Sunday Feb 15, 2026

Sunday Feb 15, 2026

Monday, 29 April 2024 01:14 - - {{hitsCtrl.values.hits}}

PABC Chairman Aravinda Perera (left) and Director and CEO Naleen Edirisinghe

Pan Asia Banking Corporation PLC has reported a steady performance reflecting improved macro-economic conditions as the bank reported its financial performance during 1Q 2024, which showed judicious portfolio management and prudency exercised in dealing with possible fallout on its asset quality in challenging times.

Pan Asia Banking Corporation PLC has reported a steady performance reflecting improved macro-economic conditions as the bank reported its financial performance during 1Q 2024, which showed judicious portfolio management and prudency exercised in dealing with possible fallout on its asset quality in challenging times.

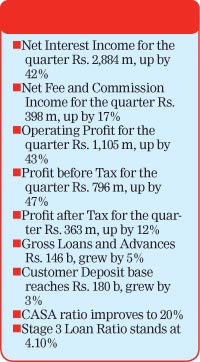

The bank reported a Pre-tax Profit of Rs. 796 million for the quarter ended 31 March 2024, which is 47% increase compared to the corresponding quarter last year, supported by improved net interest income, net fee and commission income, and other operating income.

The Sri Lankan economy has experienced some positive signs of gradual economic recovery and a measure of stability in macro-economic factors compared to the corresponding quarter last year, with the appreciation of LKR against USD and the IMF bailout followed by the Domestic Debt Optimisation (DDO) announcement.

The models used regarding collective impairment in 2023 were continued in 1Q 2024 to ensure that adequate provision buffers were in place to absorb any potential credit risk that could arise in the future. The allowance for overlays applied in 2023 were continued and maintained during 1Q 2024 as well. Meanwhile, the bank managed to end the quarter with healthy credit quality matrices due to improved credit underwriting standards and concerted collection and recovery efforts. The bank also increased impairment provision buffers held on Stage 1 and 2 exposures further during 1Q 2024 to accommodate elevation in credit risks of affected borrowers/segments.

Since the latter part of 2023, market interest rates for both lending and deposit interest rates have gradually come down in line with the policy decisions of the by the Monetary Board of CBSL to reduce policy rates couple of times.

The bank’s net fee and commission income has increased by 17% during 1Q 2024 mainly due to the increase in fee income generated from loans and advances due to increased demand for credit which resulted from the prevailing low interest rate regime and other conducive macro-economic factors in the country.

The other operating income has increased significantly by 293% due to the prudently managed FX Positions with the appreciation of LKR against USD from Rs. 324 to Rs. 300 during 1Q 2024.

The increase in personnel expenses is mainly driven by increased staff salaries, bonuses, and allowances. The increase in other operating expenses contained to 8% due to the effective cost management strategies of the bank and the cost increase is primarily due to effect of increase of VAT rates from 1 January 2024 onwards and general price increase of goods and services such as electricity and travelling expenses.

The bank reported a Profit after Tax (PAT) of Rs. 363 million in 1Q 2024 which is a 12% increase compared to the corresponding quarter last year. The bank reported an Earnings Per Share (EPS) of Rs. 0.82 for 1Q 2024.

The bank reported a Net Interest Margin (NIM) of 4.91% for 1Q 2024. Meanwhile, the bank reported a Return on Equity (ROE) of 6.42% and a Pre-Tax Return on Assets (ROA) of 1.36% for the quarter under review. Meanwhile, the bank’s Net Asset Value Per Share as of 31 March 2024 stood at Rs. 51.63.

The bank maintains all its capital and liquidity ratios well above the regulatory minimum standards. The bank’s Tier 1 Capital Ratio and Total Capital Ratio as of 31 March 2024 stood at 15.11% and 17.09% respectively. Further, the bank’s Leverage Ratio stood at 7.65% as of 31 March 2024.

The Total Bank Level Statutory Liquid Assets Ratio (SLAR) as of 31 March 2024 stood at 35.75%. Meanwhile, the bank’s Liquidity Coverage Ratio (LCR) under BASEL III stood well above the statutory minimums. The bank maintained LCR of 354.62% and 445.37% in All Currencies and Rupees respectively.

Pan Asia Bank Director and CEO Naleen Edirisinghe said: “Our resounding performance for the 1Q 2024 demonstrates that we are well on track to meet our ambitious targets post economic crisis. A growth in PBT of nearly 50% for 1Q 2024 affirms the efficacy of our strategy which will be accelerated for generating greater earnings from core banking while infusing operational efficiencies.

Pan Asia Bank leveraged on its spirit of innovation backed by digital enhancements and can-do spirit as one team to deliver this encouraging performance which sets the stage for the coming year.”