Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Wednesday, 3 May 2023 00:50 - - {{hitsCtrl.values.hits}}

Pan Asia Bank’s Chairman Jayantha S B Rangamuwa (left) and Director/CEO Naleen Edirisinghe

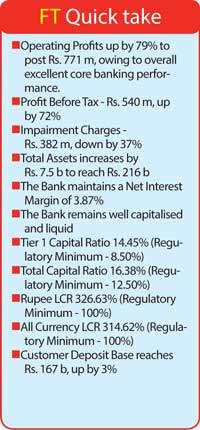

Pan Asia Banking Corporation PLC reflected a positive performance amidst a multitude of adversities emerging from challenging macroeconomic conditions as it reported its financial performance for 1Q2023, which showed judicious portfolio management and prudency exercised in dealing with possible fallout on its asset quality from sharp increase in interest rates.

Pan Asia Banking Corporation PLC reflected a positive performance amidst a multitude of adversities emerging from challenging macroeconomic conditions as it reported its financial performance for 1Q2023, which showed judicious portfolio management and prudency exercised in dealing with possible fallout on its asset quality from sharp increase in interest rates.

For the quarter ended 31 March 2023, the Bank reported a Pre-Tax Profit of Rs. 540 million, which reflects a 72% increase compared to 1Q2022. Pan Asia Bank is geared for a stronger future after delivering this superlative performance and is confident of strengthening its financial position over the coming months. The Sri Lankan economy has experienced positive signs of gradual economic recovery and stability in macro-economic factors compared to the preceding months with the appreciation of LKR against USD.

Impairment charges for 1Q2023 came down by 37% compared to the comparative period due to strong collection and recovery efforts.

The interest income for 1Q, 2023 rose by 88% due to increase in market lending rates and re-pricing effect of facilities in response to the market conditions. Further, the significant volume growth in Pawning and Short-Term Loans also led to the increase in loan related interest income.

The interest expense for 1Q2023 rose significantly by 197% mainly due to a steep increase in deposit rates and re-pricing effect of deposits in response to the market conditions.

The increase in Personnel Expenses recorded is mainly due to increased allocation for staff bonuses in 1Q2022 compared to the comparative period and annual general salary increases. Taxes and Levies on Financial Services also moved upwards mainly due to increase in Operating Profits and the effect of the recently introduced Social Security Contribution Levy (SSCL). Income Tax Expense has increased by 120% due to increase in statutory income tax rate to 30% from 24%, and operating profits also increased.

The Bank’s Post-Tax Profit increased by 50% to Rs. 324 million in 1Q2023 from Rs. 216 million in 1Q2022 due to the overall excellence.

The Bank reported a Net Interest Margin of 3.87% during 1Q2023. Meanwhile, the Bank reported a Return on Equity (ROE) of 6.33% and a Pre-Tax Return on Assets (ROA) of 1.03%.

Furthermore, the Bank’s Earnings Per Share (EPS) for 1Q2023 increased to Rs. 0.73 from Rs. 0.49 mainly due to increased trading gains from government securities, reduced exchange losses and impairment charges. The Bank’s Net Asset Value Per Share as of 31 March 2023 stood at Rs. 47.32 after an appreciation of 2%. The Total Assets of the Bank stood at Rs. 216 billion as of 31 March 2023 after posting a growth of 4% during 1Q2023.

The Bank maintains all its Capital and Liquidity Ratios well above the regulatory minimum standards. The Bank’s Tier 1 Capital Ratio and Total Capital Ratio as of 31 March 2023 stood at 14.45% and 16.38% respectively. Further, the Bank’s Leverage Ratio stood at 7.87% as of 31 March 2023.

Director/CEO Naleen Edirisinghe said: “Our resounding performance in the 1Q2023 demonstrates that we are well on track to meeting our ambitious targets for the year. A growth of PAT over 50% in 1Q 2023 affirms the efficacy of our strategy which will be accelerated for generating greater earnings from core banking while infusing operational efficiencies. Despite difficult market conditions, Pan Asia Bank leveraged on its spirit of innovation and ‘can do’ spirit as one team to deliver this encouraging performance, which set the stage for the rest of the year.”

Pan Asia Bank was ushered into Business Today's Top 40 business organisations ranking for 2021-2022 based on criteria such as portfolio, profits and risks taken, resilience, passion, and how well challenges are met. The Bank was also selected by LMD as one of the ‘Most Awarded Entities’ and top ‘Most Respected’ Entities in 2022. In addition, Pan Asia Bank was bestowed with Gold and Bronze awards at the 2022 Effie Awards in the Finance and Business Challenge Category (David vs Goliath) categories respectively.