Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 16 September 2019 00:48 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

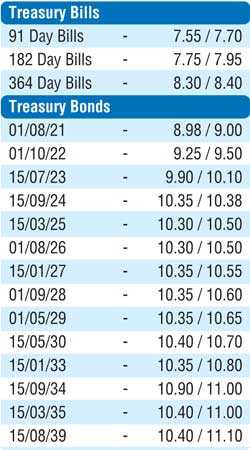

The secondary market bond yields increased across its yield curve during the shorted trading week ending 12 September, driven by the outcomes of the primary Treasury bill and bond auctions. Firstly, the weekly Treasury bill auctions saw the weighted average of the 364 day bill increase by three basis points to 8.36%. This was followed by the Treasury bond auctions, at where the five-year maturity of 15.09.24 and the 15 year maturity of 15.09.34 recorded weighted averages of 10.27% and 10.59% respectively.

In the secondary bond market, the auctioned maturity of 15.09.24 was seen trading within the range of 10.34% to 10.36% during the week against a closing of 10.00/03 recorded the previous week on a parallel maturity of 15.06.24. Furthermore, selling interest on the 2021s (i.e.01.03.21, 01.05.21, 01.08.21, 15.10.21 & 15.12.21) and 2023s (i.e. 15.03.23, 15.07.23 & 15.12.23) saw it change hands at highs of 8.78%, 8.90%, 9.02%, 9.05%, 9.25%, 9.82%, 9.85% and 9.92% respectively against its previous weeks closing levels of 8.55/65, 8.60/70, 8.70/80, 8.80/90 each, 9.55/70, 9.75/85 and 9.80/85. In addition on the long end of the curve, the auctioned 15.09.34 maturity was seen changing hands at 10.95%. This led to an upward parallel adjustment on the overall yield curve on a week on week basis.

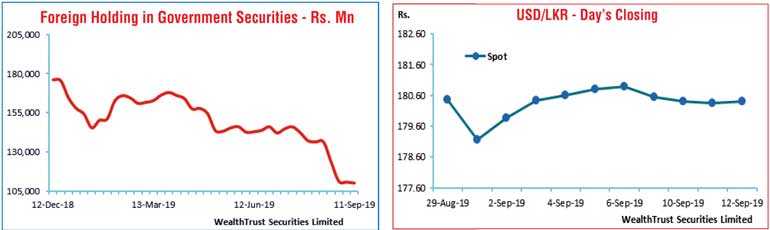

The foreign holding in rupee bonds was seen decreasing for a fourth consecutive week, registering an outflow of Rs. 0.59 billion for the week ending 11 September.

The daily secondary market Treasury bond/bills transacted volume for the first three days of the week averaged Rs. 18.60 billion.

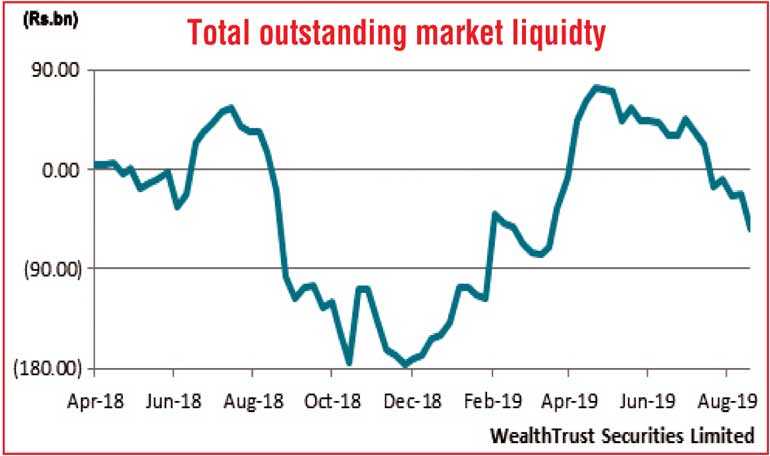

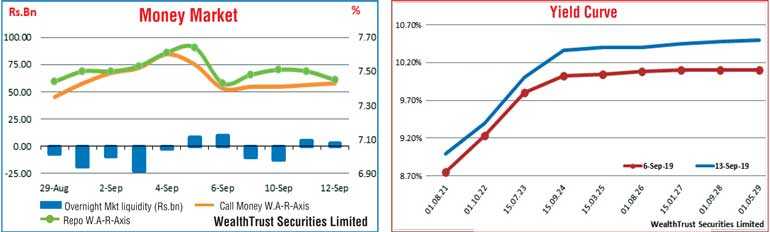

In money markets, the overall net deficit in the system was seen increasing to a five month high of Rs. 54.59 billion, a level last seen in April 2019 against its previous week’s deficit of Rs. 22.62 billion. The Open Market Operations (OMO) Department of Central Bank injected liquidity during the week on an overnight basis and term basis (i.e. seven and 14 days) at weighted average yields ranging from 7.38% to 7.45%. It further injected liquidity for Standalone Primary Dealers by way of overnight reverse repo auctions at weighted averages ranging from 7.47% to 7.51%. The overnight call money and repo rates averaged 7.42% and 7.49% respectively for the week.

Rupee appreciates during the week

In the Forex market, the interbank USD/LKR rate on spot contracts appreciated during the week to close the week at levels of Rs. 180.35/45 against its previous weeks closing level of Rs. 180.85/95 on the back of selling interest by banks.

The daily USD/LKR average traded volume for the first three days of the week stood at $80.91 million. Some of the forward dollar rates that prevailed in the market were one month - 180.75/90; three months - 181.70/90 and six months - 183.30/60.