Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 13 January 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

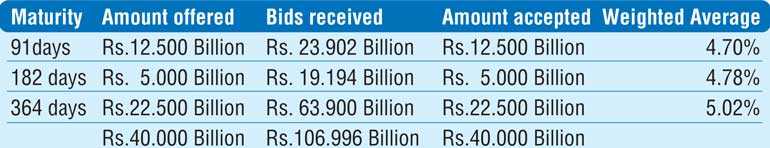

The weekly Treasury bill auction conducted yesterday recorded weighted averages below its stipulated cut off rates on all three maturities while its total offered amount of Rs. 40 billion was fully subscribed for a second consecutive week.

The weekly Treasury bill auction conducted yesterday recorded weighted averages below its stipulated cut off rates on all three maturities while its total offered amount of Rs. 40 billion was fully subscribed for a second consecutive week.

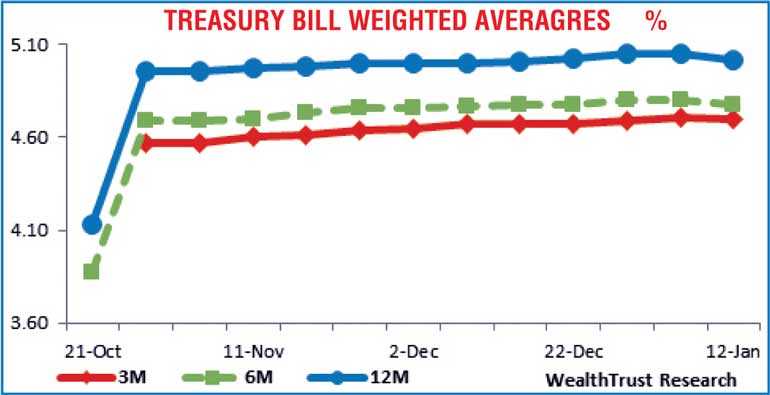

The 364 day bill weighted average dipped by 03 basis points to 5.02% against its previous week’s weighted average and this weeks stipulated cut off of 5.05% closely followed by the 182 day and 91 day bill by 02 and 01 basis points respectively to 4.78% and 4.70%. The bids to offer ratio was seen increasing to a 21 week high of 2.67:1.

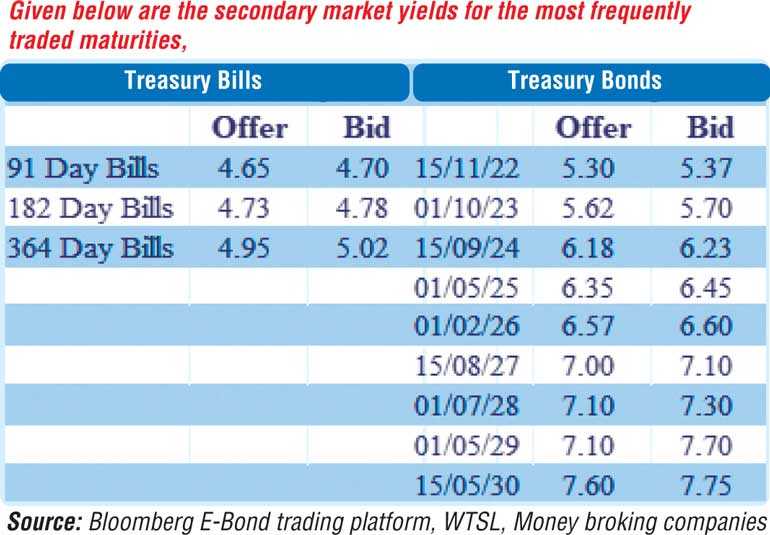

In the secondary bond market, buying interest mainly on the maturities of 2022’s, 2023’s and 2024’s saw its yields decrease further yesterday, sustaining its positive momentum for a third consecutive day. The yields on the 15.03.22, 15.11.22, 15.12.22, 01.10.23, 15.09.24 & 01.12.24 maturities decreased to intraday lows of 5.15%, 5.35% each, 5.69%, 6.20% and 6.24% respectively against its previous day’s lows of 5.20%, 5.45%, 5.50%, 5.80%, 6.27% and 6.33%.

In addition, maturities of 15.10.21, 01.10.22, 15.01.23, 15.03.23 and 15.07.23 changed hands at levels of 4.90%, 5.25% to 5.35%, 5.41% to 5.48%, 5.50% and 5.60% to 5.65% respectively as well on the short end. On the medium to long end of the curve, maturities of 01.05.25, 15.01.26, 01.02.26, 15.08.27 and 15.05.30 were seen trading at levels of 6.40%, 6.60% to 6.65%, 6.60% to 6.64%, 7.10% to 7.12% and 7.65% to 7.67% respectively.

In secondary bills, January, April, July and September 2021 maturities changed hands at levels of 4.57%, 4.65%, 4.78% and 4.80% respectively, pre-auction.

The total secondary market Treasury bond/bill transacted volumes for 11 January was Rs. 24.64 billion.

In the money market, overnight surplus liquidity continued to remain high at Rs. 232.90 billion yesterday while call money and repo rates remained mostly unchanged to average 4.54% and 4.56% respectively.

Rupee loses further

The interbank USD/LKR rate on spot next contracts depreciated marginally to close the day at Rs. 192.00/193.50 against its previous day’s closing levels of Rs. 192.00/193.00 on the back of continued buying interest by banks.

The total USD/LKR traded volume for 11 January was $ 21.45 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)