Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 30 April 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

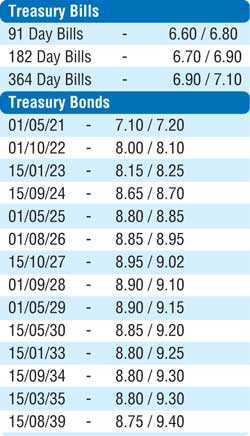

The Treasury bond weighted average rates were seen continuing its positive momentum at its auctions held yesterday as the 2-year and 8 months maturity of 15.01.23, 5-year maturity of 01.05.25 and the 7- year and 5 months maturity of 15.10.27 recorded weighted average rates of 8.14%, 8.75% and 8.88% respectively. This was in comparison to its weighted average rates of 8.50%, 8.70% and 8.90% recorded on the maturities of 01.09.23, 15.09.24 and 15.10.27 respectively on the 08th of April 2020.

year and 5 months maturity of 15.10.27 recorded weighted average rates of 8.14%, 8.75% and 8.88% respectively. This was in comparison to its weighted average rates of 8.50%, 8.70% and 8.90% recorded on the maturities of 01.09.23, 15.09.24 and 15.10.27 respectively on the 08th of April 2020.

However, the Second Phase of the auction was opened on the maturity of 15.10.27 at its weighted average due to its offered amount of Rs. 40 billion not been fully subscribed to at its First Phase of the auction. The total offered amount of Rs. 35 billion each on the 15.01.23 and 01.05.25 maturities were fully accepted at its first phase of the auctions.

In the secondary bond market, activity remained high pre-auction, with yields decreasing across the yield curve. The yields on the liquid maturities of 01.10.22, 15.12.23, 2024’s (i.e. 15.03.24, 15.06.24 & 15.09.24), 15.03.25 and 15.10.27 were seen dipping to intraday lows of 7.85%, 8.15%, 8.50%, 8.53%, 8.50%, 8.65% and 8.85% respectively against their previous day’s closing levels of 7.87/93, 8.25/35, 8.53/60, 8.58/65, 8.60/63, 8.68/75 and 8.87/93.

In addition, the 15.03.22 and 01.01.24 maturities dipped to intraday lows of 7.60% and 8.40% respectively as well. However, subsequent to auction results, yields edged up once again in two way quotes as the 15.09.24 maturity was traded at 8.60%.

In secondary bills, July 2020 and January to March 2021 maturities traded at levels of 6.72% to 6.85% and 6.97% to 7.10% respectively.

In money markets, the weighted average rates on overnight call money and repo stood at 6.41% and 6.43% respectively as the Domestic Operations Department (DOD) of Central Bank was seen injecting an amount of Rs. 5 billion by way of a 14-day reverse repo auction at a weighted average rate of 6.55%, subsequent to offering Rs. 10 billion.

It further injected an amount of Rs. 7.86 billion for Standalone Primary Dealers by way of a 14-day reverse repo auction at a weighted average rate of 6.90%, subsequent to offering Rs. 25 billion. The overnight liquidity surplus increased to Rs. 164.08 billion yesterday.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts traded at Rs. 192.75 yesterday against its previous days of Rs. 192.80.

The total USD/LKR traded volume for 28 April was $ 78.50 million.