Monday Feb 23, 2026

Monday Feb 23, 2026

Tuesday, 5 November 2019 00:00 - - {{hitsCtrl.values.hits}}

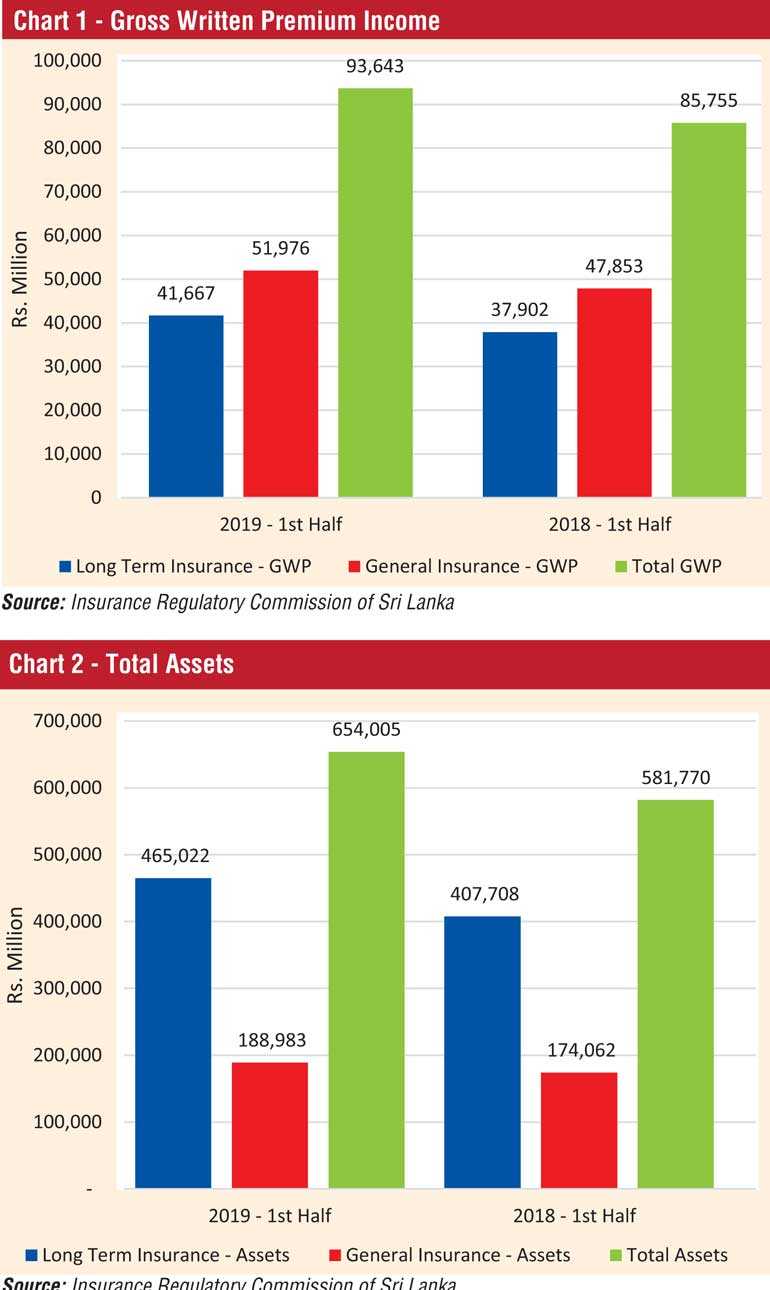

Gross Written Premium

The insurance industry was able to achieve a growth of 9.20% in terms of overall Gross Written Premium (GWP), during the first half of 2019, recording an increase of Rs. 7,888 million when compared to the same period in the year 2018. The GWP for Long Term Insurance and General Insurance Businesses was Rs. 93,643 million compared to the first half of 2018 amounting to Rs. 85,755 million. However, the growth rate has declined by 3.40% when compared to the growth rate of first half of 2018, being 12.60%.

The GWP of Long Term Insurance Business amounted to Rs. 41,667 million (1st half 2018: Rs. 37,902 million) recording a growth of 9.94% (1st half 2018: 12.61%). The GWP of General Insurance Business amounted to Rs. 51,976 million (1st half 2018: Rs. 47,853 million) recording a growth of 8.61% (1st half 2018: 12.58%).

(Refer chart 1)

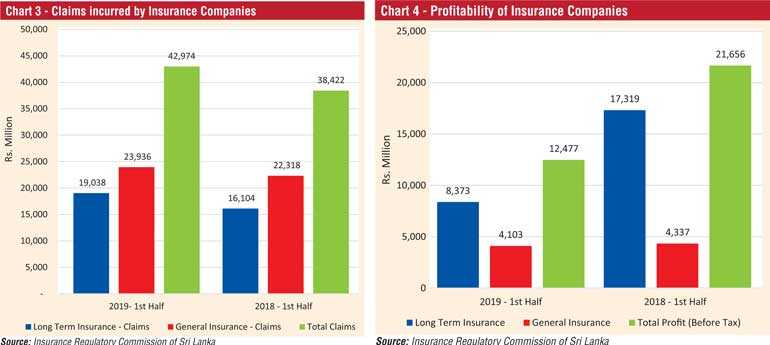

Total assets

The value of total assets of insurance companies has increased to Rs. 654,005 million as at end of first half of 2019, when compared to Rs. 581,770 million recorded as at end of 1st half of 2018, reflecting a growth of 12.42% (1st half 2018: 9.13%). The assets of Long Term Insurance Business amounted to Rs. 465,022 million (1st half 2018: Rs. 407,708 million) depicting a growth rate of 14.06% (1st half 2018: 8.68%) at the end of first half of 2019, due to increase in business volume which is represented by investments in government debt securities and deposits. The assets of General Insurance Business amounted to Rs. 188,983 million (1st half 2018: Rs. 174,062 million) indicating a growth rate of 8.57% year-on-year. However, the growth of assets of general insurance business has significantly dropped compared to 10.23% growth recorded during first half of 2018.

(Refer chart 2)

Investment in Government Securities

Investments in Government Debt Securities amounted to Rs. 187,957 million representing 45.58% (1st half 2018: Rs. 176,471 million; 47.49%) of the total investments of Long Term Insurance Business increased by 6.51%, while such investment of the total investment of General Insurance Business amounted to Rs. 43,607 million representing 37.40% (1st half 2018: Rs. 42,486 million; 37.98%) and increased by 2.64%. Accordingly, the total investment in Government Securities in the two businesses amounted to Rs. 231,564 million (1st half 2018: Rs. 218,957 million), showing an overall increase of 5.75% respectively.

Claims incurred by insurance companies

The claims incurred by insurance companies in both Long Term Insurance Business and General Insurance Business were Rs. 42,974 million (1st half 2018: Rs. 38,422 million) showing an increase in total claims amount by 11.85% year-on-year. The Long Term Insurance claims, including maturity and death benefits, amounted to Rs. 19,038 million (1st half 2018: Rs. 16,104 million). The claims incurred in General Insurance Business, including Motor, Fire, Marine and other categories, amounted to Rs. 23,936 million (1st half 2018: Rs. 22,318 million). Hence, during the first half of 2019, there is an increase in claims incurred by 18.22% and 7.25% for Long Term Insurance and General Insurance Businesses respectively, when compared to the same period in 2018.

(Refer chart 3)

Profit (before tax) of insurance companies

The profit (before tax) of insurance companies as at end of first half of 2019 in both Long Term Insurance Business and General Insurance Business amounted to Rs. 12,477 million (1st half, 2018: Rs. 21,656 million) showing a significant decrease in total profit amount by 42.39%. The profit (before tax) of Long Term Insurance Business amounted to Rs. 8,373 million (1st half 2018: Rs. 17,319 million) while the profit (before tax) of General Insurance Business amounted to Rs. 4,103 million (1st half, 2018: Rs. 4,337 million). Thus, profit (before tax) of Long Term Insurance Business and General Insurance Business has decreased by 51.65% and 5.38% respectively.

(Refer chart 4)

No. of insurance companies

Out of 26 insurance companies in operation as at 30 June 2019, 12 engaged in Long Term (Life) Insurance Business, 11 companies engaged in General Insurance Business and three companies engaged in both Long Term and General Insurance Businesses.

Insurance brokering companies

63 insurance brokering companies, registered with the Commission as at 30 June 2019, mainly concentrated in General Insurance Business. The premium income generated through insurance brokering companies during the first half of 2019 with respect to Long Term Insurance Business amounted to Rs. 622 million, 0.66% of total GWP (1st half 2018: Rs. 353 million; 0.41% of total GWP) while the premium income generated with respect to General Insurance Business amounted to Rs. 14,526 million, 15.51% of total GWP (1st half 2018: Rs. 11,584 million; 13.51% of total GWP).

The total premium income generated through insurance brokering companies with respect to General and Long Term Insurance Businesses, and Reinsurance Business amounted to Rs. 16,133 million, 17.23% of total GWP, during first half of 2019, compared to Rs. 12,599 million, 14.69% of total GWP during the first half of 2018. Thus, the total premium income generated through insurance brokering companies witnessed a growth of 28.05% during the first half of 2019 when compared to first half of 2018.

Notes:

1.Due to segregation of Sanasa Insurance Company Ltd. to General and Life insurance companies, Balance Sheet data has been used from monthly return and Statement of Income data recorded using quarterly return information

2.The above information represents insurance companies’ information excluding National Insurance Trust Fund (NITF)

3.Total Assets of the Insurance Brokering Companies represent all insurance brokering companies excluding Ceynergy Insurance Brokers Ltd., My Insurance Brokers Ltd., and Redmo Swiss Insurance Brokers Ltd. due to non-submission of quarterly returns.

(Source: Insurance Regulatory Commission of Sri Lanka.)