Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 22 March 2018 00:00 - - {{hitsCtrl.values.hits}}

By Charumini de Silva

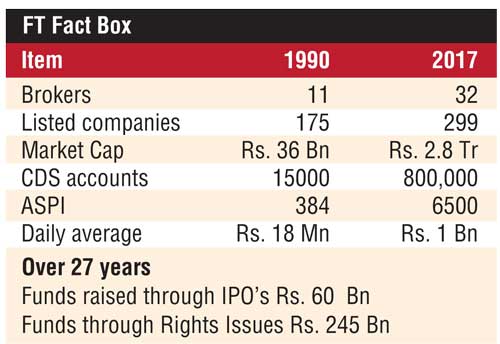

Outlining the key challenges, Colombo Stock Exchange (CSE) Chief Executive Officer Rajeeva Bandaranaike yesterday underscored six dimensions to navigate Sri Lanka’s capital market in qualifying to get upgraded from frontier to emerging markets status in the MSCI Index.

Addressing the 6th Capital Market Conference 2018 titled ‘Transform’ organised by UTO EduConsult, he pointed to lack of liquidity, lack of large companies, starvation for large IPOs, limited number of products, lack of quality research and lack of quality investment advice as key challenges they face at present in transforming the market.

“The market lacks depth is terms of size and liquidity and breadth in terms of range of products. The most commonly used yardstick is turnover velocity which at 7% is a cause for concern.The size of the market is a concern.We lack large companies.The market is starved of large IPOs but to add to the woes of the primary market, the IPO’s that came in recently – exceptfor a couple of issues – withrespect to most of them, the market price unfortunately has gone below issue price,” he added.

In addition, he said CSE has the issue of having a limited number of products, where equity for the most part and a small corporate debt market. “Investors do not have any mechanisms to hedge their risk in the equity market. Thus there is a need to have more asset classes in the market.Another challenge is the lack of quality research and lack ofgood quality investment advice. These factors have led to an erosion of investor confidence locally.”

To address these challenges, Bandaranaikeunderlined six dimensions which includes; market development, technology and innovation, risk management, market regulation, new products and institutional development and governance.

He asserted that one of the barriers, among others,is if the market multiples improve, it would be likely see more new listings and in such an environment, the benefits a listing can bring companies will outweigh other perceived disadvantages such as the fear of loss of control and compliance issues.

Thereby in this connection, he said that they were in the process of expanding the spectrum of listing offerings through the introduction of a special board for SME companies and a multi-currency board.

“On the proposed multi-currency board, we are looking to service foreign and local companies wishing to raise debt and equity capital in foreign currency. In fact, we have already received interest from both local and foreign companies to use this mechanism,” he added.

He also said the CSE is presently facing a situation where large State institutional investors, who were active in the market a few years back, have gone ‘dormant’ creating a huge vacuum. He pointed out that for the market to fully revive, these institutions must return to the market. “We have been lobbying these institutions and the Government in this regard.”

Bandaranaike asserter that they were mindful that the high transaction costs are a concern and due consideration is being given to address this issue. “Of course one has to appreciate that we have to balance the interests of both market intermediaries and investors. So we have evolved new business models for a broker, which includes the consolidation of the number of stock broker companies.”

Elaborating on some of the outcomes of the initiatives CSE has undertaken and what they expect to do going forward, he saidpromoting the market among foreign investors, local institutional investors and high net worth investors will continue and that it is likely that some innovative strategies will be used in this direction going forward.

“Our market is largely an institutional and high net worth driven market and the volumes from these two segments account for 90% of volumes. We all know that it has been foreign investors who have been driving the market in the last couple of years. In 2017, we had a foreign inflow of over Rs.100 billion and this year to date we have seen a foreign inflow of Rs.25 billion.

He said the CSE will continue their efforts targeting frontier market funds in the key destinations like Singapore, London and New York.

Pointing out that Sri Lanka has an underdeveloped retail base of investors who account for less than10% of overall volumes, he asserted that the CSE has currently commissioned an extensive country wide research survey to identify some of the key reasons which act as disincentives for such investors to invest in the equity market and what the perceptions are among potential investors, where the results of the study will feed into a marketing plan to rejuvenate the retail investor segment.

“A strong local base will be vital for the long term development of the equity market. However, low levels of financial literacy among retailers, lack of accessibility to stock broker services and investment advice and research are acting as barriers for the development of the retail segment. I also believe that brokers need to target market their segment carefully as it is not everyone who has the risk appetite for equities,” he emphasised.

Another area that has the potential to be developed is the corporate debt market he said, adding that reduction of the transaction fees for which a proposal has already been made to the SEC, enabling REPOS and providing secondary trading facilities for Government securities are some of the measures that can be taken.

In terms of technology apart from innovations, he said that the CSE is looking at moving its systems to cloud hosting, what block chain technology can do for the depository, internal development of systems as opposed to third party systems. The innovation that will impact investors in the short term will be a project that CSE is working on which will revolutionise the way retail investors can enter the market and start trading, he added.

“We are looking at introducing a system across all brokers to enable a person to opena CDS account digitally using any electronic device such as a mobile phone using face recognition and digitalised signatures to open a CDS account and then connect seamlessly to abroker of choice and start trading by connecting your bank account to the broker with througha payment wallet,” he stressed.

Bandaranaikesaid the project to introduce a Delivery Vs Payment (DVS) system for the market is already underway and it is likely that we will see the market operating on a DVP system for 2019.

As we all appreciate, effective market regulation will lead to investor confidence.He insisted that for this to happen, regulations must be enforced and believed that the new SEC Act will be passed soon in the Parliament.

On institutional development and governance,he said the most progressive initiative was the conversion of the CSE from a guarantee company to a company limited by shares, which is called the demutualisation of the exchange.

He said a separate bill has been submitted to parliament by the SEC to enable this transition. “From what we understand, the bill has now been listed for debate in Parliament and is presently at a committee reading stage.”

According to him, the demutualised exchange will see some changes to the governance structure. “There is a requirement to complete the legal conversion process within one year of the Act coming into force and from the date the company is converted, there is a requirement for the exchange to go public. So sometime in the future, you will be able to buy and sell CSE stock as well.”

If CSE would be able to navigate the capital market successfully in achieving the aspects mentioned above, Bandaranaike expressed confidence that Sri Lanka’s capital market would even qualify to get upgraded from frontier to emerging markets status in the MSCI Index.

However,he emphasised the transformation of the capital market is not an overnight affair but rather, it’s something that has to be diligently worked at and implemented in stages and we will undoubtedly see the results of these efforts in the medium to long term.

He urged that there was aneed for the implementation of a capital market development plan encompassing most of the areas he outlined. “I believe that there is a need for the regulator, the market institutions such as the CSE and CDS, stock brokers, other market intermediaries such as unit trust companies, investment managers and others involved in the capital market to come together and forge a common front to transform the market.”

Pic by Lasantha Kumara