Monday Feb 24, 2025

Monday Feb 24, 2025

Monday, 24 June 2024 00:05 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

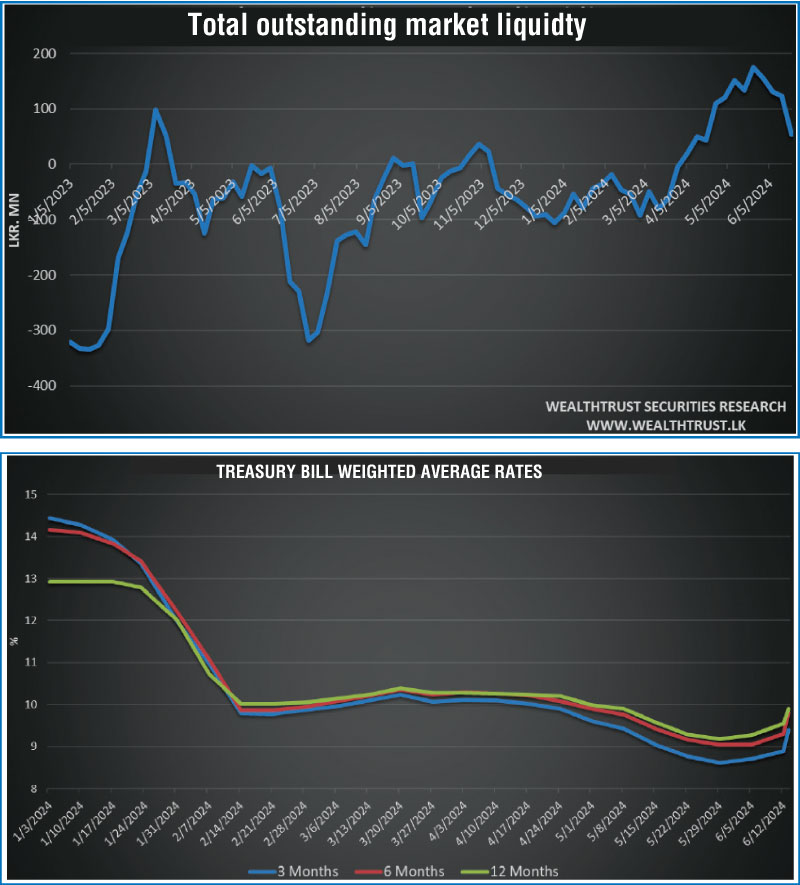

The secondary bond market activity experienced a relatively slow week ending 20 June, against the backdrop of two long weekends. Sparse trades were observed on thin overall transaction volumes, with the market almost at a standstill for much of the week, with the exception of some trading activity during the early hours of the T-bill auction day. Yields were seen increasing further during the week, resulting in an upward shift of the yield curve on a week-on-week basis.

The secondary bond market activity experienced a relatively slow week ending 20 June, against the backdrop of two long weekends. Sparse trades were observed on thin overall transaction volumes, with the market almost at a standstill for much of the week, with the exception of some trading activity during the early hours of the T-bill auction day. Yields were seen increasing further during the week, resulting in an upward shift of the yield curve on a week-on-week basis.

At last week’s Treasury bill auction, yields increased for a third week, with rates moving up across all tenors. The 91-day maturity yield rose by 50 basis points to 9.39%, the 182-day maturity by 51 basis points to 9.89%, and the 364-day maturity by 36 basis points to 9.90%. The entire offered amount of Rs. 230 billion was successfully taken up during the auction’s first phase, marking the third consecutive round of auctions exceeding Rs. 200 billion. The majority or 81% of the accepted amount was raised through the 91-day and 182-day maturities.

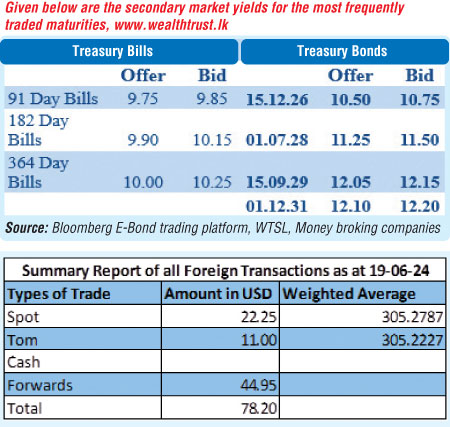

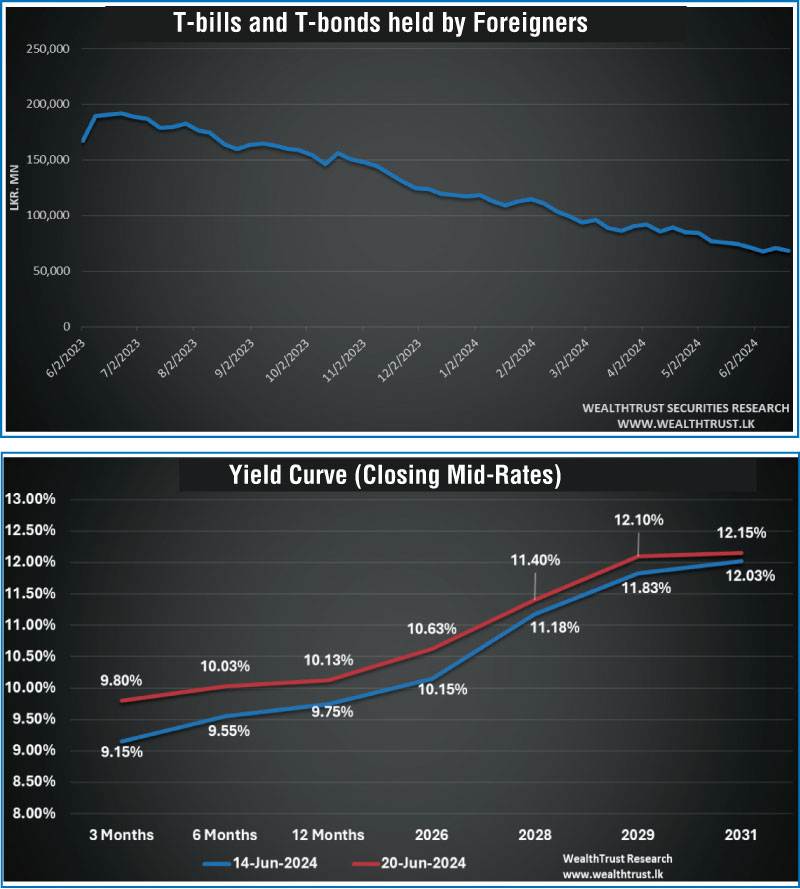

In the secondary bond market, limited trades on selected maturities were observed. The 2026 maturities of 01.08.26 and 15.12.26 were observed transacting at the elevated levels of 10.25% and 10.45% respectively. The 01.05.27 was seen trading at 10.60%. The 15.09.29 experienced a significant increase in yields on the back of renewed selling pressure which saw rates increase from an intraweek low of 11.82% to an intraweek high of 12.10%. Similarly, the 01.12.31 maturity also followed this trend and was seen moving up from an intraweek low of 12.04% to a high of 12.15%. Additionally, trades were observed on the 01.10.32 maturity within the range of 12.19% to 12.20%.

The foreign holding in rupee Treasuries recorded a net outflow of Rs. 2.19 billion for the week ending 19 June 2024. As a result, the overall holding was registered at Rs. 68.52 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first two days of the week averaged at Rs. 46.74 billion. In money markets, the total outstanding liquidity surplus reduced sharply to Rs. 54.05 billion by the week ending 20 June from the previous week’s surplus of Rs. 123.93 billion, dropping to its lowest level in 9 weeks. The Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of overnight reverse repo auctions and 7-day term reverse repo at the weighted average rates of 8.72% to 9.00%. The weighted average interest rate on call money and repo ranged between 8.73% to 8.79% and 8.84% to 8.99% respectively.

The Central Bank of Sri Lankas (CBSL) holding of Government Securities was registered at Rs. 2,609.07 billion as at 20 June 2024, down from the previous week’s level of Rs. 2,615.62 billion.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating during the week to close at Rs. 305.10/305.30. This is as against its previous week’s closing level of Rs. 302.70/302.80 and subsequent to trading at a high of Rs. 304.40 and a low of Rs. 305.50.

The daily USD/LKR average traded volume for the first two trading days of the week stood at $ 53.58 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.