Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Wednesday, 10 February 2021 01:09 - - {{hitsCtrl.values.hits}}

|

| Chairman Chandula Abeywickrema |

|

| CEO Nalin Wijekoon

|

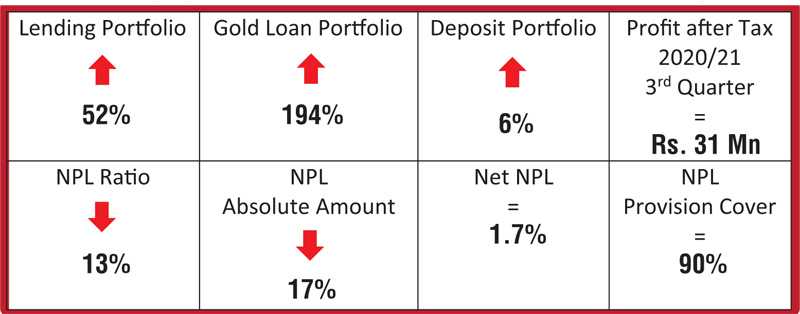

People’s Merchant Finance PLC completed another successful quarter, achieving a profit of Rs. 31 million for the quarter ended 31 December 2020 amidst the prevailing challenges in the operating environment. This continuing growth momentum is attributed to the support given by stakeholders, especially its primary shareholder, Sterling Capital Investments Ltd. (SCIL), part of Sterling Japan Co. Ltd., and the largest exporter of Japanese vehicles to Sri Lanka.

Success is also attributed to PMF’s well-developed strategic plans and the optimistic stance taken, together with the go-getter attitude of its management team and employees. Thus far, the Company has ensured that goals are being achieved above expectations and on time. PMF which embarked on its renewal, revitalisation, and repositioning path in mid-2019 remains steadfast in achieving set objectives and goals, progressing strongly in its plan to emerge as a leading player in the financial industry.

The transformation made possible

The Chairman, Chandula Abeywickrema, is convinced that PMF’s continued transformation into positive bottom line was made possible due to the vast experience and the dedicated efforts of the Board of Directors and the newly strengthened senior management team of PMF. “It is these uniquely blended efforts of the PMF team which makes it possible for the Company to achieve such success in such a challenging environment. The banned imports of motor vehicles and the lower levels of economic activities have been tough for the Company, all our employees, our customers, and other stakeholders, as well the people of the nation,” he stated. “The Company will have to remain focused on people – from employees and customers to suppliers, business partners, shareholders, and the community. They are after all the foundation on which any business or entity is developed and expected to achieve success,” Abeywickrema says.

Advancing business growth and profitability

The restructuring initiatives of the Company have reaped benefits for all stakeholders in a short period. PMF has successfully relocated two of its branches in the towns of Kurunegala and Trincomalee to serve customers better and more efficiently, increasing reach and customer convenience. The cost management focus has resulted in optimising resource utilisation while strategically allocating resources to where they are needed when they are needed. The Company’s focused efforts towards collections by working with customers to accommodate their needs and yet remain businessStrengthening core capital requirements

viable has paid good dividends as showcased in the Company’s financial results for the quarter ended 31 December 2020.

Internal process and systems development has supported external growth, and the Company is placed in a unique position to offer exceptional services and new products to the market. The corporate restructuring efforts has proved fruitful, and facilitated the cohesively directed strategy implementation.

CEO Nalin Wijekoon states, “The operational enhancements and the efficiencies achieved in just nine months since we implemented our new five-year strategic plan is progressing very well. Our second consecutive quarter of profitability in times when people are having their personal challenges, both financially and in other ways, is a true reflection of the trust in our Company by customers and the tireless efforts of the management and staff. I am sure that we will be able to achieve what we have planned for the coming financial year and make surer strides in making PMF a renowned financial services company of the nation.”

Strengthening core capital requirements

The Company’s planned right issue which was postponed due to the outbreak of the COVID-19 pandemic in 2020, will now move ahead, strengthening the minimal core capital requirements and consolidating the Company’s pursuit of strong compliance with industry regulations and laws. Furthermore, the Rights Issue which is expected to raise Rs. 811.9 million will also improve the position of internal funds of PMF creating value for our stakeholders and positioning the Company to continue its planned investments for long-term growth.

Setting the stage for the financial year 2021/22

Remaining true to its efforts to innovate and bring new and in-demand products to meet customer needs while supporting the Sri Lankan Government’s Economic Development Agenda, PMF has concluded its development of the Entrepreneurship Loan Product and has brought in an expert to facilitate implementation and successful launch in the coming financial year.

Enhancing reach and improving the delivery model by expanding the digital footprint is another focus area for the coming year. The impact of the COVID-19 pandemic and the extended lockdowns brought to the forefront the true importance of digital channels of delivery for extending customer reach. The Company is currently researching opportunities to obtain right-fit partners to realise their digital expansion strategy and improve their digital operational sphere.

PMF also has firm plans to improve branch network infrastructure and set up new branches across developing towns in the nation to augment service levels and make sure that people who require financial assistance have easy access to the same.

PMF is preparing to serve a wide cross-section of the nation’s people by offering them financial products that suit and meet their needs. The Company is also on a path to empower rural communities, women, and youth to achieve financial independence and prosper to become economically viable individuals. The support given and shown by all stakeholders is the motivating factor for the Company to continue this journey despite challenges and obstacles, pursuing a path which fosters national economic growth, sustained business development, and value creation for PMF’s stakeholders.