Friday Feb 27, 2026

Friday Feb 27, 2026

Friday, 2 July 2021 00:00 - - {{hitsCtrl.values.hits}}

|

| People’s Merchant Finance Chairman Chandula Abeywickrema |

|

| People’s Merchant Finance CEO Nalin Wijekoon

|

People’s Merchant Finance PLC (PMF) has achieved its most significant milestone along the transformation journey of success which commenced in June 2019.

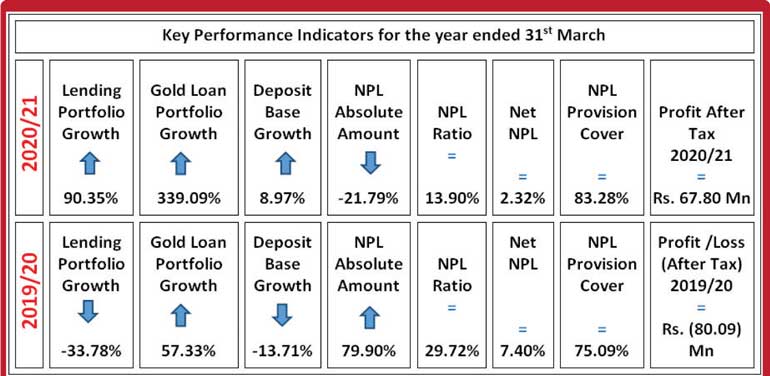

The company concluded the financial year 2020/21 by crossing several thresholds and tops its successes by earning a profit before taxation of Rs. 100 million during the period. This financial triumph is attributed to the company’s focused strategic plans which have revitalised business operations despite the prevailing economic and industry challenges.

PMF is well on its way to fulfilling its mission to serving the financial needs of small and medium-sized businesses and individuals across the nation while emerging as a leading player in the financial industry landscape.

Strategically planning for a rightful position

PMF’s transformational journey to renew, revitalise, and reposition the Company to engage on a level playing field with today’s consumers and industry competitors began in mid-2019 with the development of the cohesive five-year strategic plan.

The capital infusion by Sterling Capital Investments Ltd. (SCIL), PMF’s majority shareholder together with the appointment of a Board of Directors with significant banking and finance industry expertise and a dynamic management team to lead key business function enabled the company to focus on its next phase of business growth.

A rights issue concluded in March 2021 to satisfy the core capital requirements of the Central Bank of Sri Lanka (CBSL) also improved PMF’s governance and compliance frameworks and strengthened the company’s internal funds position. These measures have been pursued to increase the company’s sustainable market position and improve its bottom-line while safeguarding the interests of all our stakeholders.

The journey with a visionary destination

Currently, the company is engaged in renewing and diversifying its product portfolio to cater to market trends and consumer needs. This has resulted in PMF identifying a new target market, those who thrive on building domestic businesses to develop local industries and the national economy.

A firm product development strategy for the financial year 2021/22 is to launch the Entrepreneurial Loan Scheme to support Sri Lanka’s small and medium-sized entrepreneurs with a vision to succeed and grow in the future.

Adapting to harness opportunities in trying operating conditions

PMF’s journey was not without challenges. The new leadership and the company faced both internal and external challenges and uncertainties. The company’s internal challenges were strategically managed, prudently overcome, and carefully streamlined.

However, the external challenges, stemming mainly from the rapid spread of the COVID-19 pandemic, were unpredictable and unprecedented. The sudden halt in economic activity, inaccessibility in reaching customers, and regulatory changes among other developments impacted the company’s business operations. An even more critical setback for a company whose leasing portfolio consisted of nearly an 80% vehicle leasing component, was the Government’s restriction on the importation of vehicles. However, the visionary leadership together with the dynamic management team came together to circumvent these challenges and harness new opportunities for growth and prosperity.

Thus, the company’s transformational journey bore fruit. And as inundated with challenges as it was, PMF converted from a loss-making entity to a profitable licenced finance company.

A pragmatic leadership approach to facilitate turnaround initiatives

PMF’s leadership remains confident of the company’s planned future path. They credit the dedicated efforts of PMF’s team with clear guidance from the Board and management leadership to have played a large part in the company’s improved business operations.

The focused efforts to improve customer care and offer personalised customer services have also instilled the much-needed trust from customers who remained with the company amidst the many trials and tribulations over the past year. The strong partnerships and collaboration with other stakeholders are also credited to have played a critical role in achieving the success of the company to date.

PMF’s Chairman Chandula Abeywickrema attributed the company’s s success to the strong backing from SCIL, the progressive approach of the Board of Directors in implementing transformational stratagems, and the determination to succeed by the CEO and his management team.

Abeywickrema, a veteran banker with over 35 years of experience in retail and development banking and well-versed in financial inclusion, confidently said: “The journey we began in mid-2019 has progressed according to plan with the intended turnaround in the company’s performance aligned to the five-year strategy roadmap. We brought about many changes to the management team and internal processes and faced unexpected challenges with the impact of the COVID-19 pandemic, but the visionary leadership remained focused on implementing our strategic plan and the entire PMF team worked tirelessly on its implementation. Thus, the pace of our transforming journey to date has been exceptional. The results we have achieved in this financial year, the first full year of operations, showcases the inherent potential which has infused into the company’s processes and systems.”

A year of financial and operational success!

Historically, PMF’s financial performance has been average, and the Company has been in a loss-making slump for the past eight years. However, the financial year ended 31 March 2021 has proved to be a focal point showcasing the potential of PMF and the success achieved by the company’s newly-implemented five-year transformational strategies. The company’s leadership is elated to have broken an 8-year loss-making streak in a financial year inundated with challenges which abounded across countries, economies, and people due to the outbreak of the COVID-19 pandemic.

PMF CFO Nalin Wijekoon said: “The numbers speak for themselves. The turnaround to profitability after eight years, admits the pandemic-related challenges which caused a massive setback to the rural economy of Sri Lanka and the SME sector is remarkable. We were able to provide innovative financial solutions and diversify our product portfolio by utilising our branch network efficiently to meet the evolving consumer demands. The rapid growth story and consistent profitability over the past three quarters reflect only the start of a long journey of value creation to all our key stakeholders driven by focused leadership”.

Following a social transformative path to become a leading industry beacon

While following their planned path to success, PMF has also developed a digital vision considering the importance of technology to reach tech-savvy customers and the need to digitalise and operate the business in an online world.

Hence, while the company currently has only 11 branches and one gold loan Centre, newer branch openings will be limited to five in strategic locations across Sri Lanka and become operational in the next few years. The company is more focused on expanding its digital footprint and taking forward the business on a diversified platform to cater to a range of industries and emerging customer segments.

The five-year strategic plan will enable the company to meet and achieve its goals in the coming years on a sustainable footing. PMF will continue to enhance its governance and risk management frameworks and proactively meet regulatory requirements as mandated by the CBSL.

The focus in the coming few years will be to meet the economic and financial needs of Sri Lanka while simultaneously exploring opportunities to expand market presence regionally to become a regionally focused financial institution to enrich the lives of more people more often in more places by providing financial services whenever and wherever they are needed.

The achievements to date are only the beginning. PMF has ambitious plans to achieve its long terms goals. The company is confident that they will be able to continue to achieve similar successes as they navigate the path of their transformational roadmap in the coming four years.

Beyond that, the opportunities are far-reaching and PMF believes that they are just on the tip of the iceberg with this new journey with much more to be achieved as the company continues to evolve with the changing paradigms of the operating environment.