Saturday Feb 14, 2026

Saturday Feb 14, 2026

Monday, 7 August 2023 00:18 - - {{hitsCtrl.values.hits}}

Chairman Jayanatha S.B. Rangamuwa (left) and Director/CEO Naleen Edirisinghe

Pan Asia Banking Corporation PLC has announced a steady performance in the first half of FY23 amidst a multitude of adversities emerging from challenging macroeconomic conditions.

In a statement PABC said its 1H performance reflects judicious portfolio management and prudency exercised in dealing with possible fallout on its asset quality from under high interest rate regime.

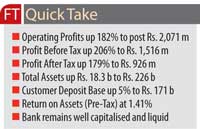

For the six-month period ended 30 June 2023, the bank reported a Pre-Tax Profit of Rs. 1,516 million, which is 206% increase compared to corresponding period last year, mainly due to increased trading gains from government securities, reduced exchange losses and reduced impairment charges.

The Sri Lankan economy has experienced some positive signs of gradual economic recovery and a measure of stability in macro-economic factors compared to the previous period, with the appreciation of LKR against USD and the IMF bailout followed by the Domestic Debt Optimisation (DDO) announcement. The Impairment charges for 2023 1H came down by 31% compared to the comparative period due to steady collection and recovery efforts and contraction in loan book during the period under review. Meanwhile, the management maintained the LKR equivalent of the impairment provisions made on SLISBs and SLDBs without a significant change during the period under review, despite the appreciation in LKR against USD during 2023 1H with the expectation of possible adverse outcomes of the on-going Government external debt restructuring program.

The interest income for 2023 1H rose by 73% due to increased market lending rates that prevailed during the period under review compared to 2022 1H and the re-pricing effect of facilities in response to the market conditions. Further, the significant volume growth in Pawning and Short-Term Loans (YoY) also contributed to the increase in loan related interest income. Apart from that, the interest income from Rupee denominated securities of the Government of Sri Lanka has also gone up significantly due to both increase in investments in Rupee Treasury Bills and high interest rates offered on such new investments compared to the previous period.

The interest income for 2023 1H rose by 73% due to increased market lending rates that prevailed during the period under review compared to 2022 1H and the re-pricing effect of facilities in response to the market conditions. Further, the significant volume growth in Pawning and Short-Term Loans (YoY) also contributed to the increase in loan related interest income. Apart from that, the interest income from Rupee denominated securities of the Government of Sri Lanka has also gone up significantly due to both increase in investments in Rupee Treasury Bills and high interest rates offered on such new investments compared to the previous period.

The interest expense for 2023 1H has also gone up significantly by 148% due to the steep increase in deposit rates, re-pricing effect of deposits as a response to the market conditions and growth in deposit base. Consequently, the Net Interest Income declined by 12% to Rs. 4,552 million during the period under review from Rs. 5,155 million in the corresponding period due to higher growth in interest expense than the growth in interest income.

The bank’s Net Fee and Commission Income declined by 26% mainly due to a drastic reduction in fee income generated from loans and advances due to weak demand for credit which resulted from the high interest rate regime and other less supportive macro-economic environment that prevailed during the period under review.

The bank reported a reduction in Other Operating Losses due to reduced exchange losses on impairment charges for loans and advances and other financial assets due to the appreciation of LKR against USD during 2023 1H which also contributed for the growth in Total Operating Income in 2023 1H. This is due to the presentation of the impact of the currency fluctuations on impairment charges on FCY loans and advances and other FCY financial assets under Other Operating Income/(Losses) in the Income Statement.

The increase in Personnel Expenses is mainly due to increased allocation for staff bonuses and increased salaries and allowances. The increase in Other Operating Expenses of 28% is due to increase in service computer maintenance, card related expenses and increased prices of the commodities compared to the prior reporting period.

Taxes and Levies on Financial Services have gone up mainly due to the increase in Operating Profits and the effect of the recently introduced Social Security Contribution Levy (SSCL). Income Tax Expense has increased by 260% due to both increased operating profits and increased tax rates.

The bank’s Post-Tax Profit has increased by 179% to Rs. 926 million in 2023 1H from Rs. 332 million in 2022 1H due to the overall excellence.

The bank reported a Net Interest Margin (NIM) of 4.24% during 2023 1H. Meanwhile, the bank reported a Return on Equity (ROE) of 8.90% and a Pre-Tax Return on Assets (ROA) of 1.41% during the period under review.

The bank’s Earnings Per Share (EPS) for 2023 1H increased to Rs. 2.09 from Rs. 0.75 improved profits. Meanwhile, the bank’s Net Asset Value Per Share as of 30 June 2023 stood at Rs. 48.68 after an appreciation of 5%.

The Total Assets of the bank stood at Rs. 226 billion as of 30 June 2023 after posting a growth of Rs. 18.3 billion or 9% during 1st Half 2023 supported mainly by the expansion in investments in LKR government securities classified under FVPL.

The Gross Loans and Advances book recorded a drop of 8% mainly due to decrease in retail credit exposures during 2023 1H due to high interest rate regime prevailed during a significant part of the 20203 1H and the cautious lending approach followed in lending to sectors/segments which exhibited high stress. Meanwhile, supported by the expansion in time deposits, the Total Customer Deposits recorded a growth of 5% to reach Rs. 171 billion as of 30 June 2023.

The bank’s Impaired (Stage 3) Loan Ratio stood at 4.15% and Stage 3 Provision Cover stood at 45.59% as of 30 June 2023. The bank continued its focused actions towards managing the quality of its loan book by containing NPLs amidst the extremely weakened economic landscape.

The bank’s Total Tier 1 Capital before deductions crossed the Rs. 20 billion mark during the period under review. The bank maintains all its Capital and Liquidity Ratios well above the regulatory minimum standards. The bank’s Tier 1 Capital Ratio and Total Capital Ratio as of 30th June 2023 stood at 15.73% and 17.65% respectively. Further, the bank’s Leverage Ratio stood at 7.69% as of 30 June 2023.

The Total Bank Level Statutory Liquid Assets Ratio (SLAR) as of 30 June 2023 stood at 32.58%. Meanwhile, the bank’s Liquidity Coverage Ratio (LCR) under BASEL III stood well above the statutory minimums.

The bank maintained an LCR of 358.96% and 408.82% for All Currencies and Rupees respectively.

Director and CEO Naleen Edirisinghe said: “Our resounding performance in 1st Half 2023 demonstrates that we are well on track to meeting our ambitious targets for the year. A growth of PAT of over 179% and 418% during 2023 1H and 2Q respectively and affirms the efficacy of our strategy which will be accelerated for generating greater earnings from core banking while infusing operational efficiencies. Despite difficult market conditions, Pan Asia Bank leveraged on its spirit of innovation and can-do spirit as one team to deliver this encouraging performance which sets the stage for the rest of the year.”