Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 4 September 2024 00:02 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yesterday saw yields dip further as the positive sentiment was carried over from the day prior, resulting in a further recovery in yields. The market remained active with healthy transaction volumes observed.

The secondary bond market yesterday saw yields dip further as the positive sentiment was carried over from the day prior, resulting in a further recovery in yields. The market remained active with healthy transaction volumes observed.

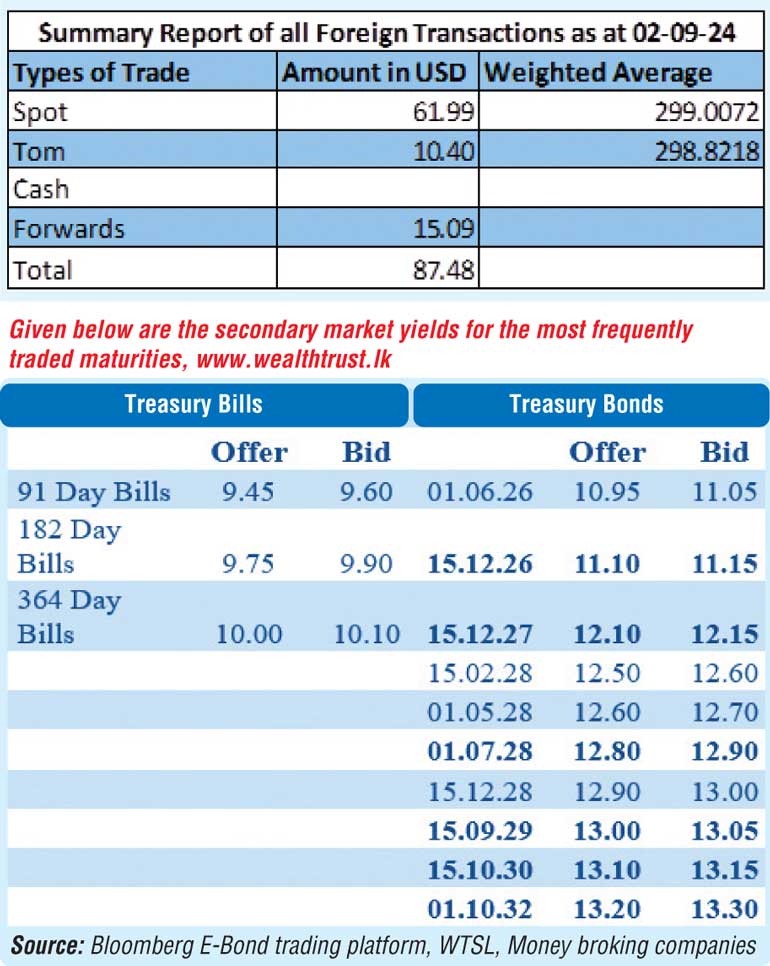

The 01.06.26 maturity traded at the rate of 10.95%. The 01.05.27 and 15.12.27 maturity were observed trading at the rates of 12.00% and 12.10% respectively. The 2028 tenors saw notable demand, with the yield on the 01.07.28 maturity dropping from 12.90% to 12.85% intraday and the 15.12.28 maturity trading at the rate of 12.95%. The 15.09.29 maturity was observed hitting an intraday low of 12.95% as against a high of 13.05%. Additionally, the medium tenor 01.10.32 was observed trading at the rate of 13.30%.

The Treasury bill auction due today will have a total amount of Rs. 152 billion on offer, an increase of Rs. 52 billion over its previous week. This will consist of Rs. 70 billion on the 91-day, Rs. 62 billion 182-day and Rs. 20 billion on the 364-day maturity.

For context, the weekly Treasury bill auction conducted last Wednesday, saw yields on its shortest tenors rise for the fourth consecutive week. Accordingly, the weighted average rate on the 91-day and 182-day tenors increased by 7 and 4 basis points to 9.49% and 9.84%, respectively. In contrast, the 364-day tenor remained steady at 10.01%. The auction fully raised the Rs. 100 billion on offer, with bids exceeding the amount offered by 1.86 times. Notably, 97% of the funds were secured through the 91- and 182-day tenors, both of which raised more than their respective offered amounts, while the 364-day maturity saw less demand. An additional amount of Rs. 5.59 billion was raised at the 2nd phase.

The total secondary market Treasury bond/bill transacted volume for 2 September was Rs. 20.89 billion.

In money markets, the weighted average rate on overnight call money was at 8.50% and repo was at 8.64%.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight and 7-day term reverse repo auctions for Rs. 25.00 billion and Rs. 37.00 billion at the weighted average rates of 8.44% and 8.96% respectively.

The net liquidity surplus stood at Rs. 56.76 billion yesterday as an amount of Rs. 118.76 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.25%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts depreciated marginally to close trading yesterday at

Rs. 299.10/299.20 against its previous day’s closing level of Rs. 298.80/299.10.

The total USD/LKR traded volume for 2 September was $ 87.48 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking

companies)