Friday Feb 20, 2026

Friday Feb 20, 2026

Friday, 27 April 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

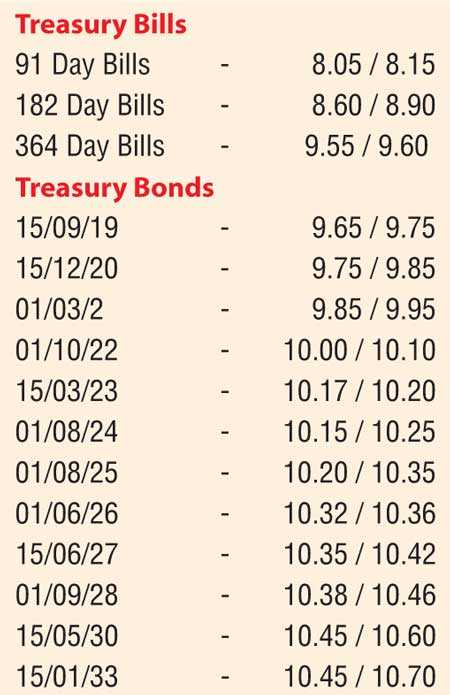

The two bond auctions conducted yesterday recorded encouraging weighted averages at either market or below market yields in comparison to its secondary market yields for similar maturities. The 2.07 year maturity of 15.12.2020 and the 7.05 year maturity of 15.10.2025 were seen registering weighted averages of 9.79% and 10.11% respectively. The total offered amount of Rs. 25 billion was met at the phase 1 stage of the auctions. Nevertheless, in the secondary bond market, yields were seen increasing further on the two 2021 maturities (i.e. 01.08.21 and 15.12.21), 15.03.23, 01.06.26 and 01.09.28 to daily highs of 10.00% each, 10.20%, 10.34% and 10.42% respectively. In the secondary bill market, July and August 2018 maturities were seen changing hands at levels of 8.10% to 8.15%.

In money markets, the overnight call money and repo rates averaged 7.84% and 7.92% respectively as the Open Market Operations (OMO) Department of Central Bank was seen draining out an amount of Rs. 23 Billion on an overnight basis at a weighted average of 7.50%. The net surplus liquidity increased further to Rs. 31.01 Billion yesterday.

Rupee dips marginally

The USD/LKR rate on spot contracts depreciated further yesterday to close the day at levels of Rs. 157.70/90 against its opening levels of Rs. 157.60/80 on the back of continued dollar demand.

The total USD/LKR traded volume for the 25 April was $ 102.90 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 158.40/55, 3 Months - 159.90/00 and 6 Months - 162.20/35.