Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 9 April 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

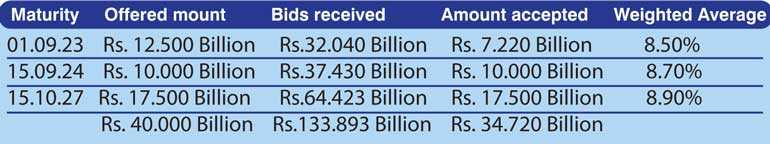

The Treasury bond auctions conducted yesterday saw weighted averages record levels well below secondary market yields as all three maturities were seen progressing to the second phase of the auction system but not to the mandatory third phase due to the minimum accepted requirement of 70% at during the first phase not being fulfilled.

at during the first phase not being fulfilled.

The three-year and five-month maturity of 01.09.2023, the four-year and five-month maturity of 15.09.24 and the seven-year and six-month maturity of 15.10.27 recorded impressive weighted averages of 8.50%, 8.70% and 8.90% respectively against its pre-auction levels of 8.95/05, 9.15/23 and 9.35/50. Nevertheless, only a total amount of Rs. 34.72 billion was accepted against a total offered amount of Rs. 40 billion.

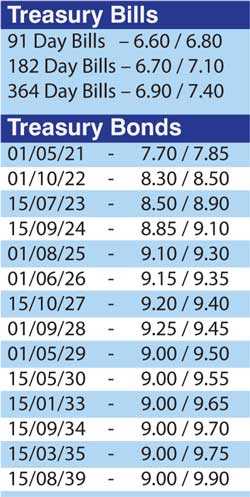

In the secondary bond market yesterday, two-way quotes were seen declining and widening subsequent to the auction results. However, maturities of 2021s (i.e. 01.03.21 and 01.05.21), 01.10.22, 2023s (i.e. 01.09.23 and 15.12.23) and 2024s (i.e. 15.03.24 and 01.08.24) were seen changing hands at levels of 7.80%, 7.85%, 8.55%, 9.00%, 9.05% to 9.07%, 9.17% to 9.20% and 9.25% to 9.60% respectively in an active pre-auction session.

In secondary bills, November 2020 and January 2021 maturities changed hands at levels of 7.25% to 7.40% and 7.35% to 7.70% respectively.

In money markets, the weighted average rates on overnight call money and repo stood at 6.50% and 6.59% respectively yesterday as the DOD (Domestic Operations Department) of Central Bank was seen injecting an amount of Rs. 4.6 billion by way of a seven-day Reverse repo auction at a weighted average rate of 6.55%, subsequent to offering Rs. 30 billion.

It further injected an amount of Rs. 4.5 billion for a period of 88 days at a weighted average rate of 6.39%, subsequent to offering Rs. 25 billion. The overnight liquidity surplus stood at a high of Rs. 71.99 billion.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts was traded within the range of Rs. 198 to Rs. 199.75 yesterday.

The total USD/LKR traded volume for 6 April was $ 84.25 million.