Thursday Feb 05, 2026

Thursday Feb 05, 2026

Monday, 24 December 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

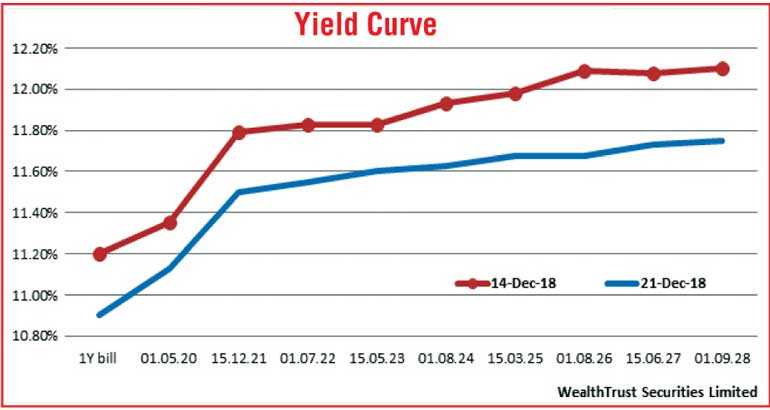

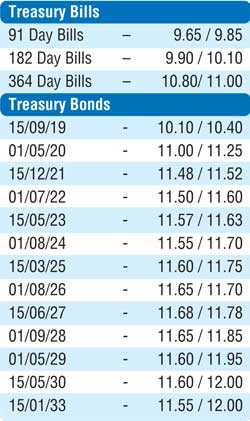

Renewed local buying interest amidst foreign selling in the secondary bond market during the week ending 21 December resulted in yields decreasing considerably, reflecting a parallel shift downwards of the overall yield curve. The bullish sentiment was supported by the weekly Treasury bill auction results, where weighted averages on the 182-day and 364-day maturities decreased by 4 basis points each for the first time in three weeks coupled with the absence of the weekly Treasury bill auction in the coming week.

In the secondary bond market, activity increased during the week with the liquid maturities of 15.12.21 and 01.08.26 hitting weekly lows of 11.47% and 11.65%, respectively, against its previous weeks closing levels of 11.75/83 and 12.05/13. Furthermore, aggressive buying interest on the 01.05.20, two 2021’s (i.e. 01.05.21 and 01.08.21), 15.05.23 and 15.06.27 maturities resulted in trades taking place at lows of 11.30%, 11.40%, 11.45%, 11.57% and 11.70%, respectively, leading to a downward shift of the overall yield curve. In the meantime, buying interest in the secondary bill market saw the 13 December 2019 bill change hands at a low of 10.95% as well.

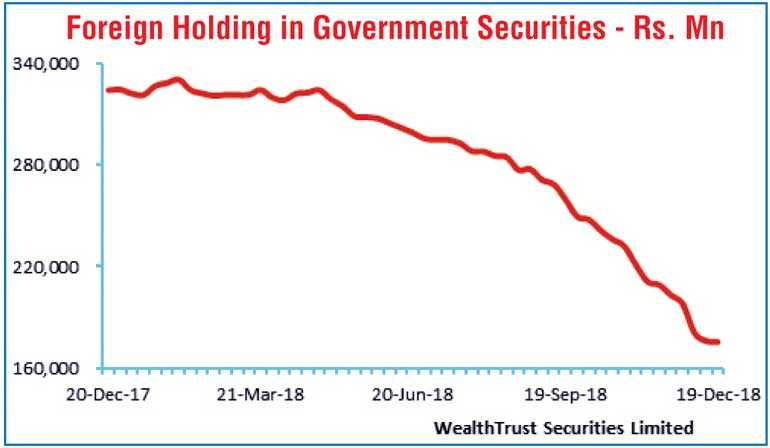

The foreign holding in rupee bonds recorded an outflow for the 15th consecutive week to the tune of Rs. 0.67 billion for the week ending 19 December.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged Rs. 11.58 billion.

In money markets, overnight call money and repo rates averaged 8.99% and 8.97% during the week, with the net liquidity shortfall in the system increasing to average at Rs. 92.67 billion, in comparison to the previous week’s average of Rs. 82.12 billion. The OMO (Open Market Operation) Department of the Central Bank injected liquidity throughout the week on an overnight and term basis (i.e. six and seven days) at weighted averages ranging from 8.84% to 8.91% and 8.86% to 8.96%. In addition, liquidity was also infused by way of auctions for the outright purchase of Treasury bills, where an amount of Rs. 2.28 billion was injected in total at weighted average yields ranging from 9.75% to 9.85% for periods of 88 and 116 days.

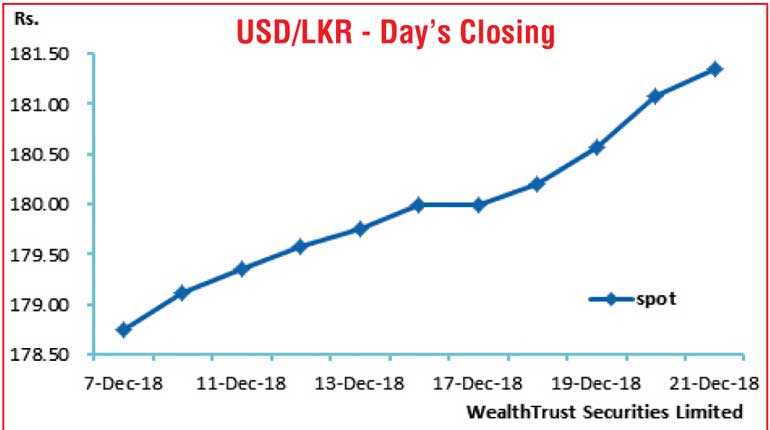

Rupee dips above Rs. 181

The continued demand by banks and importers saw the USD/LKR rate on spot contracts dip below the Rs. 181 psychological level for the first time to close the day at Rs. 181.30/40 against its previous week’s closing of Rs. 179.90/10. The daily USD/LKR average traded volume for the first four days of the week stood at $ 66.74 million.

Some of the forward dollar rates that prevailed in the market were 1 month – 182.40/80, 3 months – 184.40/80, and 6 months – 187.40/80.