Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 26 November 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

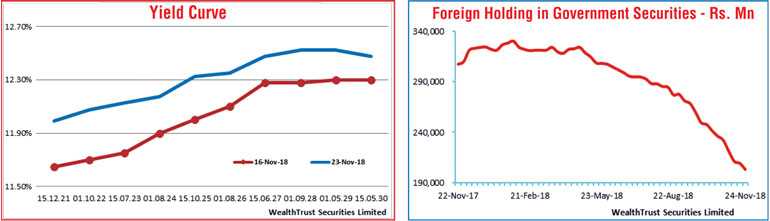

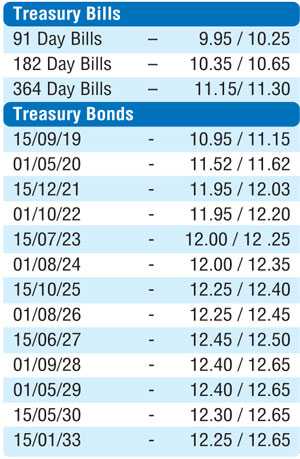

The secondary bond market yield curve recorded a parallel shift upwards during the shortened trading week ending 23 November 2018 on the back of foreign and local selling interest. Yields were seen edging up despite the weekly weighted averages decreasing as the country rating downgrade by Moody’s led to sentiment turning bearish during the week. Activity centred on the short end to the belly end of the curve as yields on the 01.05.20, 01.03.21, 15.12.21 and 15.06.27 maturities were seen increasing to weekly highs of 11.61%, 11.85%, 12.00% and 12.45% respectively against its previous weeks closings of 11.25/45, 11.57/60, 11.60/80 and 12.25/30.

The reduction in the foreign holding of Rupee bonds was witnessed for a 12th consecutive week recording an outflow of Rs. 6.05 billion for the week ending 21 November 2018.

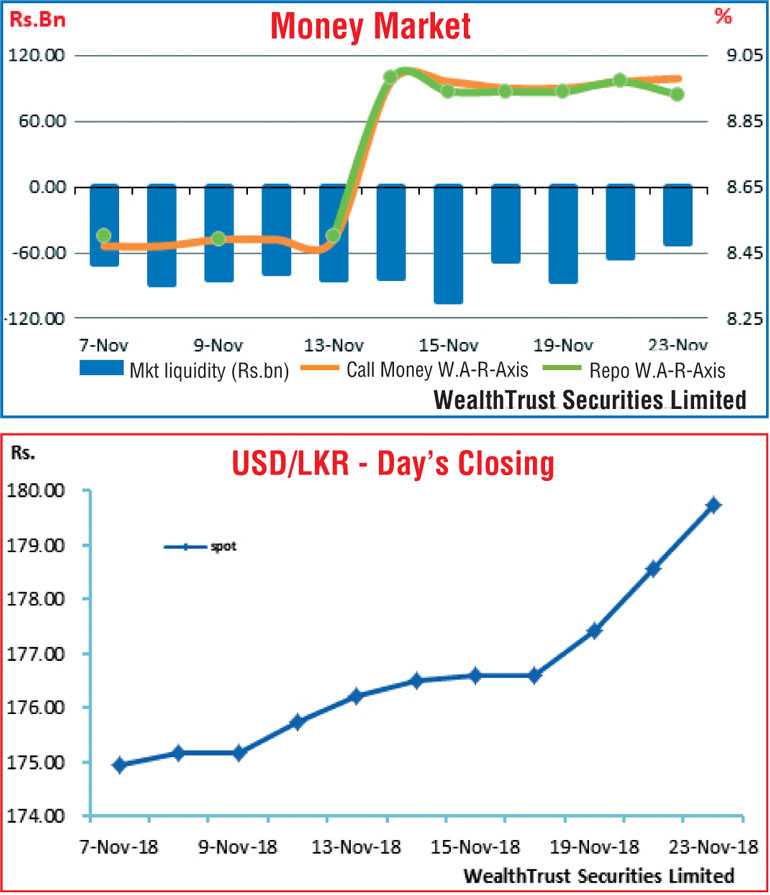

The daily secondary market Treasury bond/bill transacted volume for the first two days of the week averaged Rs. 4.08 billion. In the money market, liquidity was seen improving during the week as the average net shortfall improved to Rs. 67.04 billion against its previous week of Rs. 83.57 billion. The OMO (Open Market Operation) Department of the Central Bank of Sri Lanka injected liquidity throughout the week on an overnight and term basis for periods of 7 to 14 days at weighted averages ranging from 8.53% to 8.60% and 8.64% to 8.77% respectively. The overnight call money and repo rates averaged at 8.97% and 8.95% respectively for the week.

Rupee hits fresh low

The rupee on spot contracts closed the week considerably lower at Rs. 179.50/00 in comparison to its previous weeks closing levels of Rs. 176.50/65 subsequent to hitting a fresh low of Rs. 179.75 on the back of Moody’s rating action coupled with importer demand and buying interest by banks. The daily USD/LKR average traded volume for the first two days of the week stood at $ 140.02 million. Some of the forward dollar rates that prevailed in the market were one month – 179.90/10; three months – 182.45/65 and six months – 185.50/70.