Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 18 May 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market witnessed a round of fresh buying interest mainly during the early part of the week ending 15 May, subsequent to the monetary policy adjustment at where policy rates were cut by 50 basis points on 6 May. The primary auctions during the week saw the 15.01.2023 bond and the 364 day bill record weighted averages below its Central Bank stipulated cut off rates while the  01.07.2028 bond along with the 91 day and 182 day bills recorded weighted averages at the stipulated cut off rates.

01.07.2028 bond along with the 91 day and 182 day bills recorded weighted averages at the stipulated cut off rates.

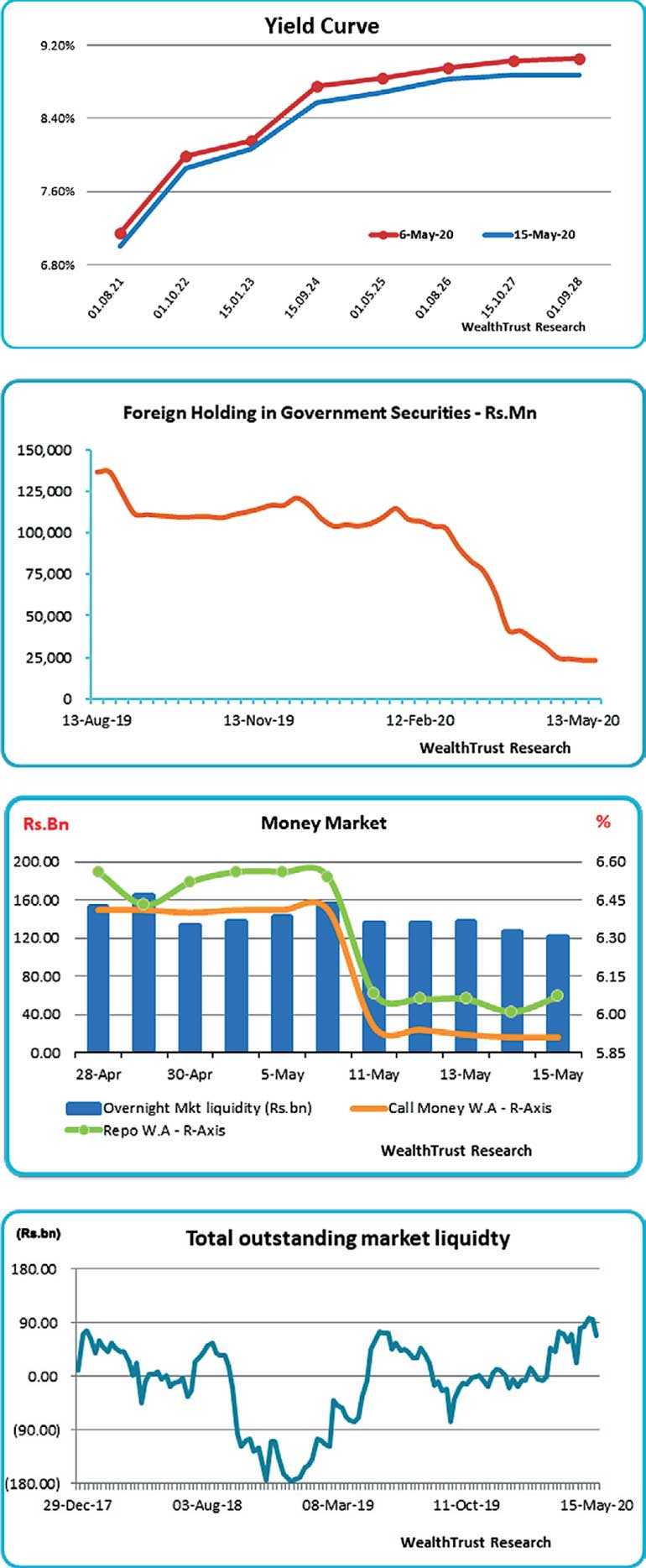

Trades were mainly seen on the market favourite maturities of 01.10.22, 15.01.23, 2024’s (i.e. 15.03.24, 15.06.24 and 15.09.24), 01.05.25 and 15.10.27 as its yields were seen dipping to weekly lows of 7.72%, 7.90%, 8.50% each, 8.45%, 8.59% and 8.75% respectively against its previous weeks closing levels of 7.95/02, 8.13/18, 8.67/73, 8.72/78 each, 8.82/85 and 9.00/05 respectively. Nevertheless, activity in the secondary bond market moderated considerably towards the latter part of the week as selling interest at these levels on profit taking saw yields edge up once again, trimming its decline.

In addition, trades along the rest of the yield curve during mid-week saw the maturities of the 2021’s (i.e. 01.03.21 and 01.08.21) and 2023’s (i.e. 15.03.23, 15.0.23 and 01.09.23) change hands within the range of 7.00% to 7.10% and 8.05% to 8.22% respectively.

In the bill market, June 2020 maturities were seen changing hands at levels of 6.50% to 6.75% while January 2021 and May 2021 changed hands at levels of 6.85% and 6.90%

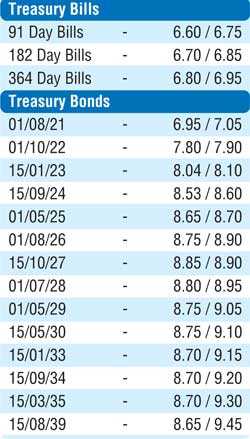

The foreign holding of Sri Lankan Rupee bonds recorded an inflow for the first-time in 16 weeks with an increase of Rs. 0.31 million for the week ending 13 May.

In money markets, the base rate change saw weighted average yields on overnight call money and repo rates decreasing to 5.93% and 6.06% respectively against its previous weeks of 6.41% and 6.55%. The total money market liquidity stood at a high of Rs. 67.64 billion. The Domestic Operations Department (DOD) of the Central Bank of Sri Lanka injected liquidity at weighted averages ranging from 6.03% to 6.41% by way of 3 to 7-day reverse repo auctions.

Rupee trades within a stable range

In the Forex market, the USD/LKR rate on spot contracts traded within a stable range of Rs. 187.87 to Rs. 188.55 during the week against its previous weeks of Rs. 187.20 to Rs. 191.00 before closing week at Rs. 187.80/00.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 67.50 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)

Given below are the secondary market yields for the most frequently traded maturities: