% and 9.30% respectively.

The market also witnessed continued foreign buying interest of rupee bonds with an inflow of Rs. 2.52 billion for the week ending 29 November, recording a total inflow of Rs. 42.63 billion over the past twelve weeks. Furthermore, the Point to Point inflation for the month of November decreased for the first time in five months to register 7.6% against 7.8% recorded in October while the annual average increased to 6.4% from 6.1%.

The daily secondary market Treasury bond/bill transacted volume for the first three days of the week averaged Rs. 6.26 billion.

In money markets, The OMO (Open Market Operation) Department of the Central Bank of Sri Lanka drained out liquidity throughout the week on an overnight basis at weighted average of 7.25% as the average net surplus liquidity for the week increased to Rs. 28.08 billion against its previous week’s average of Rs. 25.65 billion. The overnight call money and repo rates averaged at 8.13% and 7.56% respectively during the week.

Meanwhile, the CBSL Treasury bill holding was seen decreasing to a low of Rs. 19.81 billion on 30 November against its high of Rs. 321.33 billion recorded on 5 January 2017.

Rupee closes stronger

The dollar rupee rate on spot contracts closed the week stronger at Rs. 153.50/60 subsequent to dipping to an intra-week low of Rs. 153.80 against its previous weeks closing of Rs. 153.70/80.

The daily USD/LKR average traded volume for the three days of the week stood at $ 42.40 million.

Given are some forward dollar rates that prevailed in the market:

1 month - 154.40/60

3 months - 156.25/40

6 months - 158.85/00