Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 1 August 2024 01:40 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

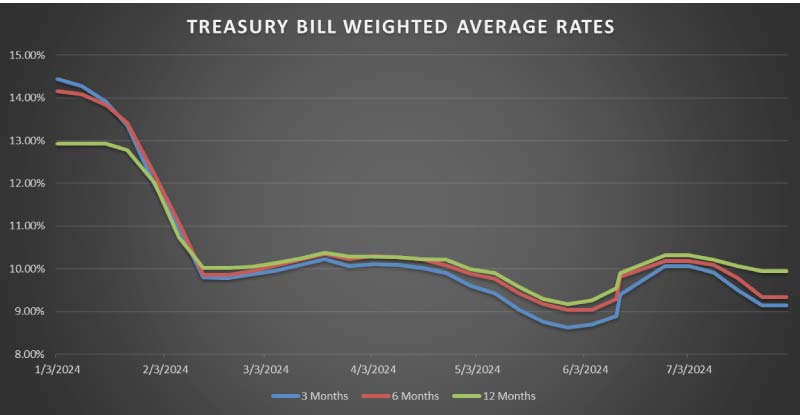

The Treasury bill auction conducted yesterday saw weighted average yields remain steady across the board for the first time in 4 weeks.

The Treasury bill auction conducted yesterday saw weighted average yields remain steady across the board for the first time in 4 weeks.

Accordingly, the rate on the 91-day tenor was recorded at 9.14%, the 182-day tenor at 9.34% and the 364-day tenor at 9.95%.

The demand for the market favourite 91-day bill saw its accepted amount hit

Rs. 85.35 billion against its offered amount of Rs. 55 billion, which led to a total amount of Rs. 126.35 billion being accepted against a total offered amount of Rs. 170 billion. The bid to offer ratio stood at 1.97:1.

The 2nd phase of the auction will be opened on 182-day and 364-day maturities at its weighted average rates until close of business of the day prior to settlement (i.e., 4 p.m on 1 Aug 2024).

The secondary market bills continued to see demand yesterday with November 2024 (close to three months), February 2025 (close to six months), and June-July 2025 (close to 12 months) maturities trading at the rates of 9.05% to 9.10%, 9.42% and 9.85% to 9.95% respectively.

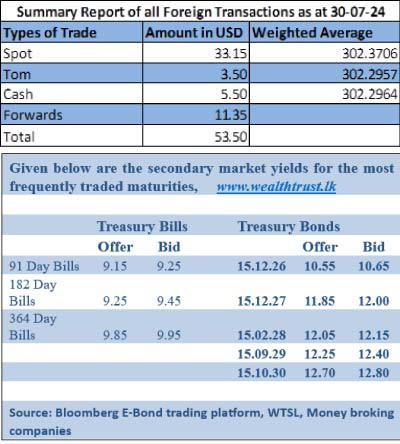

In secondary bonds market, trades were observed on the 01.06.25 and the 2026 (i.e. 01.02.26, 15.05.26 & 01.06.26) maturities at the rate of 10.00% and 10.40% to 10.60% respectively. In addition, maturities of 2028’s (i.e. 15.02.28 & 15.03.28) and 2030’s (i.e. 15.05.30 & 15.10.30) changed hands at levels of 12.07% to 12.10% and 12.75% to 12.80% respectively.

On the inflation front, the Colombo Consumer Price Index-CCPI (Base: 2021=100) for the month of July 2024 was recorded accelerating to 2.40% on a year-on-year basis as against 1.70% recorded in June 2024. This undershot both a Bloomberg forecast of 3.10% and the Central Bank of Sri Lanka’s target of 5.00% (as it has since March). The acceleration was partly attributable due to a low-year earlier base effect. In an article titled “SRI LANKA REACT: No More Easing This Year Despite Below-5% CPI” Bloomberg predicted that inflation will continue to undershoot the CBSL’s target for the rest of the year helped by weak demand, lower domestic energy prices and eased supply-side constraints. Bloomberg Economics expects Inflation to average around 3.00% this year, down from 20.5% in 2023. The article goes on to opine that the CBSL will likely keep policy rates on hold for the remaining two meetings for the year 2024.

The total secondary market Treasury bond/bill transacted volume for 30 July was

Rs. 46.41 billion.

In money markets, the weighted average rates on overnight call money and were 8.55% and 8.84%, respectively.

The net liquidity surplus stood at Rs. 98.73 billion yesterday as an amount of Rs. 9.37 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 9.25% against an amount of Rs. 133.10 billion deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.25%.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight reverse repo auction for Rs. 25.00 billion at the weighted average rates of 8.54%.

Forex Market

In the Forex market, the USD/LKR on spot contracts to closed the day broadly steady at Rs. 302.40/302.50 against its previous day’s closing level of Rs.302.48/302.55.

The total USD/LKR traded volume for 30 July was

$ 53.50 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)