Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 19 September 2024 00:00 - - {{hitsCtrl.values.hits}}

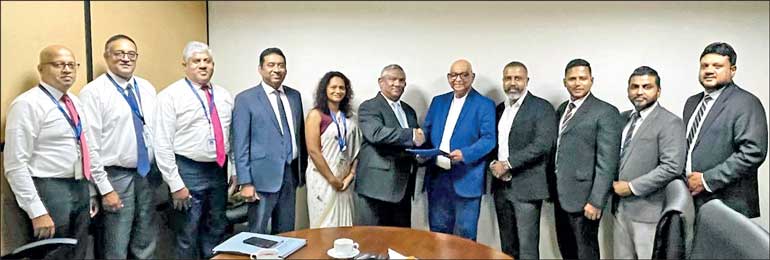

PMF Finance Chairman Chandula Abeywickrema (right) exchanges the agreement with Commercial Bank Personal Banking DGM Delakshan Hettiarachchi. Others (from left): Commercial Bank SME (Central Region) Manager Madhuranga Rathnayake, Kandy Branch Senior Manager Mahesh Abeyratne, Regional Manager (Central Region) Chaminda Ganegoda, Personal Banking AGM Varuna Kolamunna, Senior Assistant Manager – Legal Sewwandi Gunasinghe, PMF Finance CEO-designate Prof. Ajith Medis, DGM – Head of Channels and Operations Sujan Cooray, AGM – Risk Athula Bandaranayake, and Branch Operations Head Bandara Chandrasekara

PMF Finance PLC has fortified its financial position through a significant capital boost from the Commercial Bank of Ceylon PLC, Sri Lanka’s largest private commercial bank, with an initial disbursement of Rs. 500 million out of Rs. 1 billion.

This substantial funding is a strong endorsement of PMF Finance’s stability and credibility in the financial services sector, paving the way for enhanced growth and operational capacity.

The capital infusion will primarily support the development of small and medium enterprises (SMEs), a sector PMF Finance is deeply committed to nurturing. By channelling these resources into SME development, PMF Finance aims to contribute to the long-term growth of local businesses, fostering entrepreneurship and sustainable economic progress.

Commercial Bank of Ceylon PLC, the country’s leading private sector commercial bank, is renowned for its financial strength, stability, and comprehensive range of banking solutions. With over a century of service, the bank has consistently been a reliable partner for businesses and individuals, and its support of PMF Finance highlights its confidence in the company’s governance, vision, and growth trajectory. Commercial Bank’s backing signals a strong vote of confidence in PMF Finance’s long-term potential.

PMF Finance Chairman Chandula Abeywickrema said: “This substantial financial support from the Commercial Bank is a testament to our financial stability and operational resilience. The trust placed in us by the largest private bank in the country speaks volumes about our reliability and the strength of our governance. We are excited to use this capital to empower SMEs, which form the backbone of Sri Lanka’s economy. By driving sustainable growth in this sector, we are not only enhancing our business but also contributing to the nation’s economic development.”

PMF Finance CEO-designate Prof. Ajith Medis said: “The funds we have secured will be instrumental in our efforts to strengthen the SME sector. We plan to strategically deploy this capital to provide innovative financial solutions that support the growth of small and medium businesses across various industries. Our focus on sustainable investment will ensure that these funds contribute to long-term economic development and employment creation, particularly in underserved markets.”

This major financial backing from Commercial Bank further reinforces PMF Finance’s position as a stable and trusted financial institution capable of driving sustainable investments and supporting Sri Lanka’s economic growth. PMF Finance remains committed to delivering value to its stakeholders while ensuring continued strength and growth in the ever-evolving financial landscape.