Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 17 July 2024 00:16 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

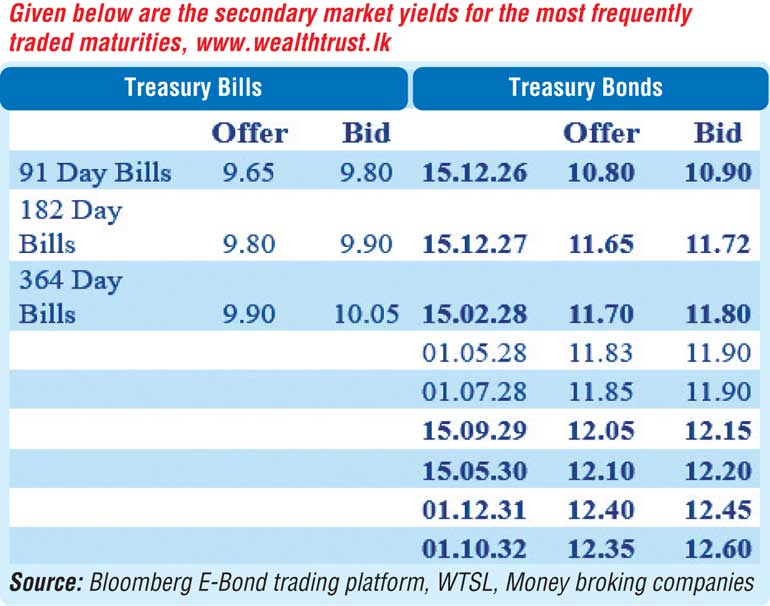

The sentiment in the secondary bond market yesterday continued to be positive with yields edging down further, with activity and volumes transacted also remaining healthy.

Accordingly, the yield on the liquid 15.12.27 maturity was observed transacting at the lower level of 11.70%. Similarly, the 15.02.28 maturity was seen dropping to an intraday low of 11.73% from a high of 11.80%. The positive trend was observed on the other 2028 tenors as well, with the 01.05.28 and 01.07.28 maturities dropping to intraday lows of 11.83% and 11.85%, as against highs of 11.85% and 11.90% respectively.

Meanwhile the yield on the 15.09.29 maturity declined from 12.12% to 12.05% intraday.

Additionally, trades were observed on the medium tenor 15.05.30 maturity at the rate of 12.10% in the early hours of the day.

Meanwhile in the secondary Treasury bill market, October 2024 maturities (close to three months) changed hands at the level of 9.72%, ahead of the upcoming T-bill auction.

The Treasury bill auction scheduled for today will offer a total volume of Rs. 110 billion, an increase of Rs. 5 billion from the previous week. This will consist of Rs. 30 billion on the 91-day maturity, Rs. 30 billion on the 182-day, and Rs. 50 billion on the 364-day maturity.

For context, last Wednesday’s Rs. 105 billion Treasury bill auction (10/07/24) went fully subscribed and saw a decrease in weighted average rates for the first time in six weeks. The 91-day yield fell by 16 basis points to 9.91%, the 182-day yield decreased by nine basis points to 10.10%, and the 364-day yield dropped by 10 basis points to 10.21%. An additional Rs 10.5 billion was raised at the second phase, being the maximum amount offered across all three maturities.

The total secondary market Treasury bond/bill transacted volume for 15 July was Rs. 10.31 billion.

In money markets, the weighted average rate on overnight call money was at 8.77% and repo was at 9.06%. The net liquidity surplus stood at Rs. 42.69 billion yesterday as an amount of Rs. 111.89 billion was deposited at the Central Bank’s SDFR (Standard Deposit Facility Rate) of 8.50%.

The DOD (Domestic Operations Department) of the Central Bank injected liquidity by way of an overnight and seven-day term reverse repo auction for Rs. 19.2 billion and Rs. 50 billion at the weighted average rates of 8.71% and 9.01% respectively.

Forex market

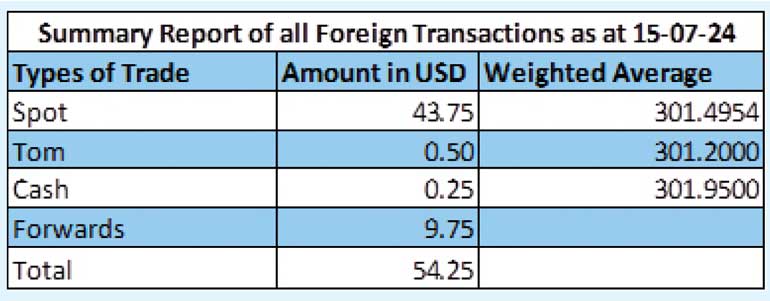

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating to Rs. 303.70/304.00 against the previous day’s closing level of Rs. 301.90/302.40.

The total USD/LKR traded volume for 15 July was $ 54.25 million.