Saturday Feb 14, 2026

Saturday Feb 14, 2026

Monday, 29 July 2024 03:30 - - {{hitsCtrl.values.hits}}

Chairman Aravinda Perera (left) and Director/CEO Naleen Edirisinghe

Pan Asia Banking Corporation PLC said it has reported a steady performance reflecting improved macro-economic conditions as the bank reported its financial performance during the 1st half of 2024, which showed judicious portfolio management and prudency exercised in dealing with possible fallout on its asset quality in challenging times.

Pan Asia Banking Corporation PLC said it has reported a steady performance reflecting improved macro-economic conditions as the bank reported its financial performance during the 1st half of 2024, which showed judicious portfolio management and prudency exercised in dealing with possible fallout on its asset quality in challenging times.

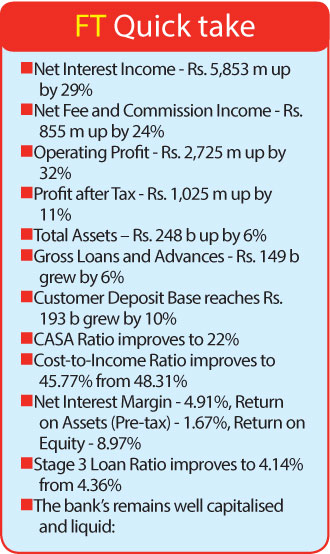

The bank reported a Pre-tax Profit of Rs. 1,996 million for the six month period ended on 30 June 2024, which is a 32% increase compared to the corresponding period last year, supported by improved net interest income, net fee and commission income, and other operating income.

The Sri Lankan economy has experienced some positive signs of gradual economic recovery and a measure of stability in macro-economic factors compared to the corresponding period last year, with the appreciation of LKR against USD and the IMF bailout, followed by the domestic and foreign debt optimisation announcements made by the Government of Sri Lanka.

The models used regarding collective impairment in 2023 were continued in the 1st half 2024 to ensure that adequate provision buffers were in place to absorb any potential credit risk that could arise in the future. The allowance for overlays applied in 2023 were continued and maintained during the 1st half 2024 as well. Meanwhile, the bank managed to end the 1st half 2024 with healthy credit quality matrices due to improved credit underwriting standards and concerted collection and recovery efforts.

The bank’s net fee and commission income has increased by 24% during 1st half 2024, mainly due to the increase in fee income generated from loans and advances, due to increased demand for credit which resulted from the prevailing low interest rate regime and other conducive macro-economic factors in the country.

The net gains from trading decreased by 57% during the reporting period due to the drop in capital gains from Sri Lanka Government Rupee Securities (T-Bills/Bonds) classified under FVPL.

The other operating income has increased significantly by 270% due to the prudently managed FX positions with the appreciation of LKR against USD from Rs. 324 to Rs. 306 during 1st half 2024.

The bank strived for earnings maximisation through portfolio re-alignment and effective cost management amidst improved macro-economic conditions as the bank reported an improved Cost-to-Income Ratio of 45.77% during the 1st half of 2024 from 48.31% for the year 2023.

The increase in personnel expenses is mainly driven by increased staff salaries, bonuses and allowances. The increase in other operating expenses was contained at 7% due to the effective cost management strategies of the bank, with the cost increase primarily due to the effect of increased VAT rates from 1 January 2024

onwards and general price increase of goods and services, such as electricity and travelling expenses.

The bank reported a Profit after Tax (PAT) of Rs. 1,025 million in the first half of 2024

which is an 11% increase compared to the corresponding period last year. The bank reported an Earnings Per Share (EPS) of Rs. 2.32 for the first half of 2024.

The bank maintains all its capital and liquidity ratios well above the regulatory minimum standards. The bank’s Tier 1 Capital Ratio and Total Capital Ratio as of 30 June stood at 16.09% and 18.04% respectively. Further, the bank's Leverage Ratio stood at 7.32% as of 30 June.

The bank’s Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) under BASEL III Accord stood well above the statutory minimums. The bank maintained LCR of 316.22% and 262.02% in All Currencies and Rupees respectively and NSFR of 150.38% as of 30 June.

Commenting on the bank’s performance Director/CEO Naleen Edirisinghe said: “Our resounding performance for the first half of 2024

demonstrates that we are well on track to meet our ambitious targets post the economic crisis. A growth in PBT of 32% for the first half of 2024

affirms the efficacy of our strategy which will be accelerated for generating greater earnings from core banking while infusing operational efficiencies. Pan Asia Bank leveraged on its spirit of innovation backed by digital enhancements and can-do spirit as one team to deliver this encouraging performance which sets the stage for the coming year.”