Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 18 January 2019 00:00 - - {{hitsCtrl.values.hits}}

Gross Written Premium

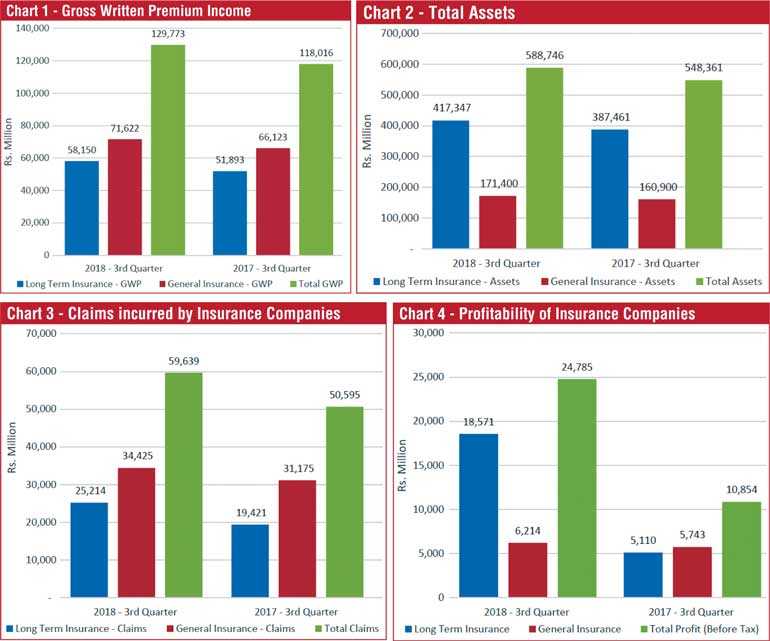

The insurance industry was able to achieve a growth of 9.96% in terms of overall Gross Written Premium (GWP), during the 3rd quarter of 2018, recording an increase of Rs. 11,757 million when compared to the same period in the year 2017.

The GWP for Long Term Insurance and General Insurance Businesses for the period ending 30 September 2018was Rs. 129,773 million compared with the same period in 2017 amounting to Rs. 118,016 million posting a growth of 9.96% (Q3, 2017: 15.53%). The

GWP of Long Term Insurance Business amounted to Rs. 58,150 million (Q3, 2017:Rs. 51,893 million) recording a growth of 12.06% (Q3, 2017: 11.50%). The GWP of General Insurance Business amounted to Rs. 71,622 million (Q3, 2017: Rs. 66,123 million) recording a growth of 8.32% (Q3, 2017: 18.89%). (Refer chart 1)

Total assets

The value of total assets of insurance companies has increased to Rs. 588,746 million as at 30 September 2018, when compared to Rs. 548,361 million recorded as at end of 30 September 2017, reflecting a growth of 7.36% (Q3, 2017: 10.14%).

The assets of Long Term Insurance Business amounted to Rs. 417,347 million (Q3, 2017: Rs. 387,461 million) indicating a growth rate of 7.71% year-on-year. However, the growth of assets of long term insurance business has significantly dropped compared to 13.27% growth recorded during the 3rd quarter of 2017.

The assets of General Insurance Business amounted to Rs. 171,400 million (Q3, 2017: Rs. 160,900 million) depicting a growth rate of 6.53% (Q3, 2017: 3.28%) at the end of the 3rd quarter 2018. Accordingly, the growth of assets of general insurance business has shown a significant increase compared to the same period of 2017. (Refer chart 2)

Investment in

Government securities

At the end of the 3rd quarter 2018, investment in Government Debt Securities amounted to Rs. 162,672 million representing 43.30% (Q3, 2017: Rs. 181,791;51.33%) of the total investments of Long Term Insurance Business, while such investments of the total investment of General Insurance Business amounted to Rs. 40,787 million representing 36.70% (Q3, 2017: Rs. 34,685;33.88%).

Accordingly, the total investment of both Long Term Insurance Business and General Insurance Business in Government Securities amounted to Rs. 203,460 million (Q3, 2017: Rs. 216,476 million). Thus, the investment in Government Securities of Long Term Insurance Business has decreased by 10.52% and the investment in Government Securities of General Insurance Business has increased by 17.59% respectively.

Claims incurred by insurance companies

The claims incurred by insurance companies during the 3rd quarter of 2018 in both Long Term Insurance Business and General Insurance Business was Rs. 59,639 million (Q3, 2017:Rs. 50,595 million) showing an increase in total claims amount by 17.87% year-on-year. The Long Term Insurance claims, including maturity and death benefits, amounted to Rs. 25,214 million (Q3, 2017: Rs. 19,421 million). The claims incurred in General Insurance Business, including Motor, Fire, Marine and other categories, amounted to Rs. 34,425 million (Q3, 2017: Rs. 31,175 million).

Hence, during the 3rd quarter of 2018, there has been an increase in claims incurred by 29.83% and 10.43% for Long Term Insurance and General Insurance Businesses respectively, when compared to the same period in 2017. The claims incurred in Long Term Insurance as a percentage of GWP of Long Term Business is 43%, whereas the claims incurred in General Insurance as a percentage of GWP of General Insurance Business is 48%. (Refer chart 3)

Profit (Before Tax) of Insurance Companies

The profit (before tax) of insurance companies as at end of the 3rd quarter 2018 in both Long Term Insurance Business and General Insurance Business amounted to Rs. 24,785 million (Q3, 2017: Rs. 10,854 million) showing an increase in total profit amount by 128.36%. The profit (before tax) of Long Term Insurance Business amounted to Rs. 18,571 million (Q3, 2017: Rs. 5,110 million) while the profit (before tax) of General Insurance Business amounted to Rs. 6,214 million (Q3, 2017: Rs. 5,743 million).

Thus, profit (before tax) of Long Term Insurance Business and General Insurance Business has increased by 263.42% and 8.19% respectively. Profits (PBT) of Life insurance business shows a significant increase (Rs. 13.46 b) mainly due to profit recorded by an insurer from sale of its subsidiary. Further, three life insurance companies reported a notable growth in PBT compared to the 3rd quarter of 2017.(Refer chart 4)

Number of insurance companies

Out of 25 insurance companies in operation as at 30 September 2018, 12 are engaged in Long Term (Life) Insurance Business, 11 companies are carrying out only General Insurance Business and two are composite companies (dealing in both Long Term and General Insurance Businesses).

Insurance brokering companies

The 65 insurance brokering companies registered with the Commission as at 30 September 2018 mainly concentrate on General Insurance Business. The premium income generated through insurance brokering companies in the 3rd quarter of 2018 with respect to General Insurance Business amounted to Rs. 5,983 million, 4.61% of total GWP (Q3, 2017: Rs. 5,827 million; 4.93% of total GWP) while the premium income generated with respect to Long Term Insurance Business amounted to Rs. 131 million, 0.22% of total GWP. (Q3, 2017: Rs. 65 million; 0.12% of total GWP).

The total premium income generated through insurance brokering companies with respect to General and Long Term Insurance Businesses and Reinsurance Business amounted to Rs. 6,646 million, 5.12% of total GWP, during the 3rd quarter of 2018, compared to Rs. 6,167 million, 5.22% of total GWP during the 3rd quarter of previous year. Thus, the total premium income generated through insurance brokering companies witnessed a growth of 7.76% during the 3rd quarter of 2018 when compared to the 3rd quarter of 2017. Insurance brokers are also acting as intermediaries in selling foreign health insurance products.

Loss adjusters

The IRCSL has also registered 10 individuals to carry out loss adjusting activities for the industry.

Notes:

Figures published for 3rd quarter of 2017 were revised due to the classification differences and rectifying errors noted.

Above analysis does not include information in respect of NITF and MBSL.

Inter segment transactions (i.e. transactions between Long Term and General Insurance segments) have not been considered.